The Euro looks likely to bounce at this point, after showing signs of support underneath and then reaching above the 1.11 handle. However, this is a market that is dead in the water and of course the Euro continues to suffer at the hands of negative yields in the bond markets on the continent. Beyond that, we also have the issue of Germany going into a recession, so that of course weighs upon the Euro in the Forex market. Beyond that, we also have Brexit going on and although most of the negativity is thought to be housed in the United Kingdom, it’s quite unlikely that the European Union will escape this situation unscathed either.

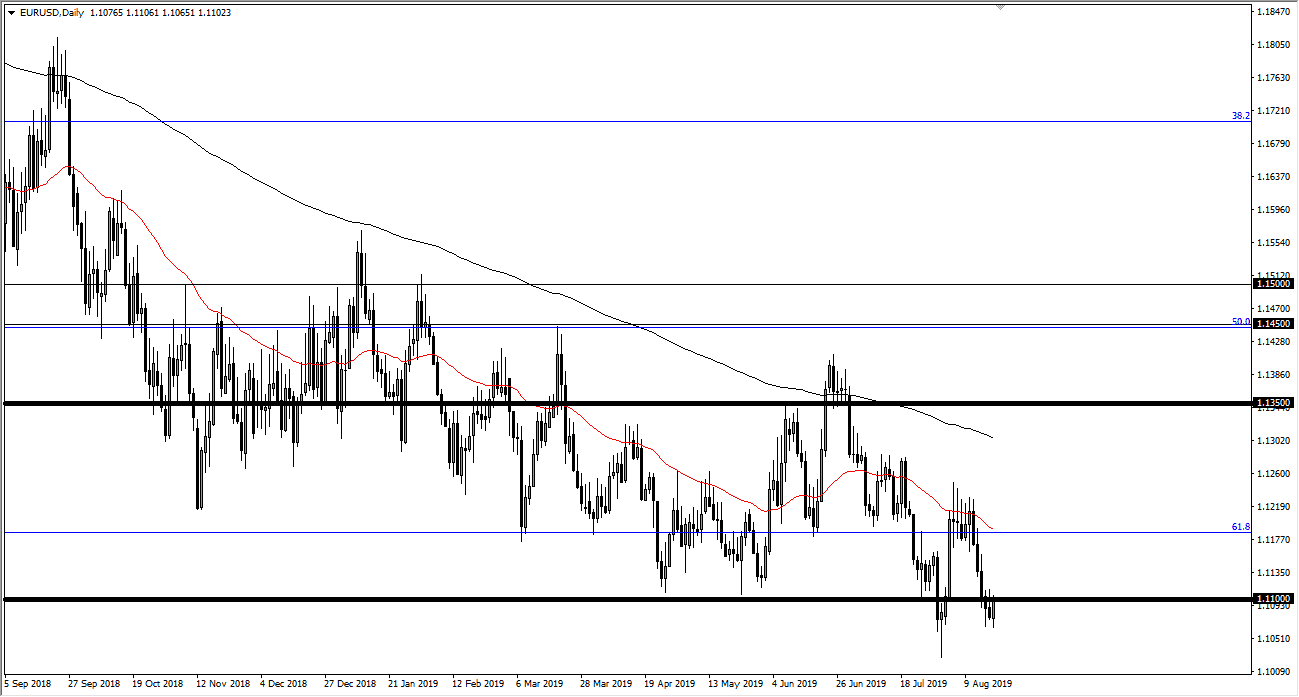

Beyond all of that, we have the US Treasury market that is absolutely on fire. Ultimately, I think that the US dollar will continue to attract flow due to all these reasons I have mentioned. Look at this chart, I think that if we break above the high from the trading session on Monday, then we could have a little bit more of a bounce but then I think it’s only a matter time before the sellers come back. I would bet on the 50-day EMA offering a bit of resistance that we could see the market start to pull back from.

Looking at the downside, I think there is a lot of support between the 1.11 level and the 1.10 level. Ultimately, if we do break down below the 1.10 level, then it’s likely that we will unwind quite drastically. We are underneath the 61.8% Fibonacci retracement level, have even retested it to see whether it would hold as resistance, and it has. However, typically we will go down to the 100% Fibonacci retracement level which is closer to the 1.05 EUR level. However, this pair has a long history of chopping around back and forth but with a slightly negative downtrend. At this point, I believe it’s only a matter time before this market sells off yet again, so I don’t have any interest in buying, even if we do break above the high from the Monday session. At that point I will simply look for exhaustion above to take advantage of. Ultimately, if we break down below the lows of the Tuesday session then I think the market will continue to go down to the 1.10 level where it has its next major fight.