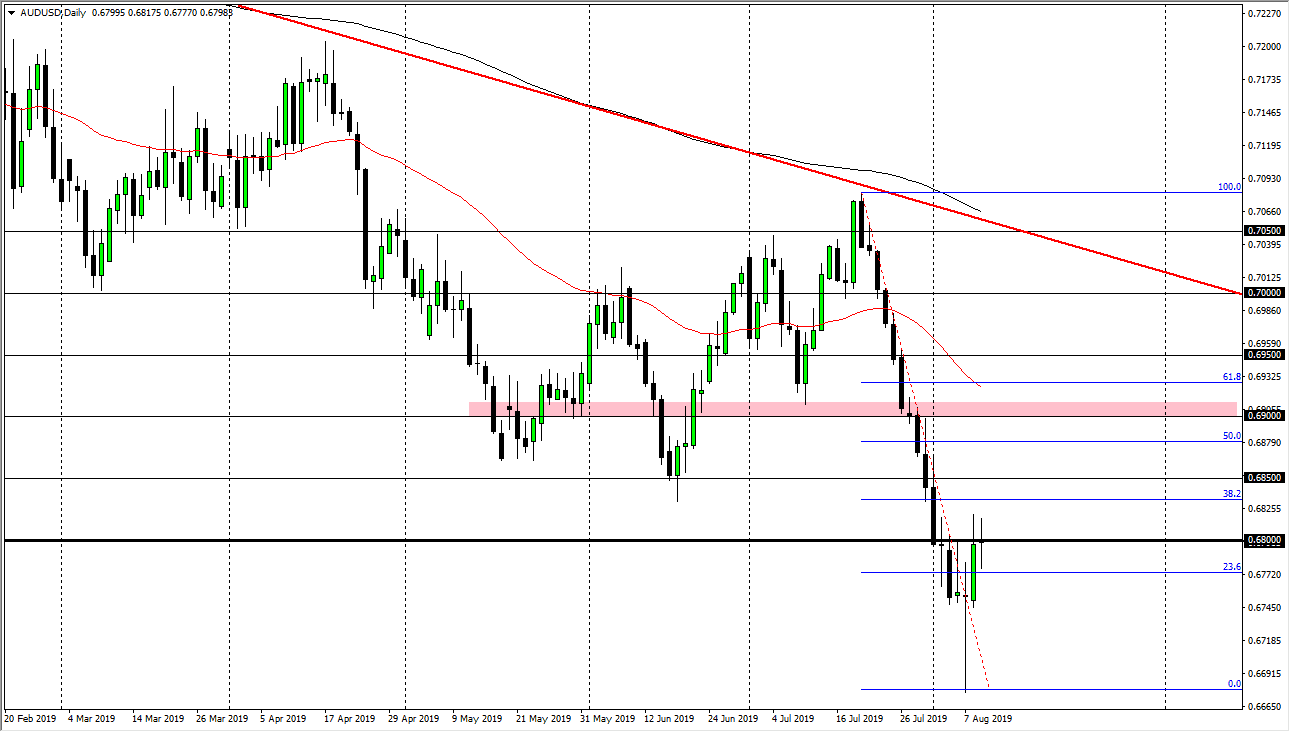

The Australian dollar went back and forth during the trading session on Friday, dancing around the 0.68 handle. That’s an area that attracts a lot of attention of course, and it should be noted that the weekly candle stick is a hammer. The hammer of course is a bullish candle stick, and it’s very likely that the market participants will continue to look at the Aussie with a bit of uncertainty. Because of this, I’m looking for an opportunity to sell this pair but I recognize that we probably have a bounce ahead of us.

The Aussie dollar has been oversold so this bounce has been necessary for quite some time. As you can see on the chart, I have the 0.69 level marked as an area of interest, and now it looks as if the 50 day EMA is starting to come right into that area. Beyond that, it is between the 50% and the 61.8% Fibonacci retracement levels, which of course attracts a lot of attention as well.

I’m willing to step back and look for signs of exhaustion to take advantage of so that I can start shorting again. The greenback is favored by most currency traders out there, and you should keep in mind that the Australian dollar is highly sensitive to everything that’s going on right now between the Americans and the Chinese. With the trade talks seemingly going nowhere, it’s hard to imagine a scenario where the Australian dollar can strengthen greatly as it is so highly levered to China.

If we were to break down below the bottom of the candle stick for the Friday session, then I think we could go a little bit lower but more than likely we will see an attempt at that 0.69 handle before we start shorting again. Unless something drastic happens between the Americans and the Chinese, I can imagine a scenario where Australia suddenly picks up. Beyond that, we also have several central banks around the world cutting interest rates, and that of course doesn’t do much for commodities. With India, New Zealand, and Thailand all cutting rates, it suggests that the Asian part of the world is finally starting to hurt due to the financial slowdown, and that of course weighs upon the Aussie itself. I continue to look for selling opportunities but I would prefer to sell at higher levels if I get that opportunity.