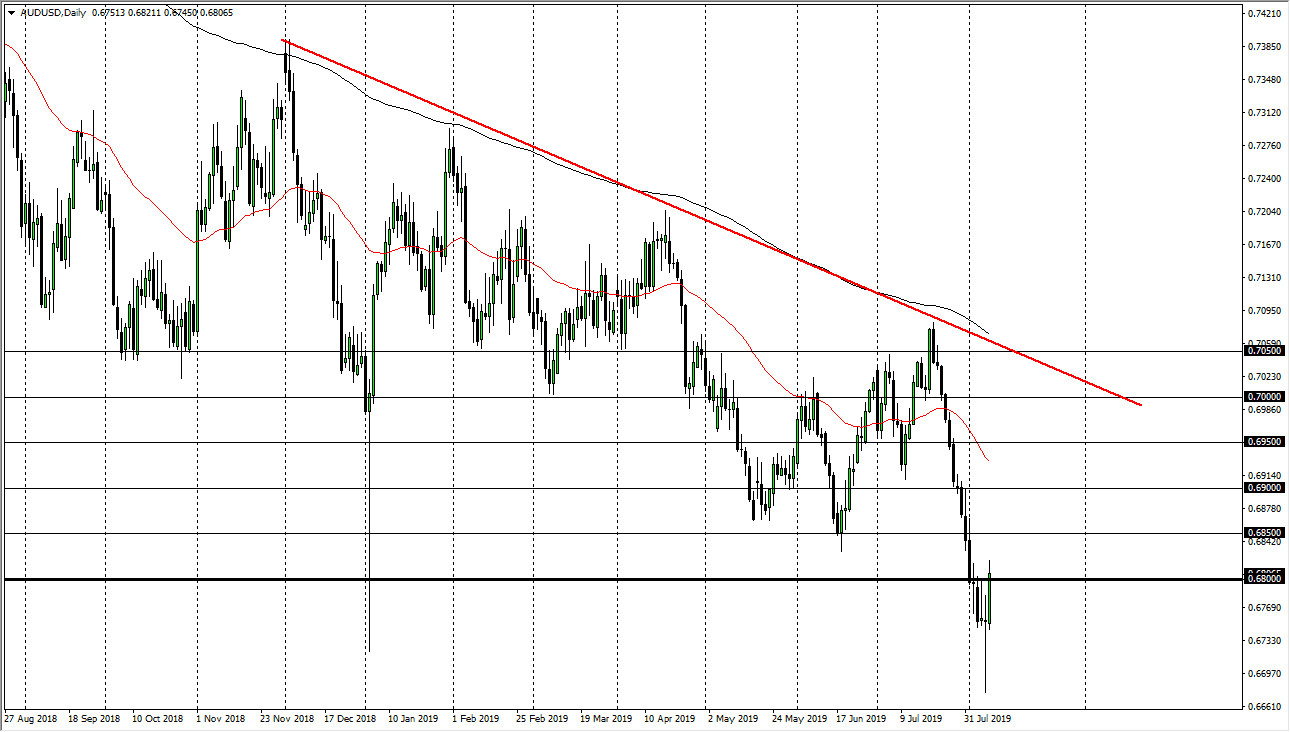

The Australian dollar has rallied quite nicely during the trading session on Thursday, breaking above the 0.68 handle. Now that we have broken above the hammer from the previous session on Wednesday, this is technically a signal to start buying the Aussie dollar. However, all you have to do is look at the chart and realize that we had been extraordinarily oversold, so it makes sense that we would get a bit of a bounce. The question now is “What would we do with this bounce?”

Considering that nothing has changed in the global situation, I believe that the Australian dollar will continue to struggle. We are starting to see Asian banks cut interest rates, with New Zealand, India, and Thailand all cutting rates in the same day. That being the case, it’s very likely that there are bigger concerns out there when it comes to Asia and therefore people will be looking to short the Aussie dollar as demand for Australian commodities must be falling.

The Australian dollar is suffering from the Australian economy fledgling after a 30 year expansion. Because of this, any rally at this point should end up being a selling opportunity. I presently see the 50 day EMA as being crucial resistance, and the fact that it is starting to reach towards the 0.69 level tells me that it’s very likely to be right in that region. Every 50 pips or so we see potential resistance barriers, so I’m simply going to let the market rally a bit, and then try to sell the Aussie in order to take advantage of what has been a rather reliable downtrend.

Looking at this currency pair, I believe that we are probably going to eventually make a move towards the 0.65 handle, but that’s a longer-term call and not necessarily something that will happen in the next couple of days. Overall, I believe that if you are patient enough to simply let the market rally and show signs of exhaustion, then you can take advantage of what has been rather reliable. This downtrend has been extraordinarily overdone for some time, so I look at this bounce as an opportunity, not something to be worried about, or even try to take advantage of to the upside. I suspect Friday could be a bullish day, and I think the higher we go, the better off I will be shorting.