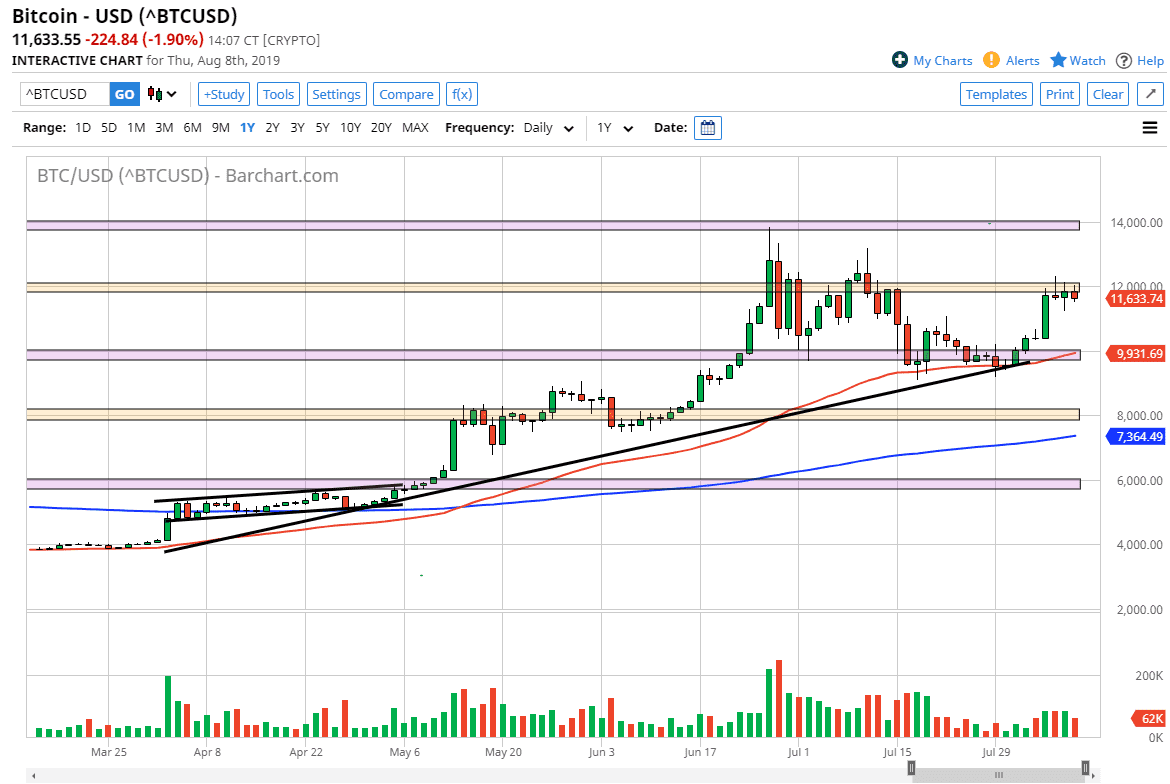

Bitcoin has had a bit of a slow day on Thursday, originally try to break above the $12,000 level but could not hang onto enough momentum to do so. Because of this, it looks as if the Bitcoin market is starting to run out of momentum. This coincides quite nicely with the gold market, and as the two markets are moving in tandem for much of the same reasoning.

Looking at this chart, it’s obvious that the $12,000 level has been resistance in the past, as well as $13,000. I think there is a lot to get through above in order to go higher, so a bit of a pullback really wouldn’t be a huge surprise. I recognize that the shooting star and the hammer that preceded the candle stick from the Thursday session show the confusion, and as we go into the weekend it’ll be interesting to see how Bitcoin reacts to the global situation.

Going back to the correlation with gold, both markets are rallying due to people trying to hide money from the devastation out there. Chinese, Venezuelan, and Iranian citizens have all been throwing money at the Bitcoin market, to preserve some semblance of wealth. Beyond that, gold has been lifted because of interest rates out there being slashed by just about every central bank you can think of. That’s yet another reason to think that Bitcoin should continue to go higher over the longer-term.

All things being equal though, we could get a bit of a pullback. That pullback should be an opportunity to start buying Bitcoin “on the cheap” as the $10,000 level underneath should be massive support. We not only have a large, round, psychologically significant figure, but we also have the 50 day EMA, the large, round, psychologically significant figure, and of course the uptrend line. We have bounced from there previously, and as a result it’s likely that there should be a lot of interest paid to that area. I think at this point if we were to break down below there it would be rather surprising and could show a bit of an unwind. However, it looks as if people will continue to get out of fiat, using both Bitcoin and gold to do so. If we can break above the candle stick from Tuesday, that’s a sign we are ready to continue to go much higher. Otherwise, I’m looking for pullbacks offer value.