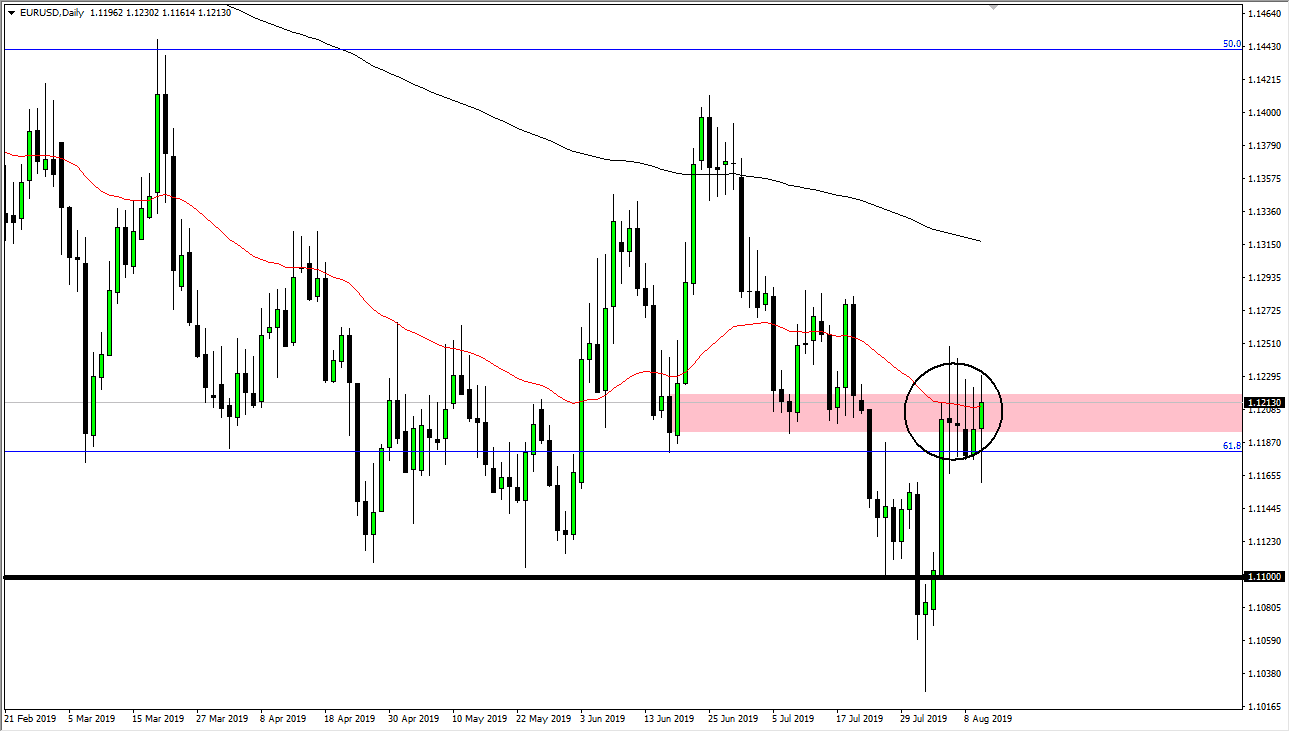

The Euro has continued to show a lot of volatility, as we continue to dance around the 50 day EMA. That EMA of course is something that longer-term traders pay attention to, and it is flattening. When you look at the several last few days, you can see that we are hanging around this EMA, and it continues offer significant amount of resistance. Beyond that, the 1.13 level above is resistance, and the top of a resistive barrier that starts at the 1.12 handle. Because of this, I think it’s only a matter of time before we roll over and show signs of exhaustion.

All things being equal, the Euro has shown quite a bit of bullishness during the day as we initially had fallen only to turn around but at the end of the day it looks like we are going to show signs of weakness still. Because of this, I think it’s only a matter of time before we roll over and break down towards the lower levels, especially near the 1.11 handle. That being said, people do trust the US dollar, at least for the moment, as central banks around the world continue to go down the road of monetary easing, so the question is whether or not the Federal Reserve is going to join the fray. Currently, there are a lot of questions as to whether or not we are going to see more interest rate cuts coming out of the Federal Reserve, so I think there’s a lot of volatility just waiting.

All things being equal, you should see a lot of questions asked about the European Union as well, as the economy is in that part of the world are starting to slow down, so one would have to think that the European Central Bank will continue to have to lower interest rates as well. It’s not until we break above the 1.13 level that I would be bullish, so this point I’m simply looking for opportunities to sell this currency pair although I’m the first person to suggest that the closed during the trading session on Monday was a bit encouraging for the buyers, but we still have a ton of work to do. Ultimately, I think that it’s only a matter time before the sellers come back in but I am willing to capitulate this attitude above the 1.13 handle as it probably opens the door to the 200 day EMA followed by the 1.14 handle.