The Bitcoin market has done very little during trading on Tuesday, as we continue to see plenty of support just below. That being said, the Bitcoin market continues to look very quiet as most of the larger traders out there are away on vacation. This is typically one of the least exciting weeks to trade financial markets of the year, and I think we will continue to see a somewhat lackluster situation, but it certainly looks as it has much more support than it does resistance.

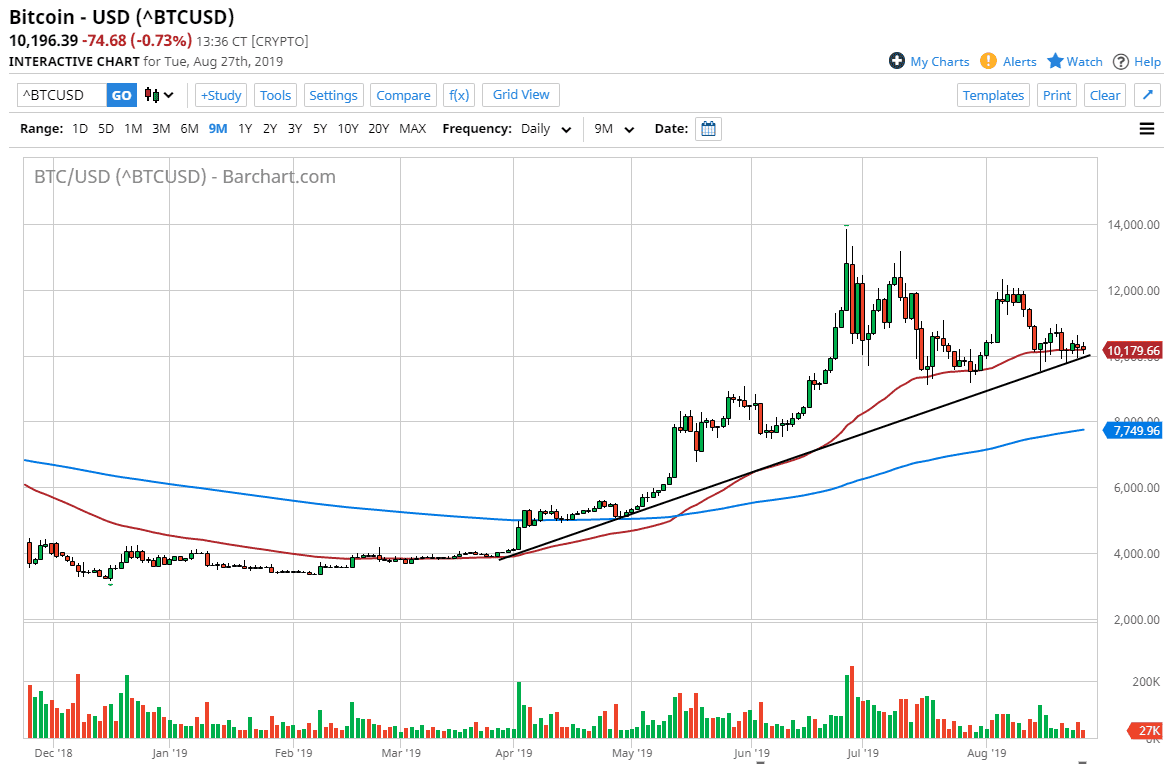

The 50 day EMA is currently slicing through the bottom of several candlesticks, and it should also be noted that several of the recent candlesticks have been hammered. This suggests that we are going to continue to try to go higher, perhaps reaching towards the $12,000 level. That doesn’t mean that it has to happen today, nor does it have to happen quickly at all. However, I do think that we continue to see Bitcoin rallied, mainly because there are so many concerns about fiat currency right now. Central banks around the world continue to cut interest rates and liquefy the markets by doing quantitative easing, which helps the idea of assets being used to store of value.

There is a nice trend line underneath, and of course the $10,000 level makes quite a bit of sense as it is essentially one of the most round and full figures that you can see on the chart. With that, it attracts a lot of attention. At this point, I believe it’s more or less a “support zone” that extends down to $9500 or so. If we were to break down below there, then we probably go down towards the 200 day EMA which is just below the $8000 level. That being said though, it appears that we will continue to see traders willing to step in and support this market so I don’t expect to see it break down to the 200 day EMA. However, if we were I think that becomes even more supportive then current levels, as it will represent value as well. While I don’t exactly see Bitcoin as a screaming bullish market right now, I do recognize that it is much more likely to bounce that it is to break down in the short term. With that I remain bullish, but recognize that a certain amount of patience will be needed to take advantage of the uptrend.