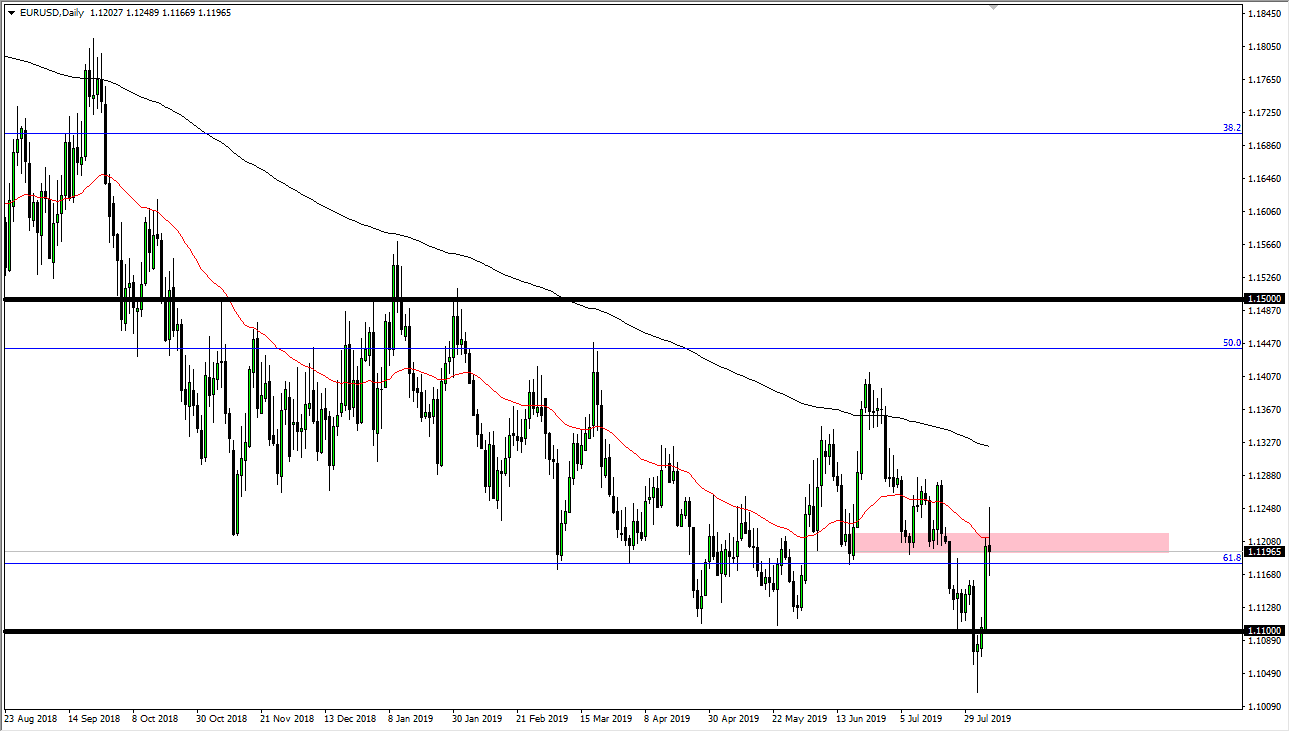

The Euro went back and forth during the trading session on Tuesday, showing signs of exhaustion, breaking above the 50 day EMA but then turning around to form some type of shooting star. At this point, the market looks as if it is going to continue to respect the 100 PIP range between 1.12 and 1.13 as potential support or resistance. In this case obviously it will be resistance as we have bounced from a lower level and had recently broken below the 1.11 level.

The market has pulled back from the initial rally during the day after the United States had labeled the Chinese as “currency manipulators.” I think that traders will have been looking at this market as a potential selling opportunity as people were willing to bet against the US dollar because of that move. That being said though, longer-term traders start to look at the overall picture of the market and understand that this rally would have been an opportunity to “pick up the US dollar on the cheap.”

Ultimately, if we do break above the top of the candle stick for the trading session on Tuesday, it’s very likely that we then will have to fight towards the 1.13 level. That level should be massive resistance, but at this point I think we are likely to see the 200 day EMA reach towards that level quickly. All things being equal though, this is a market that has been in a downtrend for some time, but we do get these occasional chops like we had just gotten through. The market bounced like a rocket from the 1.11 handle, but it is just a technical figure and it looks like the sellers are starting to take advantage of again.

At this point, I think that the market probably goes looking towards the 1.10 level underneath, as it is a large, round, psychologically significant figure. The market has broken through the 61.8% Fibonacci retracement level, and then rallied towards that level again over the last couple of days. Now I think that if we break down from here we have a real chance of reaching towards the 100% Fibonacci retracement level, down at the 1.05 EUR level. If that happens, it will more than likely be a major negative move to the downside because the market would be looking for some type of safety.