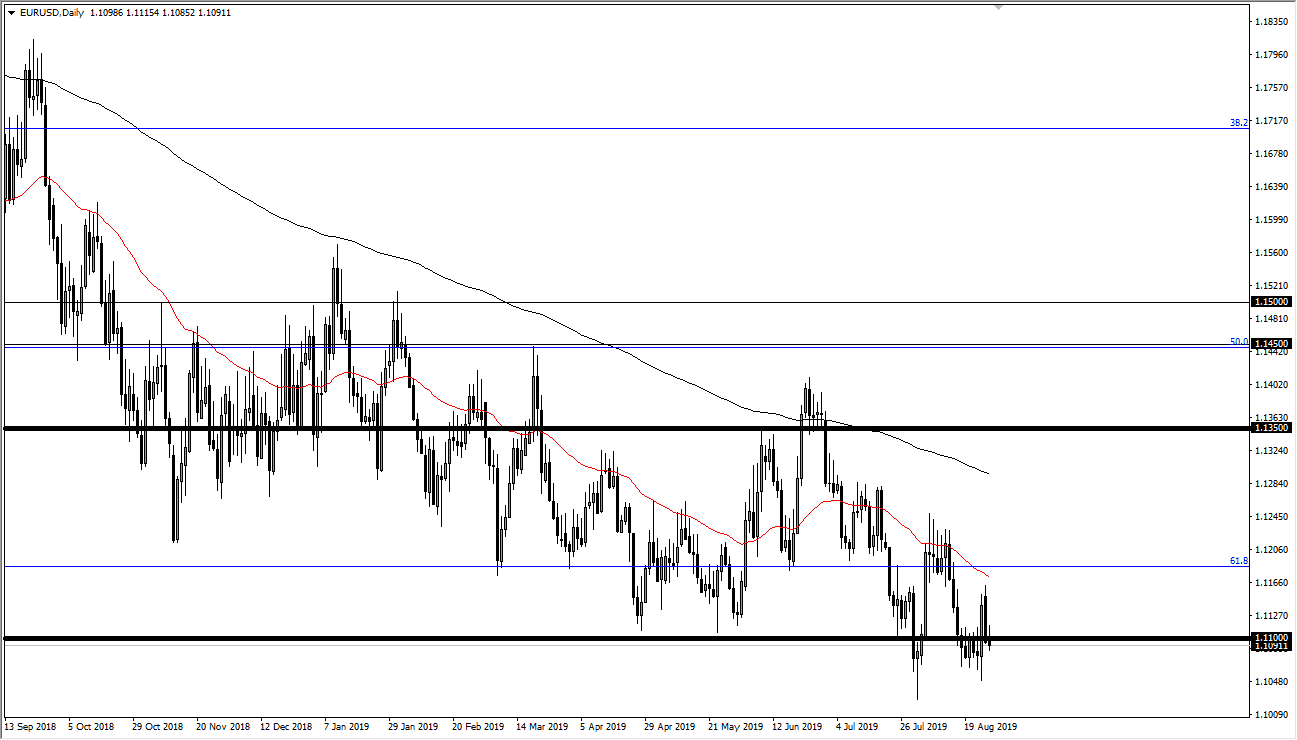

For those of you that don’t know, this is typically one of the least exciting trading weeks of the year, as quite a few of the larger traders around the world are on awaited vacation. Because of this, there is going to be a lack of volume, and interest in trading. With that in mind it isn’t a huge surprise to see that the market is simply hanging about the 1.11 EUR level.

Another thing to pay attention to is that the area of from that level down to the 1.10 EUR level offers a significant amount of support. In fact, it is essentially a “support zone” that the market will be paying attention to. With that in mind I believe that the market continues to find plenty of reasons to grind a bit lower, but it is going to do so very slowly. After all, there are a lot of concerns out there about what the Federal Reserve may do next. The Federal Reserve of course is likely to cut rates, but the European Central Bank is most certainly under the gun as Germany looks ready to go into recession, or for that matter might already be there. The EU is full of zombie banks, and it’s likely that growth in the European Union isn’t coming anytime soon.

Add to all of that the fact that most of the larger bond markets in the European Union are now yielding negative rates, it’s not a huge surprise to see that the US dollar continues to strengthen overall. Money is flowing into the US bond markets, because unlike the EU, they offer yield. Remember, money always goes to where it’s treated best. There is likely going to be even further quantitative easing coming out of the European Union, and while the Federal Reserve is looking to drive down rates through quantitative easing, we still see quite a significant rate differential between the two economies. What’s even more pressing is the fact that it’s more or less a “risk off” world right now, and that of course favors the US dollar in general as well. All things being equal I think we go much lower but it’s going to be a grind for the next 100 pips or so. Once we break below the 1.10 EUR level, then we have the possibility of going down to the 1.05 EUR level.