The Euro rallied quite nicely during the Wall Street trading session on Friday after initially pulling back. Looking at the chart, it’s obvious that this is a nice bounce and it is at an extreme low. That being said though, the Euro has probably reacted more or less against the tariff levied upon the Americans by the Chinese during the trading session, but quite frankly this is just simply a “tit-for-tat” move. I think it’s only a matter time before the markets calm down and understand that although this of course hurts the US economy, the US economy is still without a doubt the strongest economy in the world right now. Beyond that, Germany is starting to slip into recession so one has to wonder how long the Euro can rally.

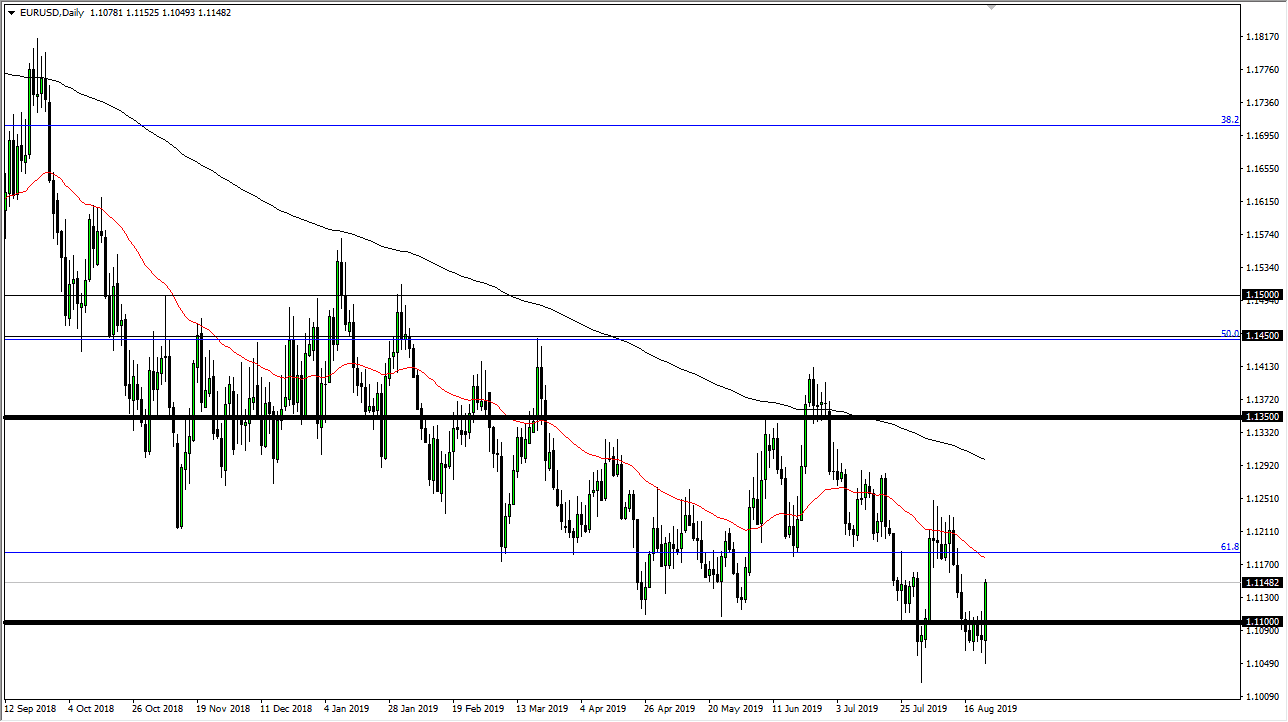

Beyond that, there’s also the question as to whether or not this is going to be short covering heading into the weekend, which could have caused a little bit more of the upward pressure that we have seen. The 1.11 level has been massive support previously and I think it extends down to the 1.10 level after that. To the upside, the 50 day EMA offers a significant resistance barrier, so I think that any signs of exhaustion in that area would be reason enough to start shorting. I suspect that the market will have a hard time breaking down but I think as the ECB continues to ease its monetary policy, we will probably finally break down below the 1.10 level. If we do, then it’s very likely that we will continue down to the 1.05 handle after that. After all, when you are below the 61.8% Fibonacci retracement level, it will quite often send the market down towards the 100% Fibonacci retracement level.

To the upside, and I do believe that it’s the less likely scenario, the 50 day EMA will cause a significant amount of resistance, just as the 1.12 handle will. I think at this point any signs of exhaustion will be jumped on in that area as well, so I like the idea of simply waiting for “cheap dollars” and taking advantage of it. That being the case, I suspect that we will continue to see a lot of volatility and choppiness in this market, but then again I think that’s going to be the case with Forex trading regardless of the pair.