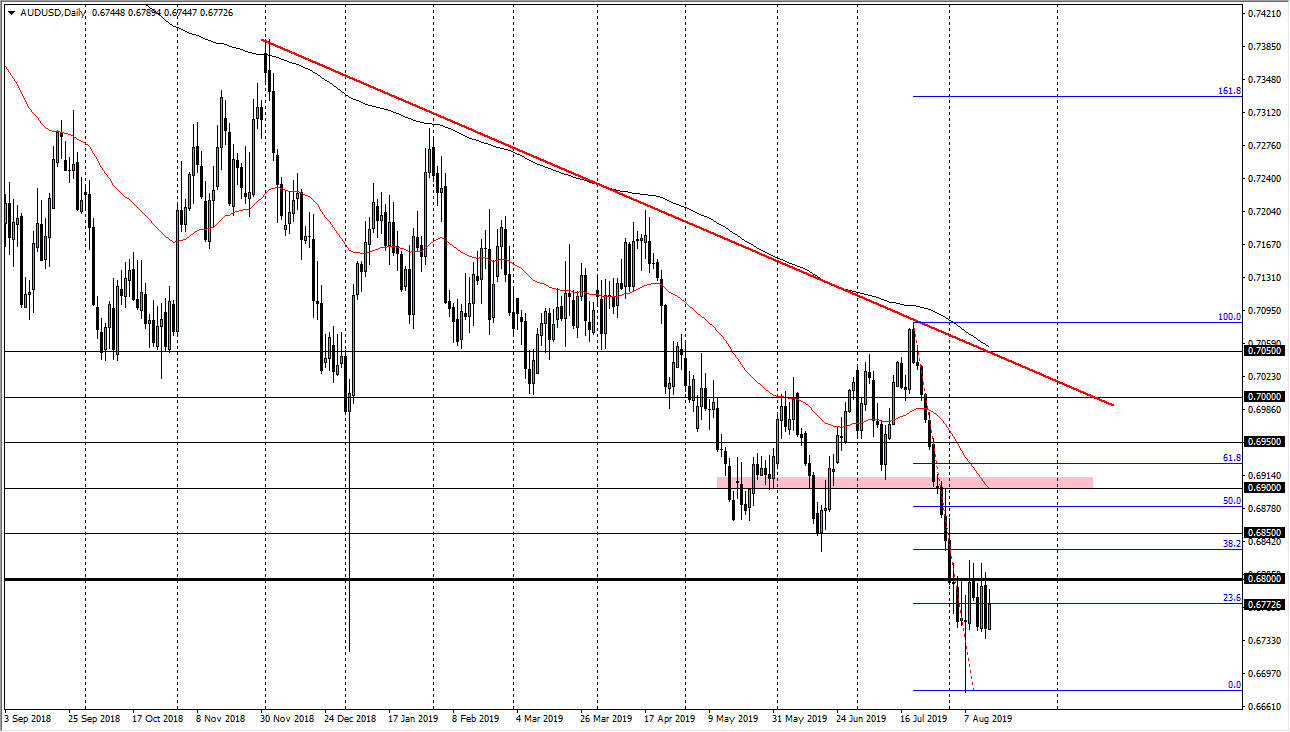

The Australian dollar has rallied a bit during the trading session on Thursday, as we continue to see the market try to test the 0.68 handle. This is an area that was massive support previously so it makes quite a bit of sense that it is going to be massive resistance right now. That being the case, we have seen this market bounce back and forth between the 0.67 and 0.68 levels, and at this point I think it’s only a matter time before we break down as we have cleared major support.

In the meantime, we are getting used to the idea of being below the 0.68 handle, and at this point I think it is only a matter of time before we accept lower pricing, mainly because of the US/China trade situation. After all, the trade wars are heating up and not cooling off, so I think that will continue to weigh upon the Aussie as it is so highly levered to the Chinese economy.

The fact that the Gold markets have rallied significantly has not help the Australian dollar as it appears the Reserve Bank of Australia is set to ease its monetary policy as the Australian housing market is starting to struggle. As exports to places like China slow, that also has a major amount of negativity around the Aussie economy. Further compounding this move is that the US treasury market continues to attract a lot of attention, and therefore capital. That capital flying through currency markets has driven down currencies against the greenback on the whole, so the Aussie of course will be any different.

To the downside I think that the hammer from a couple of weeks ago could be targeted. If we break down below that hammer, then it’s very likely that the trap door opens and we go much lower. At that point I would start to target the 0.65 handle underneath as it is a major support level based upon the monthly chart. Ultimately, I think we continue to fade this market on short-term rallies but I also recognize that we don’t have a lot of movement in the charts right now, so I think were just simply going to be in a tight back-and-forth type of scenario. Even if we did break above the 0.68 handle I think that the 0.69 level is even more resistance from a structural standpoint and of course the fact that the 50 day EMA is right there.