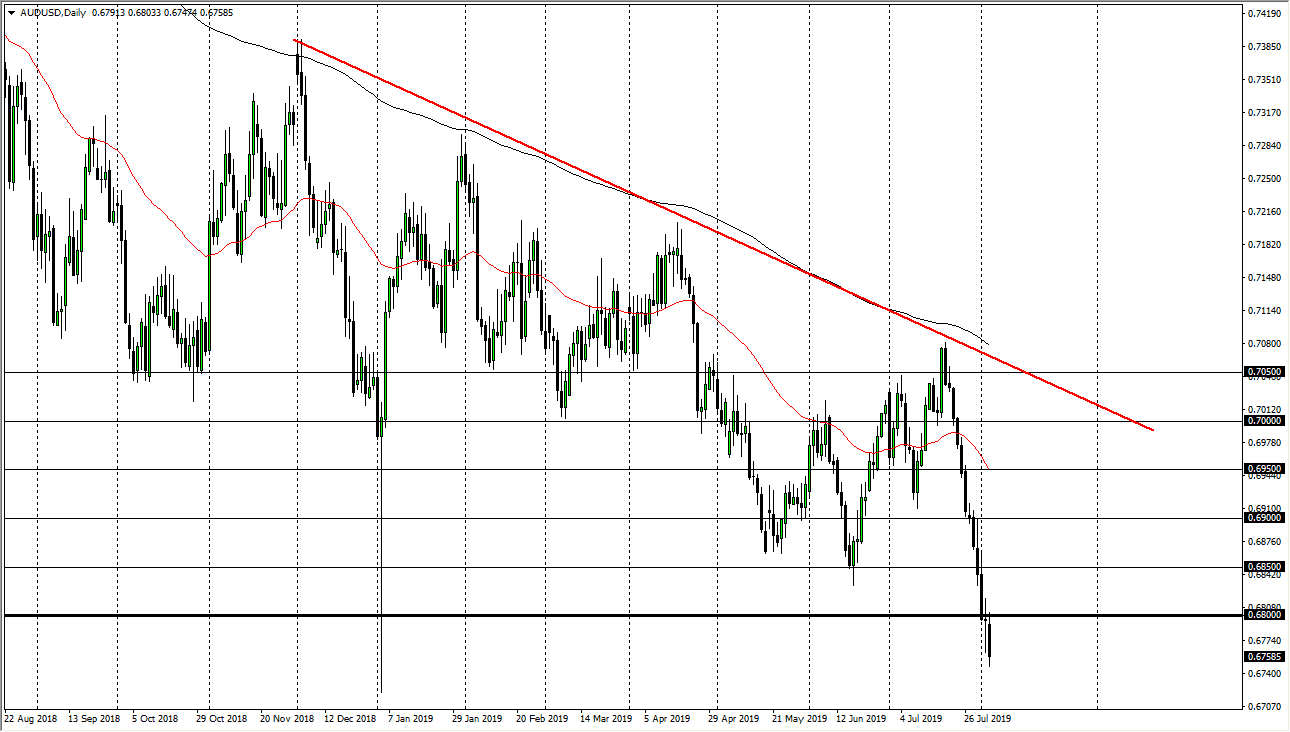

The Australian dollar has initially tried to rally during the trading session on Monday but found enough of resistance at the 0.68 level to fall rather hard and break down through the bottom of the candle stick from Friday. This is a very negative sign, and it could send this market much lower. At this point I think we could be looking at a move down to the 0.65 handle.

At this point, rallies are to be treated with suspicion, just as I said on Friday. However, we did not get the bounce, and we have actually made an even more bearish signal as we have broken through the bottom of the hammer. I still believe that every 50 pips or so you should be looking for a selling opportunity in this market, as it is so technically driven. At this point, we are in a downtrend and there’s no reason to think it is anything different. At this general level, I think it’s very likely that the Australian dollar will continue to get hammered based upon the US/China trade war situation getting worse.

Never forget that the Australian dollar is a proxy for mainland China, and therefore traders will avoid Australia if China continues to be a problem. Overall, I believe that the market is one that you wait for value in the US dollar to start selling. We are starting to see capital flight out of China, and that of course helps safety asset such as gold, which typically would help the Australian dollar but it’s because we are in such a “risk off” situation that it makes sense the US dollar will continue to appreciate due to not only the safety aspect of the greenback, but also the fact that the treasury markets will continue to attract quite a bit of money.

Rallies at this point are selling opportunities and not a reason to go long until we get some type of resolution to the US/China situation and although we are oversold at this point, until we have that situation figured out, there’s no reason to be long of the Aussie. An area that I’m very interested in shorting from is going to be the 0.69 level above if we can get some type of nice bounce. However, even though we are oversold it’s obvious that we been oversold for a while, traders seem to be ignoring that.