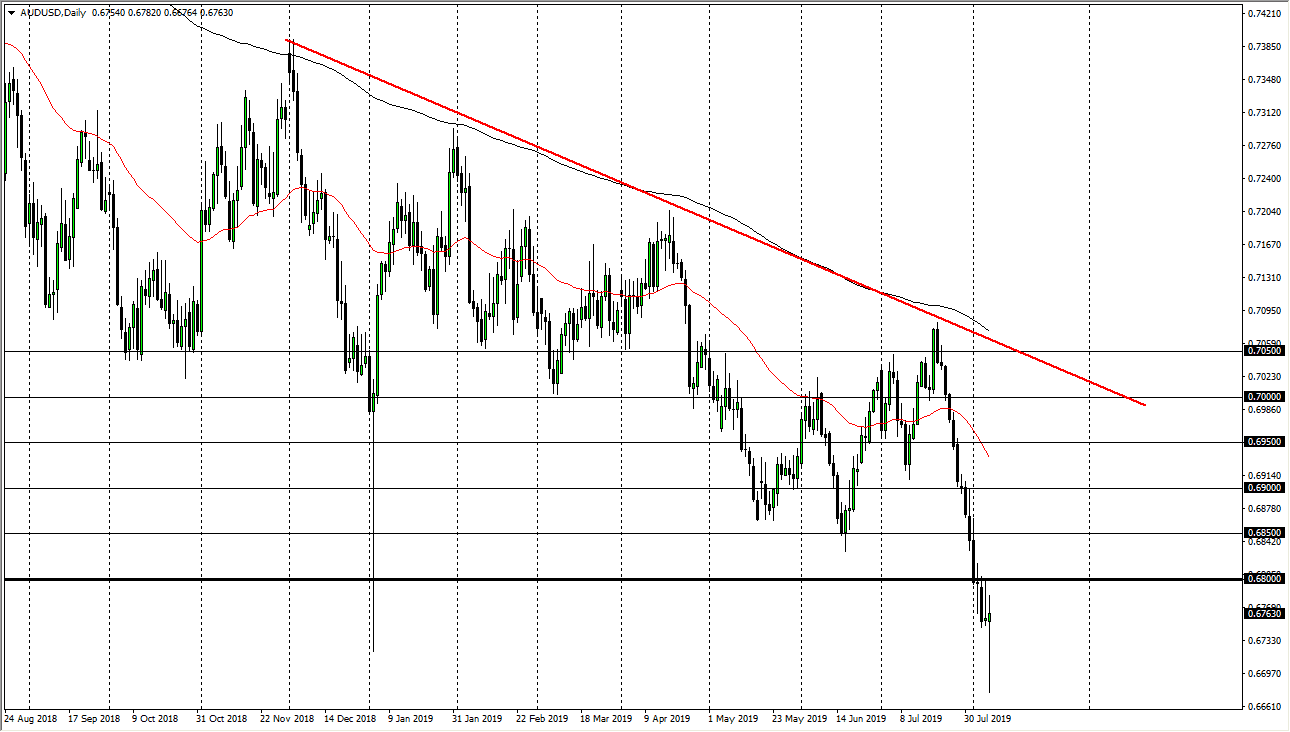

The Australian dollar fell hard during the trading session on Wednesday, reaching as low as 0.6676 before bouncing significantly to form a hammer for the day. This is a very bullish candle stick, especially considering what kicked it off.

Initially, this market sold off rather hard as the Royal Bank of New Zealand did a bit of a surprise rate cut. This had a bit of a knock on effect” in the Australian dollar, as the two economies tend to be very similar. If New Zealand felt the need to cut interest rates, then clearly there’s something out there that have spooked them. Beyond that, we have also seen the Indian and Thai central banks cut rates. If you get this many central banks cutting interest rates at the same time, generally that means something. In this case, it means that Asia is worried about growth.

Australia is a major supplier of commodities for China. It is because of this that the Australian dollar is used as a proxy for the Chinese yuan, as it isn’t freely traded. If Australia is not going to be exporting as much to China, that also wears upon the idea of Australian strength. That being said, it looks as if we have gotten a bit ahead of ourselves, as the last two weeks have seen this pair fall almost 500 pips.

The main barrier above is going to be the 0.68 level. If we can break above there then the Australian dollar has a chance to make a bigger move. Even so, I would be looking for exhaustion near the lines that I have marked on the chart, meaning every 50 pips. Those areas could continue to attract a lot of selling pressure, but at this point I think you should be very patient about jumping into the market after a rally. Even though it seems a bit drastic, we could easily bounce towards the 0.69 level and still be in a very negative trend.

There is always the alternate scenario, and that would be breaking below the bottom of the hammer that is forming for the trading session on Wednesday. If we do break down below there, this market will almost certainly unwind down to the 0.65 level, which I think is my longer-term target anyway, we set this point. With Asian banks cutting rates, people are starting to bet on the RBA doing the same.