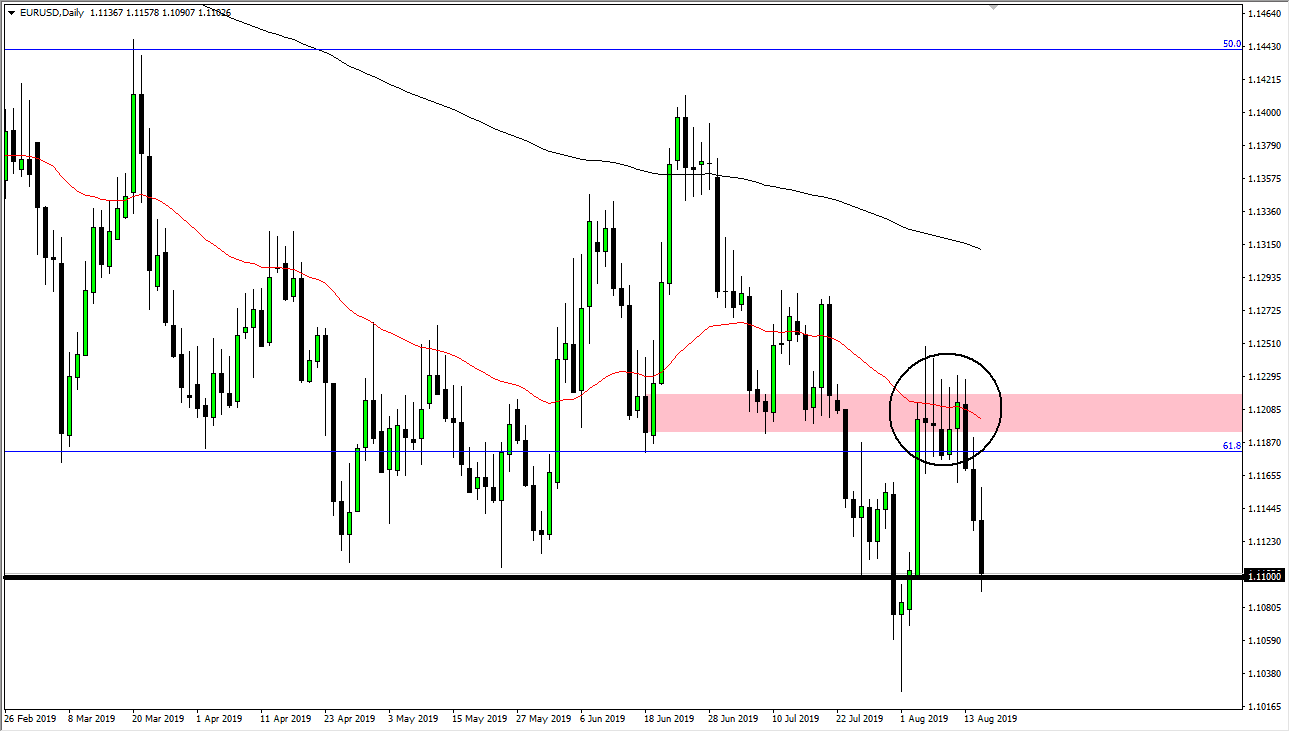

The Euro has initially tried to rally during the trading session on Thursday but then broke down rather significantly to reach towards the 1.11 handle. This is an area that has been massive support in the past, so it makes a bit of sense that we have stopped here after falling so hard. That being said though, I think that the Euro is going to continue to struggle as the market is likely to focus on a handful of things right now.

The initial thing that they will be paying attention to is the fact that the US Treasury markets have continued to take in a ton of money. The bond market has of course attracted a lot of money as people are concerned about the global growth situation and of course the trade situation between the Americans and the Chinese. That obviously requires a lot of US dollars, so it drives up the value of the very same currency. With that being the case, I think that the Euro is going to face that headwind in the form of a strong greenback.

On the other side of the equation we have a lot of recessionary talk coming out of the European Union, and with Germany looking very much like a recession just waiting to happen, it makes quite a bit of sense that the Euro would struggle. The European Central Bank is likely to do something to ease the monetary policy, so that of course will work against the value of the currency as well. Ultimately though, there is a massive hammer from a couple of weeks ago sitting just below the 1.11 the EUR level, so that could cause a bit of support. I think that support will extend down to the 1.10 EUR level which makes quite a bit of sense considering it is a large, round, psychologically significant figure.

Looking at the Fibonacci retracement tool, the 61.8% Fibonacci retracement is now in the rearview mirror. If that’s going to be the case, we should continue to see selling as it typically means we will go looking towards the 100% Fibonacci retracement level. That means that we could be looking towards the 1.05 EUR level underneath, although obviously it would take quite some time to get down there. In the meantime I believe that every time this market rallies you should probably be looking for signs of exhaustion on a short-term chart to start selling.