The Euro should continue to drift a bit lower due to the fact that the market has been focusing on US Treasuries as of late, and of course the differential between the German and American economies. Remember, Germany is the biggest driver of what happens with the Euro and the European Union, and as a result it’s very likely that the Germans heading towards a recession will continue to weigh upon the Euro itself.

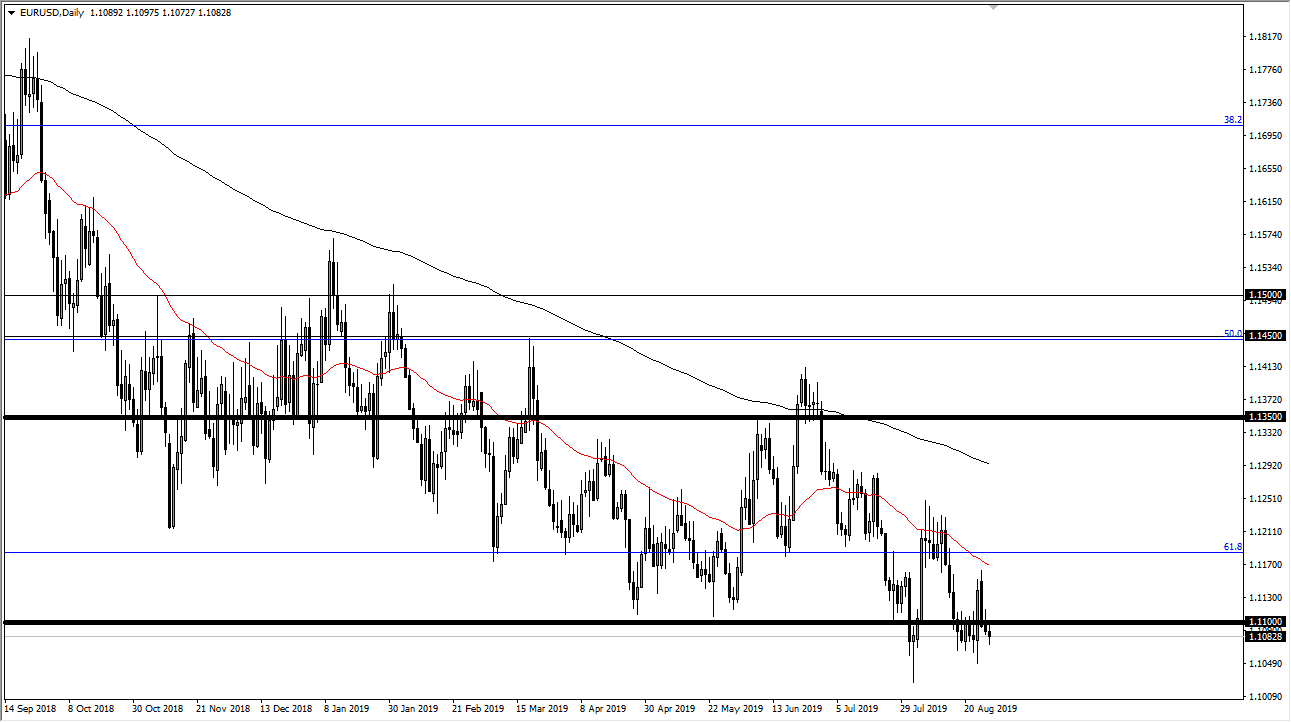

We have broken the 1.11 EUR level, although it’s not the first time. At this point, the market should continue to see a lot of support underneath, perhaps extending down to the 1.10 EUR level. With all of that noise just waiting to happen, I think there will be the occasional bounce that we can take advantage of, and as soon as we get some type of exhaustion based candle, I would be a seller. In fact, I believe that the 50 day EMA above will continue to cause resistance as seen on the daily chart, and as has been the case over the last several weeks.

Looking at this chart, it looks as if we are going to continue to see negativity overall but I do think that it’s only a matter of time before there will be some value hunting. I believe that value hunting is going to be a nice opportunity, so be patient to take advantage of the downside. In fact, I have no interest in buying this market until we get above the 1.1250 level, something that seems to be very unlikely to happen in the short term.

At this point, if we can break down below the 1.10 level is very likely that the Euro goes down to the 1.05 level as it is the 100% Fibonacci retracement level. Ultimately, we are well below the 61.8% Fibonacci retracement level and that typically means that we wipe out the entire uptrend. All things being equal, this is a market that I think continues to drift lower, and that rallies should be looked at with complete suspicion. The Euro will continue to be in a lot of trouble, simply because of the economic conditions and the fact that not only do we have a bond market in America that is attracting a lot of attention, negative yields in the European Union of course has money running from the continent as well. Remember, money goes to where it’s treated best.