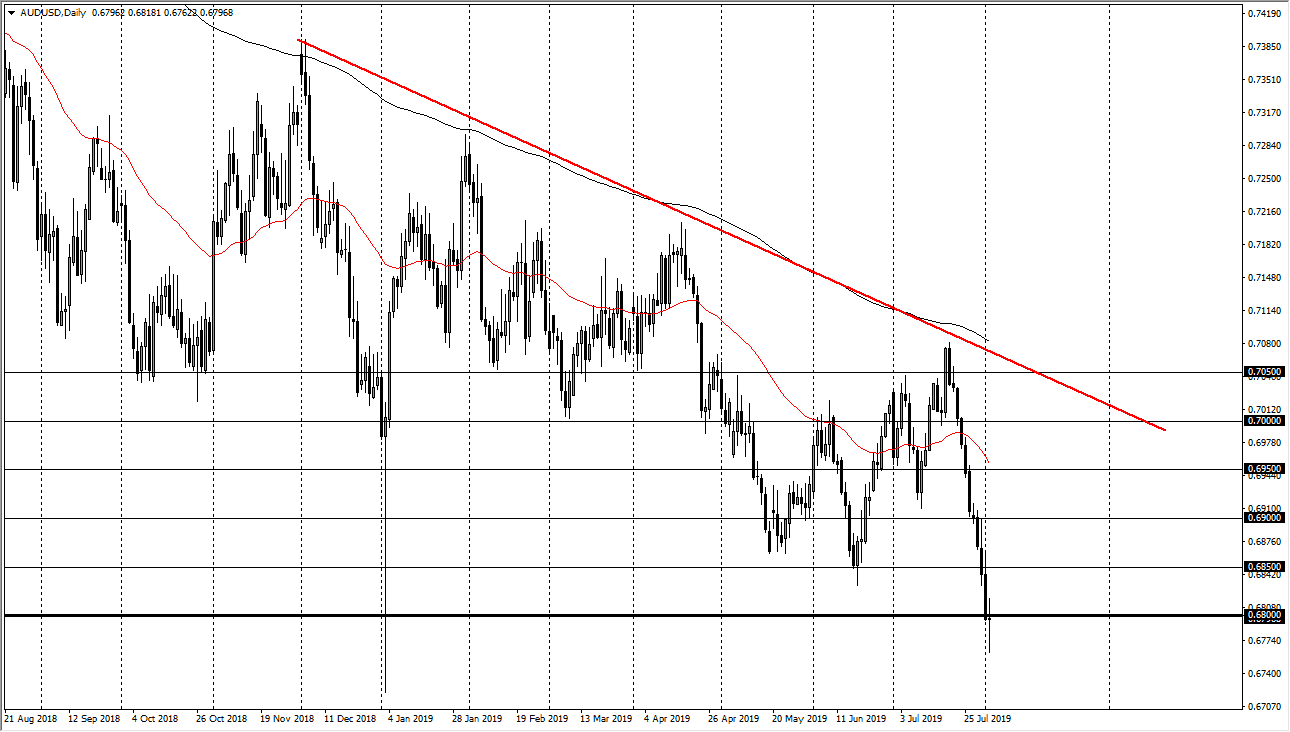

The Australian dollar has gone back and forth during the trading session on Friday, as we hang around near the 0.68 handle. This is an area that of course has been very crucial on longer-term charts and I have been talking about this for some time. I did not expect to fall straight down to this level, as we have 11 negative candlesticks in a row to get here. That is beyond ridiculous, and most obviously oversold. That being said though, it’s obvious that the trend is still to go lower, so now we have to approach this rather patiently, because jumping in with both feet can get you hurt.

I need to see some type of bounce to get comfortable shorting at this point. Granted, I recognize that a break down below the bottom of the candle stick for the day would be a negative sign and technically a sell signal, the reality is that we have fallen off of a cliff and it’s only a matter time before we get some type of “dead cat bounce.” That should give you an excellent opportunity to sell from higher levels, and as you can see on the chart I have marked off every 50 pips with a line. That should be a guideline for where to look for selling opportunities if we get signs of exhaustion.

A break down below the bottom of the candle stick for the trading session on Friday could open up the door down to the 0.65 handle. That’s a level that obviously would cause a lot of support based upon the round figure, and I think it makes for a nice target at this point. That being said though, we are a bit oversold so I think we will get another sawtooth pattern, meaning that we could get a significant bounce. I would ignore that bounce, because we have just recently been fooled into thinking that there was a possibility of recovery. The Australian dollar has failed to prove itself and now has shown its true colors, as a currency that simply can’t pick up itself from the floor. The US dollar should continue to strengthen, but at this point you can’t chase the trade and that’s essentially the way I look at this chart, as one that is trying to get people to chase the trade. Patience will be needed.