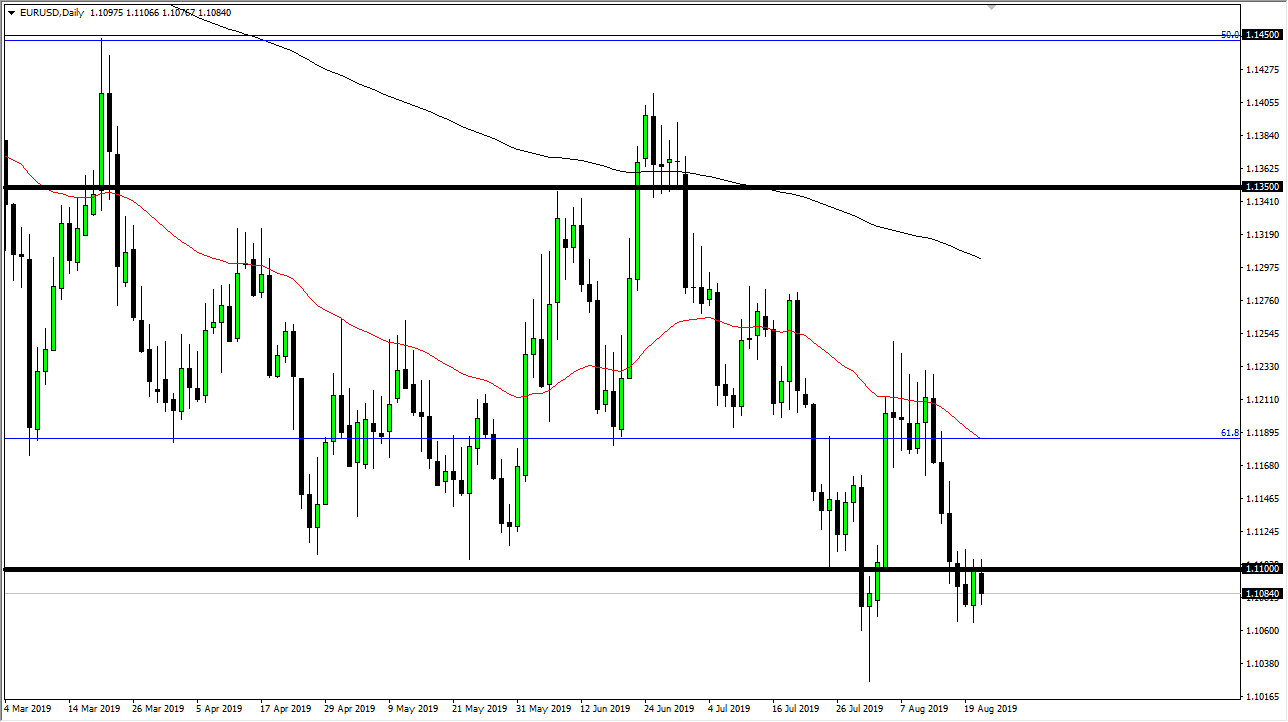

The Euro initially tried to rally during the New York trading session on Wednesday, but continued to see plenty of sellers above, especially near the 1.11 EUR level which has previously been an area of massive support. The market has plenty of support all the way down to the 1.10 EUR level, and therefore I think it’s very likely that we are going to see this market continue to bounce around in this area. Having said that though, it’s likely that this market is going to continue to find plenty of reasons to fail, so if we do rally from here I think it’s only a matter of time before sellers get involved on signs of exhaustion.

To the upside, the 50 day EMA is starting to turn lower, so I think at this point it’s likely that we will have plenty of opportunities to sell the first signs of exhaustion as the Euro can’t seem to find its own footing. This makes quite a bit of sense considering that the Germans are entering a recession, and of course the Treasury market in the United States continue to attract a lot of attention. As long as that’s going to be the case it’s very likely that the US dollar will strengthen going forward.

All things being equal, I believe that the market continues to grind in this general vicinity, but I don’t know if we can have a straightaway break down. We have central bankers meeting at Jackson Hole this week and having statements of the next couple of days, so there might be a bit of volatility but that also means it might be the end of the day on Friday before we have any clear directionality here.

I certainly favor the downside and I think rallies are nice opportunities to pick up the US dollar “on the cheap.” If we were to somehow turn around and break above the 1.1250 level, then you would have to take that rally seriously, and that will probably only happen of Jerome Powell says something extraordinarily dovish. I think at this point though, there are so many concerns about the European Union and the negative interest rates in the bond markets over there that the Euro will continue to lose steam and we will eventually break that 1.10 EUR level underneath. It’s going to be noisy but negative overall.