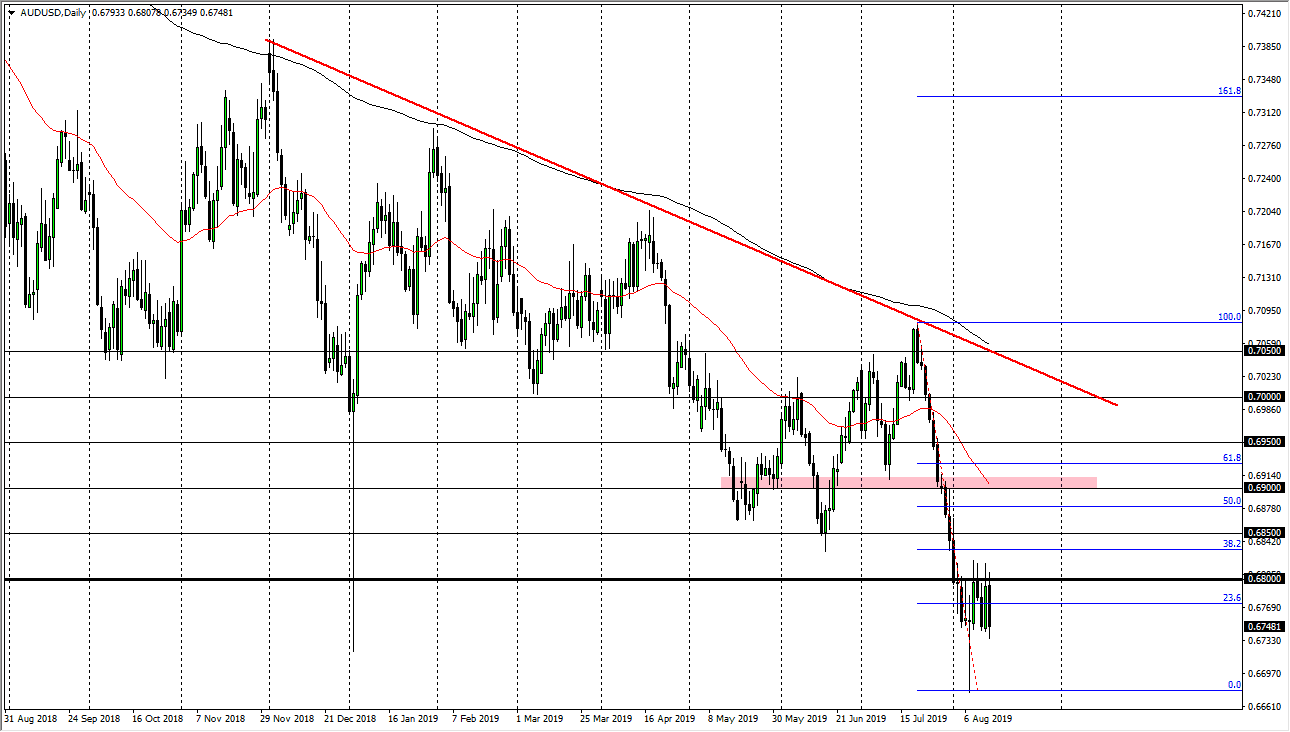

The Australian dollar has initially tried to break above the 0.68 level during the trading session on Wednesday but then broke down significantly again. We are currently bouncing around a consolidation area that has been a feature of this market, and now it looks like we are going to continue going lower. At this point, I think that rallies are to continue to be sold as the Australian dollar is a proxy for the Chinese economy.

The US/China trade war continues to be a problem, and therefore I think the Australian dollar will continue to take it on the chin. Beyond that, we are starting to see signs of recessionary headwinds as the yield curve has completely inverted. This of course has people concerned about global growth, and the Australian dollar of course will continue to strengthen because of global tension in fear. As money flows into the treasury markets, it makes sense that the US dollar continues to strengthen.

To the downside, I think the initial target would be the bottom of the hammer from the previous week, and then eventually the 0.65 handle which should be massive support as well due to the fact that it is such a large, round, psychologically significant figure. At this point, I think we are destined to go down to that level, perhaps testing a major support level based upon not only the round figure, but also the monthly charts. To the upside, the 0.69 level is massive resistance as we have seen it act importantly more than once, and of course we have the 50 day EMA sloping through that level. Regardless, I think what we are about to see is a major breakdown of the Australian dollar, and then eventually recovery but we need some type of good news coming out of either the United States or China involving trade.

Until then, I suspect that we continue to see sellers come in and punish the Aussie every time it tries to recover. I know that I will be fading short-term rallies, but I’m not looking for explosive moves, just more of a grind to the downside as we have so much in the way of interest in of course we are oversold in general. One thing is for sure though, it is very interesting that the market seems to be very comfortable with the idea of being below the 0.68 handle, something that was a bit of a surprise to me.