The Australian dollar has initially tried to rally during the day on Thursday but the later in the day we get, the less risk appetite there seems to be around the world. The Australian dollar is obviously a risk appetite influenced currency, so as long as we have a lot of uncertainty out there, it makes sense that the Australian dollar would sell off. Remember, the Australian dollar is highly levered to the Chinese economy, and of course we have the US/China trade tariffs continuing to take swings at each other. As long as that’s going to be the case the Australian dollar will suffer.

The one thing that has been working for the Australian dollar has been the gold market but it got absolutely hammered during the trading session. That being the case, it’s very likely that there is still yet another reason for the Aussie to start selling off. The candle stick looks very negative, and I think that will continue to be the case going forward. Ultimately, I think that the market goes down to the 0.65 handle, which is a major support level on longer-term charts, including the monthly chart.

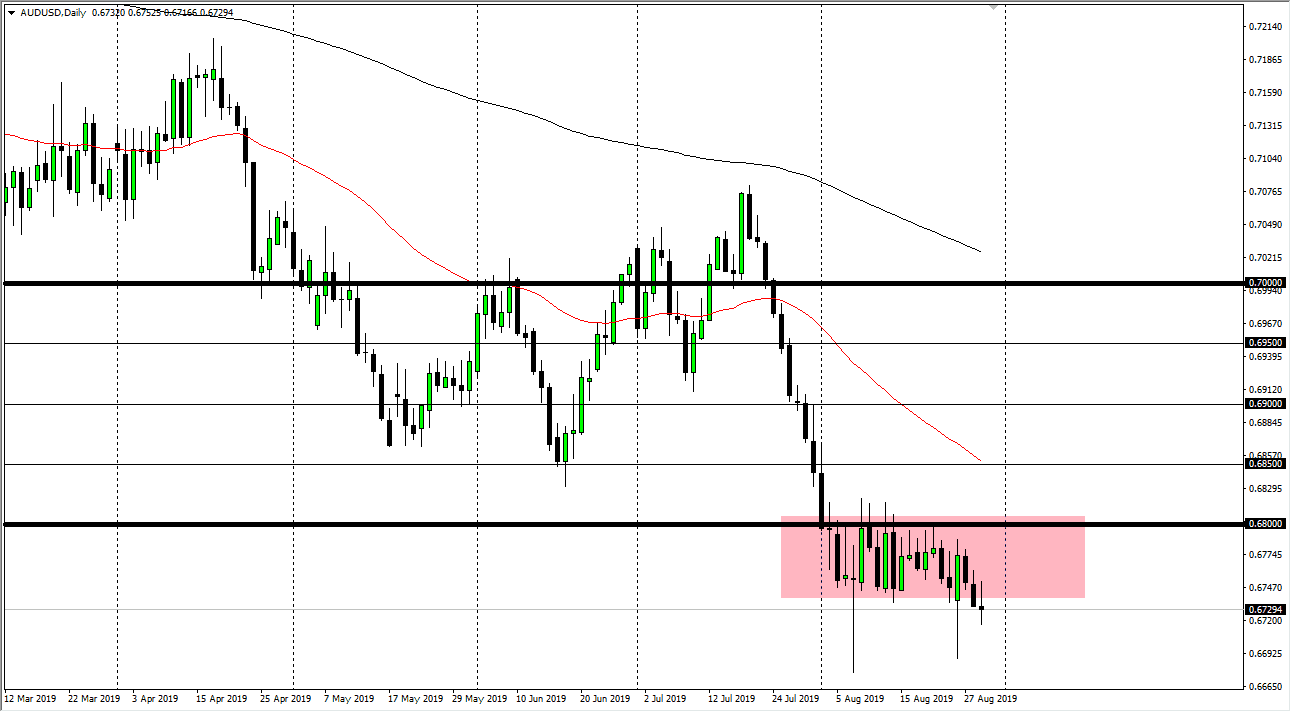

At this point in time it’s likely that rallies will be sold, extending all the way to the 0.68 level after that. This level, the 0.68 handle, should be the “ceiling” in the market currently. Ultimately I think that this market will continue to be a “fade the rallies” type of situations so therefore we need to keep that in mind. The US dollar has been strengthening due to a whole host of reasoning, not the least of which will be the treasury market that has been on absolute fire. Beyond that, it’s just simply money running away from the Australian housing bubble, so therefore I think it’s very likely that we should continue much lower.

If we were to break down below the 0.65 level that would be an absolute disaster. I don’t know that we will, so I think it’s only a matter of time before that level would offer a significant amount of support. If we were to break down there it would probably be the result of some type of major financial meltdown. In the meantime though, I think that we just simply fade short-term rallies take small profits, rinse and repeat as this is a choppy but negative market.