EUR / USD's recent bullish correction attempts did not exceed the 1.1249 resistance level recorded during Tuesday's trading session, before settling around 1.1200 again at the time of writing, awaiting stronger incentives to complete the correction. Weak Eurozone economic data results have not helped the single currency complete the correction and the US dollar continues to reap stronger gains against other major currencies. The lack of US economic data since the beginning of this week's trading has contributed to the lack of any incentives for the pair. The current strength of the US dollar may weaken the US position if they try to enter into a currency war with China, which has weakened the value of the Chinese Yuan to a 10-year low below the $7 level. The United States accused China of starting a currency war in retaliation for the ongoing trade dispute.

The global trade war is still increasing the pressure on the Eurozone economy, and this is clearly evident on the industrial sector in the region.

From the United States, the US Federal Reserve cut interest rates for the first time since 2008 and the US dollar did not care to the expected announcement, with the bank asserting that the cut would not be a permanent policy and that what happened was only an update to the policy cycle. In general, the mixed economic performance and monetary policy of both the Eurozone and the US will favor continued downward pressure on the pair.

The US-China trade war saw strong and dangerous developments with Trump imposing more tariffs on China and the latter devalued the Chinese Yuan to hit US exports on world markets.

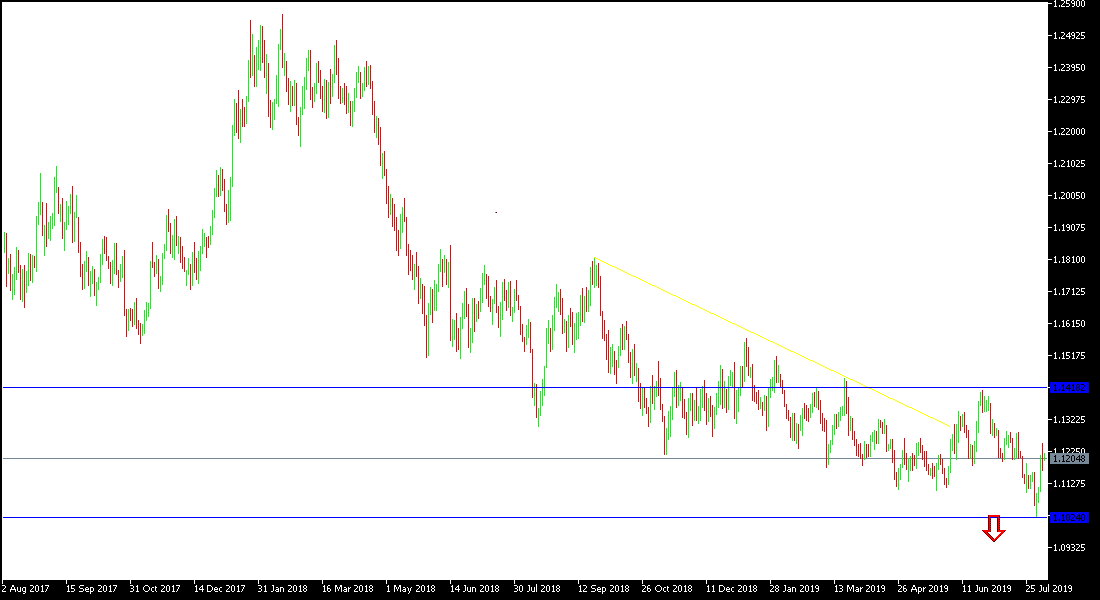

Technically: The move of the EUR / USD below the support level of 1.1200 will increase the bearish momentum again, and therefore the pair may move to test the support areas at 1.1155, 1.1080 and psychological support at 1.1000 respectively. On the upside, the closest resistance levels are currently at 1.1285, 1.1330 and 1.1400 respectively. Overall, the pair is still floating within a bearish channel.

On the economic data front: The economic calendar today will focus on the announcement of German industrial production and the U.S weekly oil inventories only.