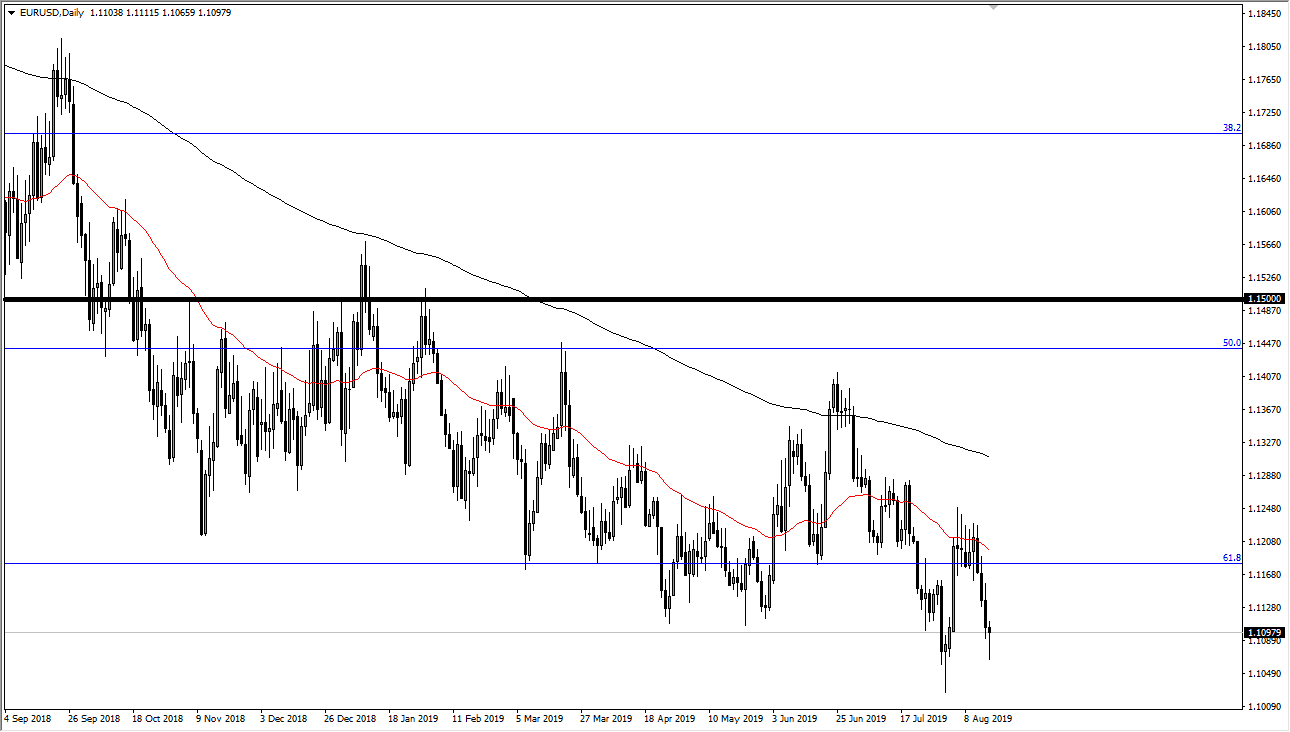

I do believe that the Euro is going to eventually fall much lower, and the closing candlestick on Friday did suggest that a bit of a bounce was imminent. At this point, I would anticipate a bounce towards the 50-day EMA which is pictured in red on the chart. I think at that point you’d be looking to sell again as there is simply no reason to think that the downtrend is over. Yes, I recognize that we are starting to see a lot of support right around the 1.11 handle again, but I think part of the reason for this phenomenon is traders trying to unload before the weekend so that they don’t carry too much in the way of risk.

US Treasuries continue to attract a lot of order flow, and that of course means US dollars. With that being said I think it’s only a matter time before we crack the 1.10 level underneath and continue to go much lower. However, this pair is likely to continue to see a lot of choppy behavior but that’s typical for this pair. Ultimately, this is a market that will favor trading short-term rallies at the first signs of exhaustion, but that doesn’t mean that will get big moves. I think it’s going to continue to be more of a grind lower, as the pair has been so jagged for so long. The European Central Bank looks likely to ease monetary policy as economic numbers of the European Union continue to fail, and although the United States may be heading into a bit of a recession, it’s likely that the markets will continue to flood into Treasuries as the safety of capital is going to continue to be important.

It’s not until we break above the 1.13 level that I would be impressed, and quite frankly I think that this is going to end up giving us an opportunity to pick up the US dollar “on the cheap.” With that, I am a seller of rallies, and most certainly a seller of a break down below the 1.10 level. Based upon the Fibonacci retracement tool, we are below the 61.8% Fibonacci retracement level, perhaps heading towards the 100% Fibonacci retracement level which is closer to the 1.05 EUR level. Unless something changes drastically with the attitude of the central banks, this market should continue to attract sellers.