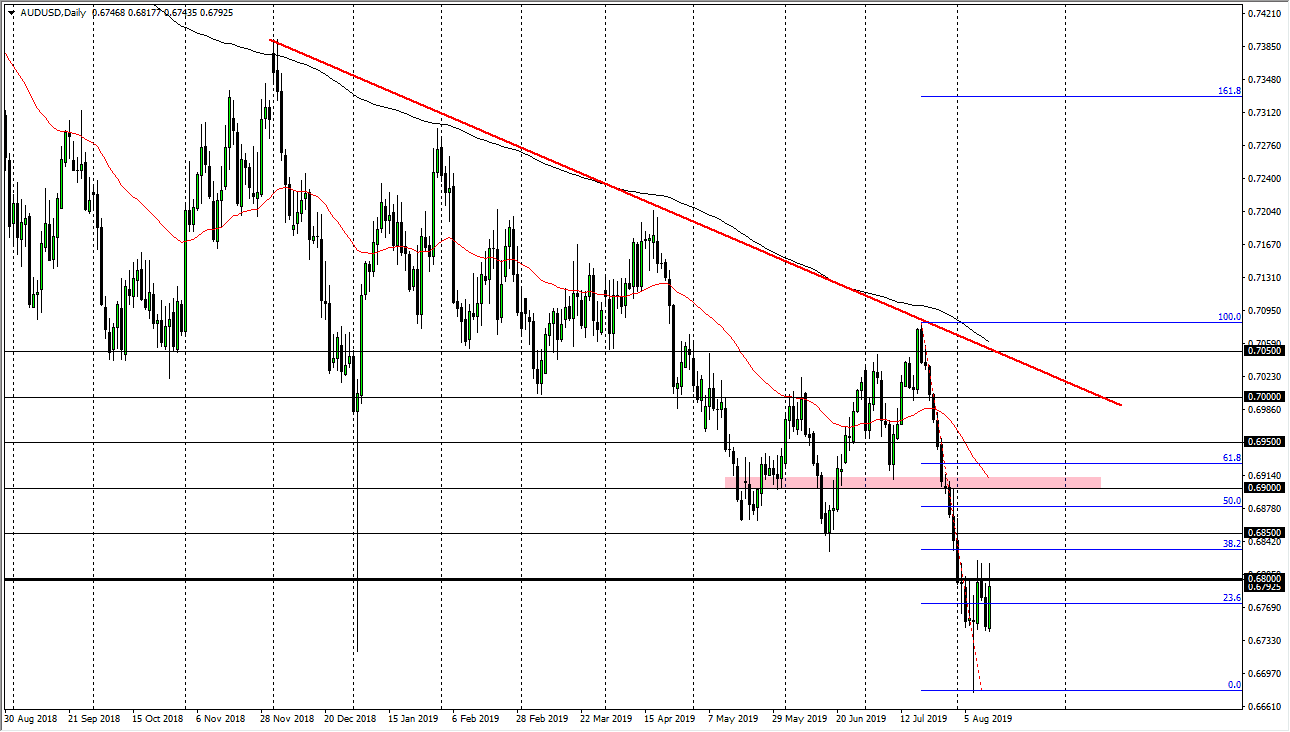

The Australian dollar has tried to rally during the trading session on Tuesday, and it did keep some of the gains as we reached towards the 0.68 level, an area that of course is crucial from a longer-term standpoint as I have pointed out several times. The rally was nice, but the reality is that we haven’t broken through the resistance, so it makes quite a bit of sense that we could roll right back over from this major level. With the market reacting quickly to the announcement that the Americans were going to delay tariffs against the Chinese, we did get a sudden surge in the Australian dollar is one would expect. However, as we start to close out the day it’s obvious that we aren’t quite that convinced.

The 0.68 level is massive resistance, and I think that we have even more resistance above at the 0.69 handle. Ultimately, I think it’s only a matter time before the sellers jump in and take advantage of “cheap dollars.” The Australian dollar is obviously very highly levered to the Chinese economy, so the tariff announcement of course doesn’t really act much as a surprise. I like the idea of taking advantage of these rallies as they show exhaustion on short-term charts, although I recognize that we are at extended levels.

The 50 day EMA above is currently hanging about the 0.68 level, so it’s very likely that we will continue to see sellers in that general vicinity. To the downside, I believe that the 0.65 level will be targeted underneath, as it is a large, round, psychologically significant figure and an area that we had been seen quite a bit of action around on longer-term charts. All things being equal, I like the idea of fading these rallies and taken advantage of short-term moves. I believe that we are in consolidation at this point, so given enough time I do think that we will roll right back over. Ultimately, it’s not until we get at the very least a daily close above the 0.69 level that I would consider buying, and quite frankly I don’t even think that might do it. In other words, it’s all about waiting for signs of exhaustion that you can take advantage of and being very patient in the meantime. We are in the dead of summer, and more importantly in the dead of vacation season so the next couple of weeks could be somewhat quiet.