The minutes of the US Federal Reserve meeting held in late July showed that members plan to pay close attention to the effects of the data on the economic outlook. At last month's meeting, Fed members voted 8-2 to cut interest rates by 25 base point to 1.25%. The decision to cut interest rates came even though participants in the meeting generally considered that the negative risks to the future of economic activity have diminished somewhat since their meeting in June. However, the Fed noted that financial conditions appeared to be “based on the importance” of expectations that the central bank would cut interest rates.

The minutes of the meeting were in favor of the US dollar and thus the EUR/USD remained stable under downward pressure below the 1.1100 support level, reaching the 1.1080 level, as the European single currency awaited the PMI figures for the manufacturing and services sectors of the Eurozone economies. Hopes for German fiscal stimulus could not strengthen the Euro, as it was offset by weak inflation in the Eurozone. The worst economic situation in the region will force the ECB to introduce more stimulus plans at its earliest meeting and we may see Mario Draghi's hint of this happening during his comments at the Jackson Hole symposium. On Wednesday, for the first time ever, the German government sold 30-year bonds at a negative interest rate. However, bidders at the auction were willing to pay more than the face value they would receive when the bond matures.

The sale is in addition to the amount of negative yield bonds around the world, suggesting that investors expect global economic growth and inflation to remain weak for years to come.

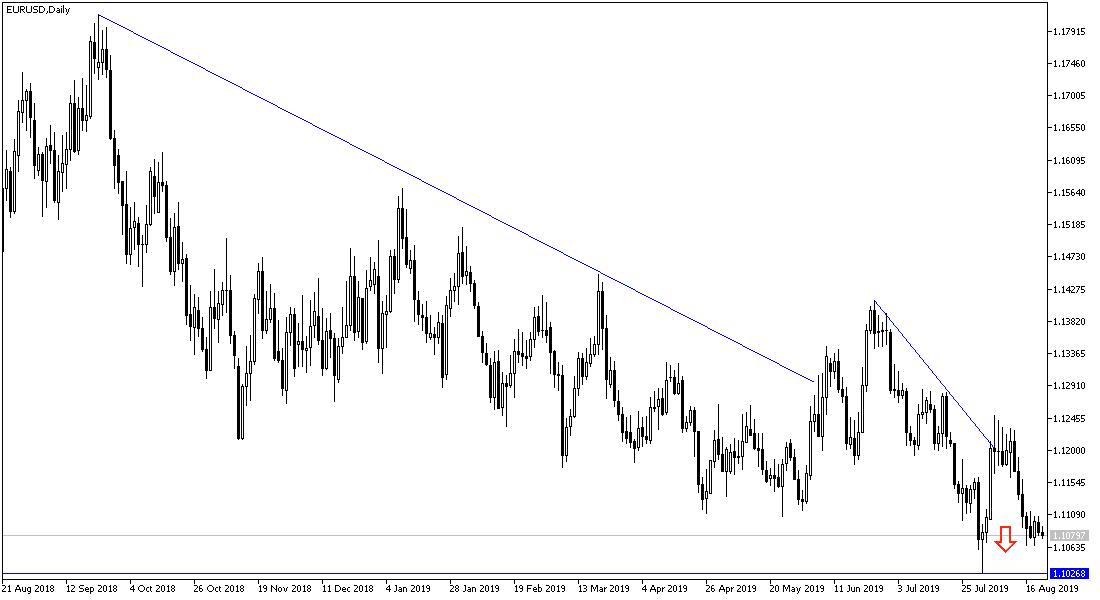

Technical analysis: EUR/USD is still floating within a violent bearish channel, and even with technical indicators generally reaching oversold areas, investors see no incentive to buy. The strong support levels of the pair are currently 1.1040, 1.0970 and 1.0880 respectively and with this, we may see good thinking from forex traders to buy the pair with nearby bounce targets. If it moves towards the resistance levels of 1.1165, 1.1230 and 1.1300, it may start the opportunity for a bullish correct. With economic performance and monetary policy diverging between the Eurozone and the US, it is important to sell the pair at every upward bounce.

On the economic data front, the economic calendar will focus today on the release of the manufacturing PMI from Germany, France, and the Eurozone. Then the weekly US jobless claims are released. Later in the day, the Eurozone Consumer Confidence will be announced. Taking into account the start of the important Jackson Hole Symposium.