The Euro rallied a bit during the trading session on Friday, breaking above the 1.111. By doing so, it looks as if the Euro is trying to save itself but there is a ton of noise above that will continue to weigh upon it. The only thing I can think is that perhaps traders are starting to cover short positions going into the weekend, which would make sense considering that in the environment we find ourselves in, a sudden announcement or tweet can send the market haywire.

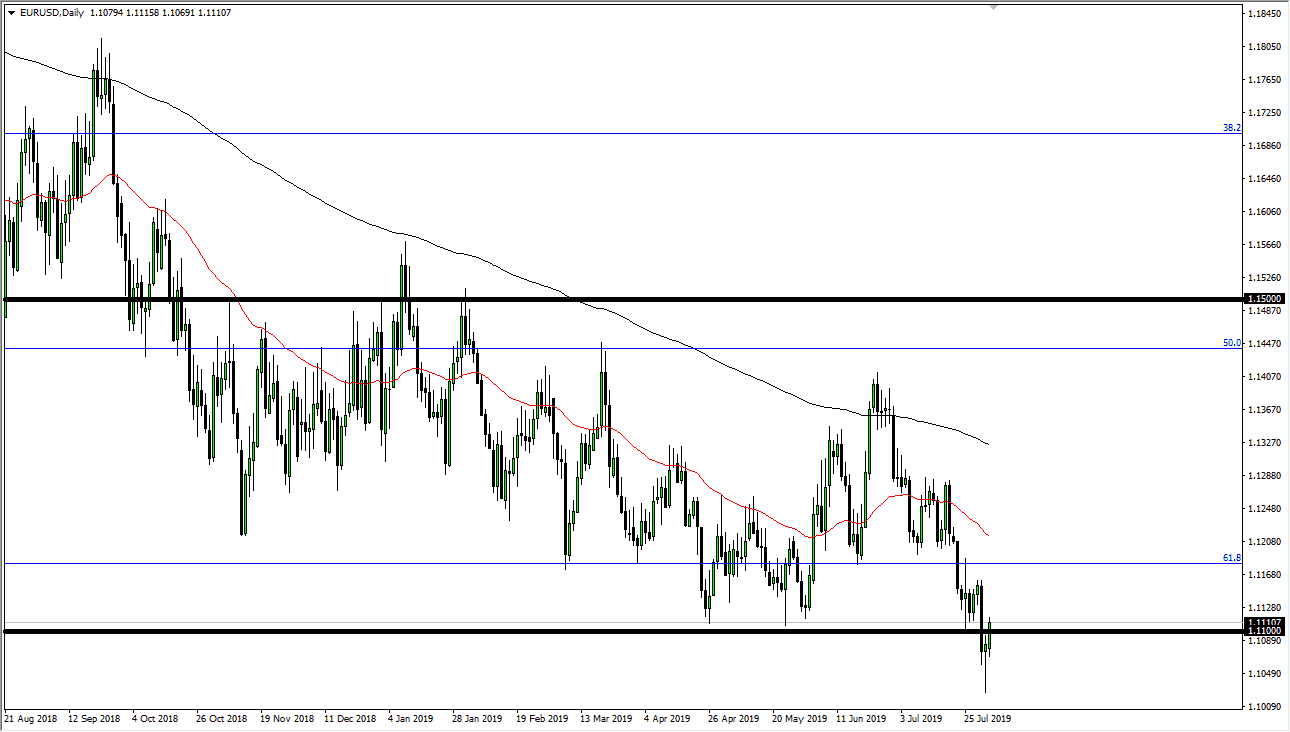

I see the 1.1175 level above as suggesting significant resistance, so at this point I think what we are looking at is a scenario that still remains “sell the rallies”, but I also recognize that if we were to break above the 1.12 level, then the market could probably go much higher. With that being the case, I believe that the market would have formed a major bottom if that does in fact happen. However, right now it still looks as if there is a lot of selling pressure, and of course the ECB is likely to continue to loosen monetary policy. With that being the case I am looking for rallies that show signs of exhaustion that I can take advantage of.

The alternate scenario of course is that a break down below the hammer from the Thursday session, which would signify more selling coming. At that point I would anticipate that the market would go to the 1.10 EUR level, and then perhaps even lower than that. We are a bit stretched, but I don’t see how this market rallies significantly. We are below the 61.8% Fibonacci retracement level which of course is a major area.

Any time you break down below the 61.8% Fibonacci retracement level is quite common to see the market go down to the 100% Fibonacci retracement level. That of course would be the 1.05 EUR level, which is a potential longer-term target. I have no desire to buy the Euro anytime soon, because we have seen that although the Federal Reserve is dovish, it’s not quite as dovish as the European Central Bank. In other words, this is a battle between lightweights and it will continue to be choppy and difficult to trade. Waiting for signs of exhaustion is about the only thing I can suggest here, because this is probably the worst pair in the Forex world.