The Euro ripped to the upside during the trading session on Monday as the rhetoric between the United States and China has heated up, showing signs of getting worse, not better. This has people running from the dollar, at least in this particular case to avoid all of that trouble. The fact that the Chinese are looking to dig in and retaliate via Forex markets suggests that we are about to see a currency war.

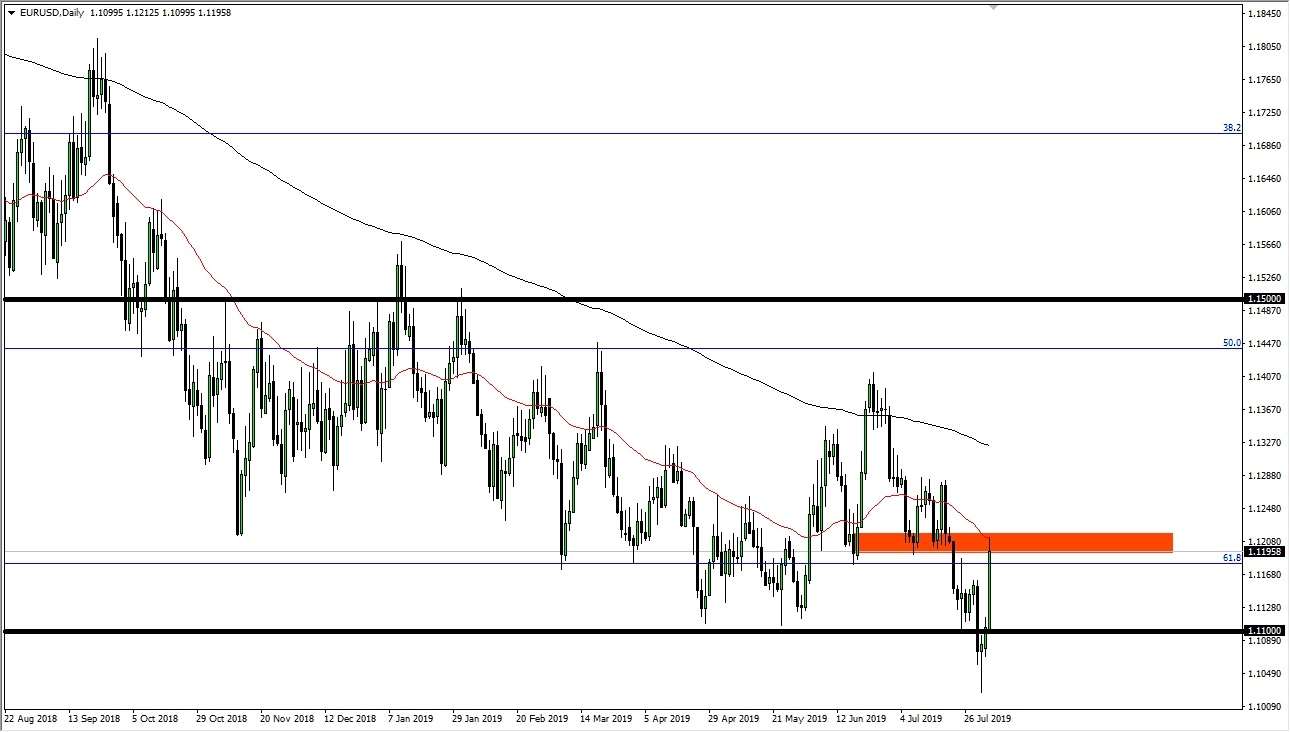

At this point though, you will notice that the 50 day EMA has stepped in and push the market lower. The 1.12 level of course is psychologically resistant, and at this point I think that the market participants will be looking for reasons to short this market. That doesn’t mean that we can’t go higher in the short term, but I think there is a ton of resistance between here and the 1.13 level that could push this market to the downside.

The candle stick is very bullish, and I’m the first person to admit that. I think part of this may be due to the stock market, as it got absolutely hammered in the United States. That being said though, I believe this is a short-term phenomenon, and perhaps an extension of the psychology of bouncing from just below the 1.11 level which was massive support. All things being equal, I will be sitting on the sidelines looking for signs of exhaustion that I can take advantage of. This is a market that continues to be negative overall, and I think in a few days we will look at this as an opportunity to start shorting again. Yes, this has been very impressive but unless you believe it’s truly a trend change, it’s only a matter time before we break back down and reach towards that 1.11 handle. Once we do, then we will try to take out that hammer from the Friday session, and reach down towards the 1.10 level. That’s an area that of course is large, round, and psychologically important. This doesn’t mean that things won’t get noisy or whatever, but I do think if you look back to the left, you can see that this pair does this all the time, as we just chop around aimlessly with a slightly negative bias. The 200 day EMA which is pictured in black is my “line in the sand.”