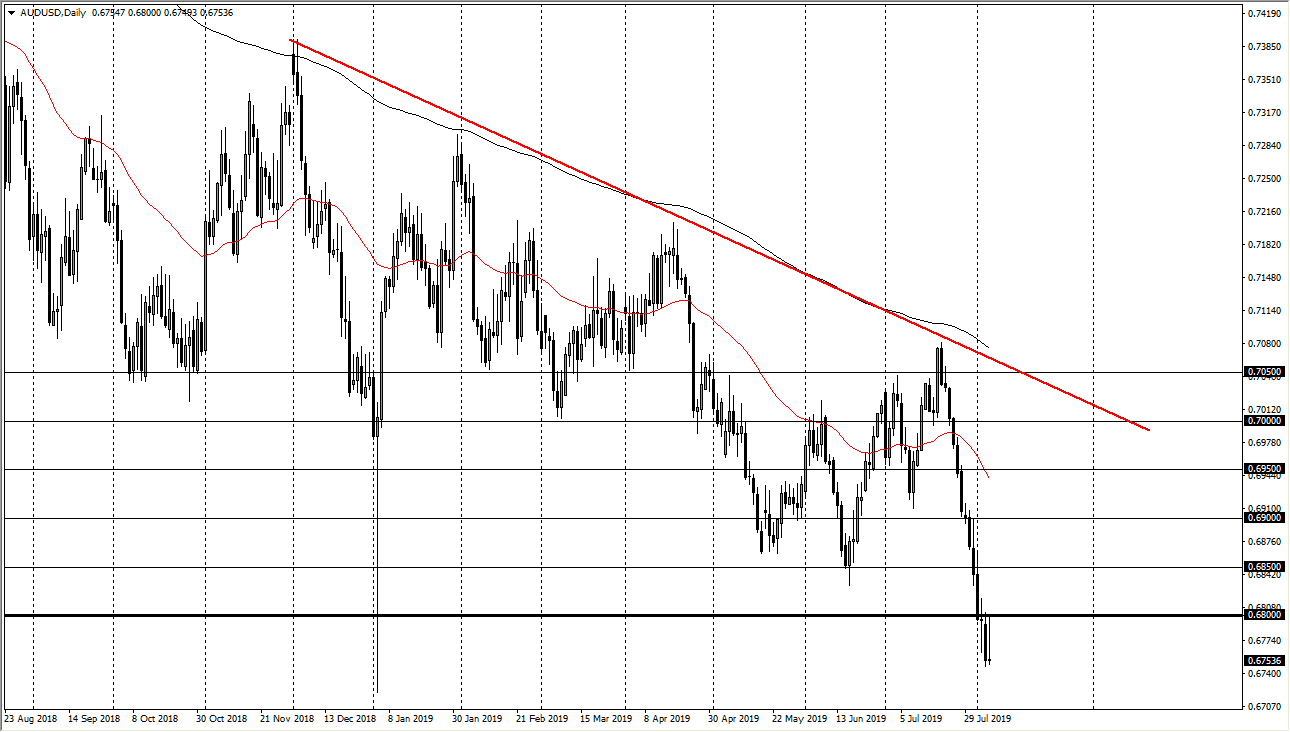

The Australian dollar rallied initially during the trading session on Tuesday, slamming into the 0.68 level above, which of course is a large, round, psychologically significant figure. That’s an area that was pretty significant support, and it’s obvious that it should now be significant resistance. The Australian dollar falling against the US dollar makes quite a bit of sense considering everything that’s going on. However, I will be the first person to tell you that I am a bit surprised that the fall has been this rapid.

After the Americans labeled the Chinese “currency manipulators”, we saw the US dollar get hammered against some Asian currencies, but that was mainly done by Asian traders. By the time the Asian session was over, the Europeans took over and started buying the US dollar as it is considered to be a “safer currency.” Ultimately, the market looks likely to continue the downward pressure as breaking through the 0.68 level was crucial. The 0.65 level underneath will be the target longer term, but that doesn’t mean will get there immediately.

Alternately, if we were to break above the hammer from late last week which closed near the 0.68 handle, that would be a very bullish sign, but only for a temporary bounce. As we are so oversold, I think some type of bounce is necessary. The market has been very responsive to moves in 50 pips increments. Ultimately, I also see the red 50 day EMA as a major resistance barrier as well, so I think that will also offer resistance going higher. I would love to see this market break higher, but it probably won’t stick for any length of time as we are light years away from the US/China trade resolution, which I believe is a major barrier to higher pricing in the Australian dollar.

If we were to break down below the 0.65 level, that would be an absolute disaster for the Australian dollar. I think at that point you could start to see central banks get concerned with its exchange rate. All things being equal, we are oversold so I think it’s only a matter time before the sellers come back in. I would look for exhaustive candles on the 50 pip levels that I have marked on the chart, and I would be a seller at any of those levels.