The Euro continues to struggle overall, but at this point I think it’s probably going to continue more of the sideways move than anything else in the short term. That being said, we are going to need to pay attention to the longer-term charts and therefore September could be quite crucial when it comes to the Euro overall.

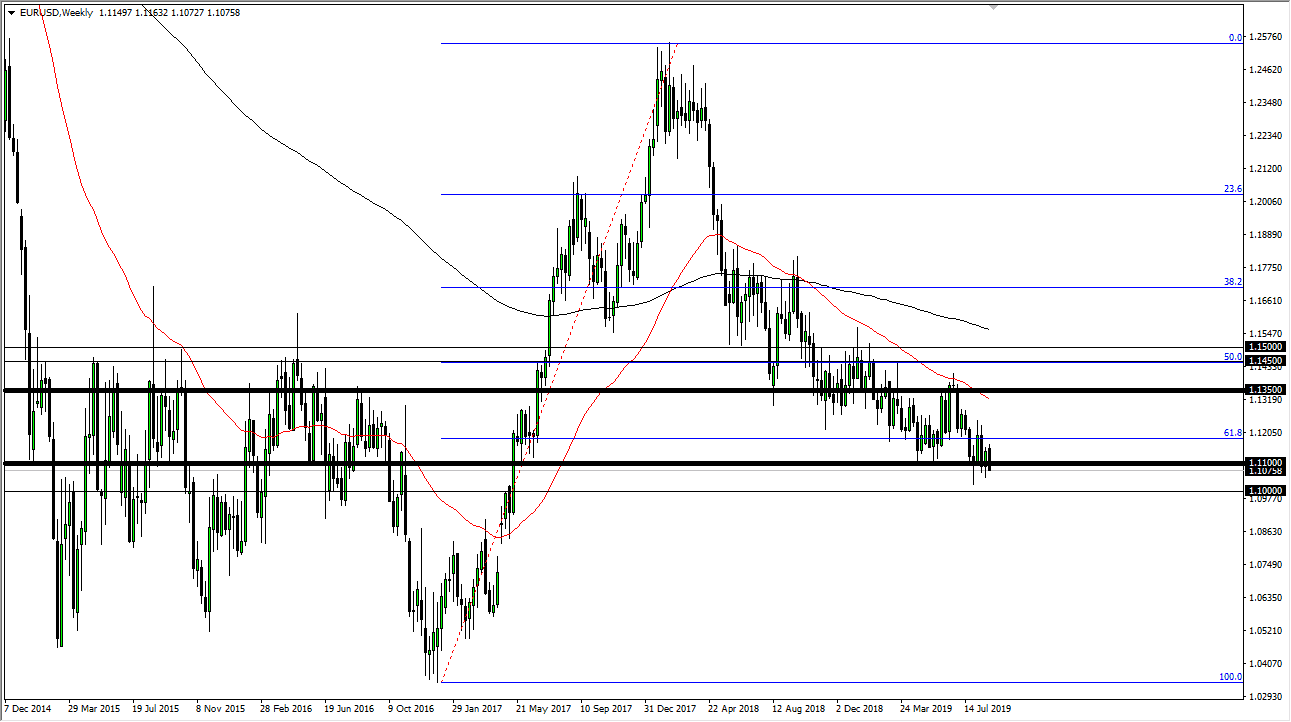

I believe that the 1.11 EUR level is the beginning of significant support, extending down to the 1.10 EUR level. I think this is essentially a “support zone”, and it should cause quite a bit of upward momentum or at least noise in the market. All things been equal though, I think that if we break down below the 1.10 EUR level, it will open up what is essentially the “trapdoor” in this market. This is my base case scenario but I don’t think it happens right away. Keep in mind that September is always an interesting month to trade, mainly because it’s when traders come back from the holiday season in the summertime.

This is a market that continues to cause a lot of noise but when you think about the flow of money, it makes perfect sense that we continue to drop longer-term. I think that short-term rallies will continue to offer opportunities to sell the Euro as the Germans enter recession. Keep in mind that the bond markets quite often will drag the currency markets in whatever direction yield favors. Right now, we have a lot of negative bonds in the European Union, and at the time of writing everything but the 30 year bond in Germany is in fact negative. Alternately, the US Treasury markets offer positive yield, so it makes sense that we continue to see the greenback pick up momentum.

To the upside, if we were to break above the 1.1250 level, then it could have the market reaching towards the 1.1350 EUR level. That seems to be unlikely though, and I put that out about 10 or 15%. That doesn’t mean we will get the occasional rally obviously, but those are to be punished as they have been for two years. I can’t imagine that the month of September will be any different, at least not without some type of major switch in attitudes. The European Central Bank seems hell-bent on going into loose monetary policy, and although the Federal Reserve is likely to cut rates, that’s already known.