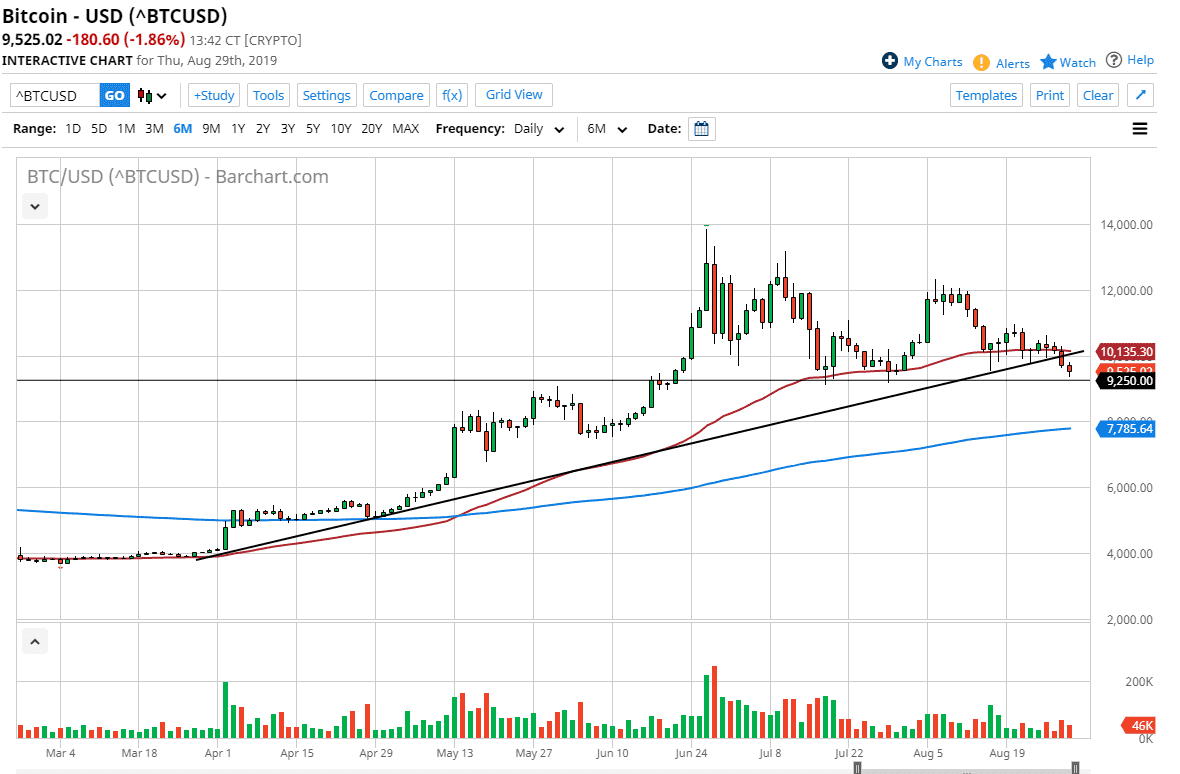

The Bitcoin market fell again during the trading session on Thursday, as we have broken through an uptrend line, and now looks susceptible to selling pressure. That being said though, there is a significant amount of horizontal support at the $9250 level, and that’s an area that could attract some attention. That being said, we also have broken through the 50 day EMA, so having said that it’s likely that the $9250 level could cause a bit of interest, and it could be tested rather stringently. It comes down to where we close for the Friday session. If we close below the $9250 level, then I think the market probably goes down towards the 200 day EMA, which is of course going to be supportive once we get down there. It’s closer to the $8000 level so if we do get a break down below the $9250 level, it’s likely that we could see a pretty significant move down to that level.

Ultimately, if we do get a bit of a bounce from here we will then test the bottom of the trend line, and then of course the 50 day EMA. If we can clear the 50 day EMA, then the uptrend can continue and we will probably go looking towards the $12,000 level. Overall, I think this is a market that continues to see a lot of volatility and choppiness, and as a result I would anticipate that you are probably better off waiting for the weekly close before putting serious money to work. I do believe that Bitcoin will eventually find buyers, but I also recognize that we could be gunning for trouble in the short term.

All things being equal though, the Bitcoin market has attracted a lot of monetary flow due to the issues about the world right now, and it is likely that the market will continue to be attractive for those seeking shelter from the geopolitical and trade issues. While things may have calmed down over the couple of days previous, the reality is it’s only a matter of time before something happens that shakes the nerve of traders around the world again. All things being equal I think it’s only a matter time before somebody comes in to pick this up. Perhaps there is a bit of profit taking going on, but at the end of the day it’s not a massive break down even though we have cleared the uptrend line. The rate of failure has been rather slow.