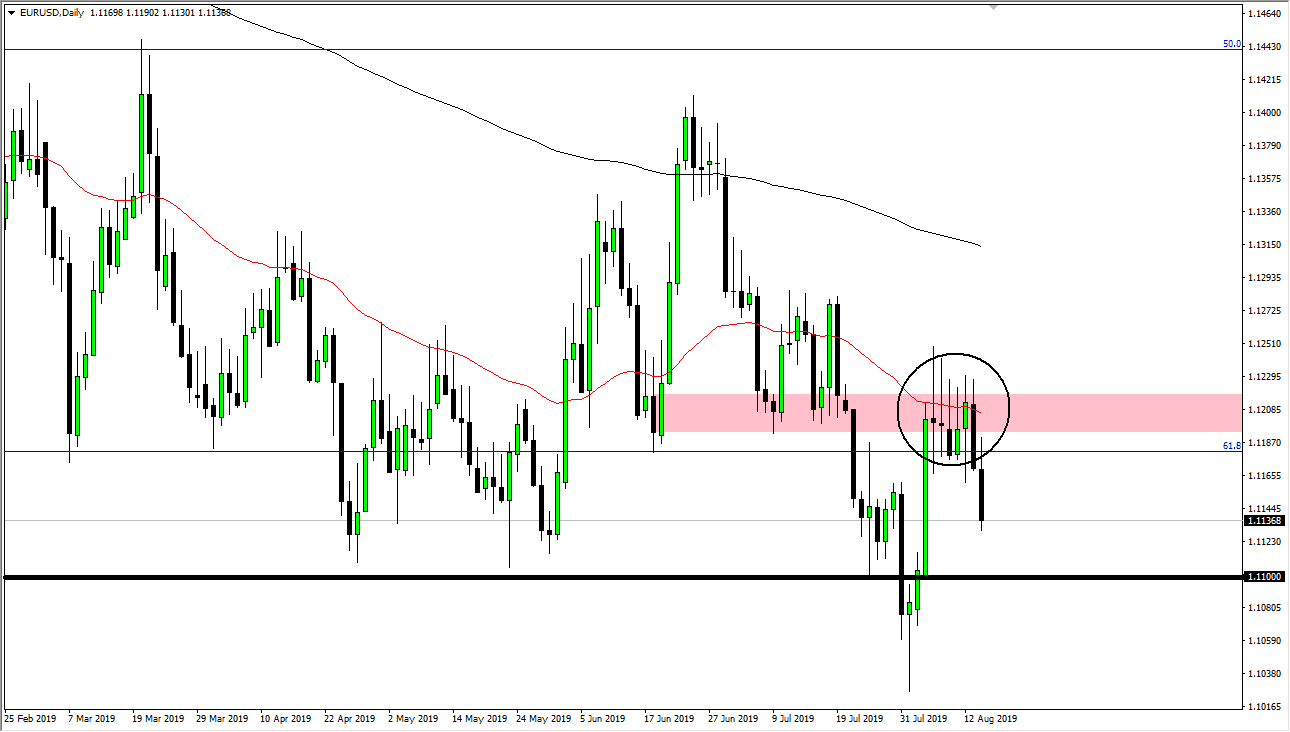

The Euro has rallied a bit initially during the trading session on Wednesday and then sold off rather drastically. Now that we have broken well below the 1.12 level, the market is likely to reach down towards the 1.11 level after that. Overall, the market looks very soft, it makes sense that the Euro would fall against the US dollar considering that the treasury markets have rallied quite stringently. Ultimately, the market is favoring the greenback for good reasons, not the least of which would be the fact that we have an inverted yield curve between the 2 and 10 year treasury notes. Because of this, it makes a lot of sense that people are worried about recession, which drives even more money into the bond markets.

Beyond that, the European Union has been posting horrific economic figures, and that of course will more than likely drive down the value of the Euro anyway. Even though we have seen an inverted yield curve and have historically low rates in the United States, there is still an interest rate differential that favors America. With that, it makes sense that money continues to flow into this pair. I do think having said that that there is a lot of support between 1.11 and 1.10 below.

All things being equal, we are going to try to take out that “melt up candle” from last week that shot straight up through the 1.11 handle. I think that the Euro continues the downtrend though, and it’s obvious that the 50 day EMA has caused major issues, as we have seen the market fail to stay above it for any significant amount of time. All things being equal, I think that we are going down to the 1.10 level over the next several weeks, and if we can break down below there we could go as low as the 1.05 EUR level which is the 100% Fibonacci retracement level.

Between now and the lows, I anticipate that any short-term rally will be a selling opportunity at the first signs of exhaustion, as the market continues to look very soft. With that, I think that the US dollar strength could continue to be a major issue, not only this pair but several other ones as we have seen a lot of greenback strength everywhere and it seems to only be spreading at this point. I have no interest in buying this pair anytime soon.