The beginning of this week's trading was positive for the EUR / USD as it moved towards the 1.1163 resistance. With the announcement of contraction in the German economy for two consecutive quarters, it was confirmed to the markets that the largest economy in the Eurozone entered a real recession, which increased the pressure on the Euro again, pushing it towards 1.1097 level at the time of writing. The pair did not benefit much from the recent update of the US Federal Reserve monetary policy future, both from the minutes of the last meeting and statements made by Governor Jerome Powell at the end of the week, as the Bank confirmed that it will monitor economic developments and external risks to determine the appropriate monetary policy, and admit that the US economy faces some Risks that will adversely affect its growth path.

The latest update on the future of the US Federal Reserve policy showed a split among the members of the Fed's policy on the amount and timing of further interest rate cuts, some of whom demanded not to cut rates at the current stage and to wait for real and persistent weakness in the US economy performance.

In contrast, as Germany's economic performance continues to weaken and global trade tensions increase, financial markets and investors are waiting for strong measures from the European Central Bank to stimulate the region's economy by launching bond buying plans and cutting interest rates. The next meeting may be the most appropriate for these measures, as the economic situation in the region is worsening and hence increasing the pressure on the Euro.

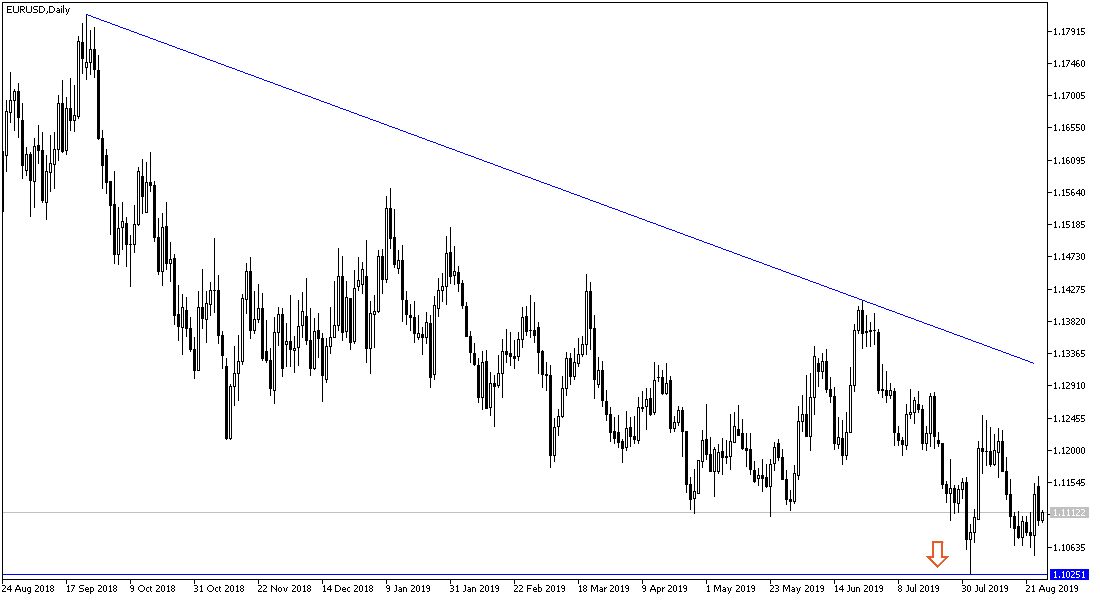

According to the technical analysis: As mentioned before, we confirm that the bearish momentum of the EUR / USD will remain strong, and that the recent gains will be temporary as the different economic performance and monetary policy between the Eurozone and the US remain in favor of the US dollar. The move back below 1.1100 support, as it is currently, will support the move towards stronger support levels that could reach 1.1045, 1.0980 and 1.0900 respectively. A correction back up would hit resistance levels 1.1185, 1.1260 and 1.1330 respectively. I still prefer to sell the pair from every bullish level.

On the economic data front: Today's economic calendar contains Germany's GDP. Then the US Consumer Confidence and Richmond Industrial Index.