The Australian dollar fell a bit during the New York trading session on Thursday but it remains well within the trading range that we have been in for the past few weeks. I suspect that more of this will continue, but overall I am more bearish than bullish because the Australian dollar is so highly tethered to the Chinese economy.

We have seen the lot of trouble with the U.S.-China trade relations, and of course the Chinese economic numbers are some of the lowest we have seen in the last 36 years. That being the case, Australia won’t be exporting as much raw materials to China, as there won’t be as much construction or manufacturing. In this eventuality, it’s likely that the Australian dollar will struggle in the longer term, and I do believe that every time this market rallies you should be looking to sell. Ultimately, although we are at the bottom of the range, I’m not willing to buy this market as I believe that it’s only a matter of time before we get that bounce, only to see it fail again.

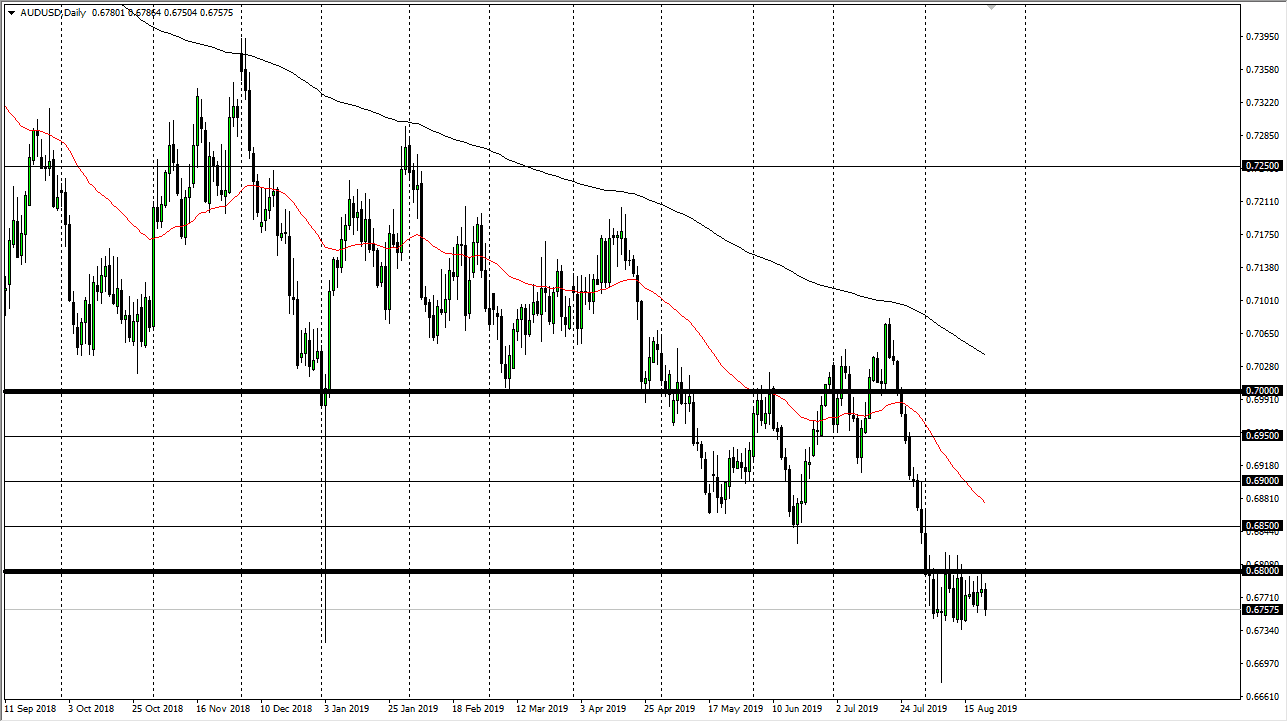

At this point, the 0.68 level is significant resistance, extending about 30 pips. If we were to break above that obviously things would change for at least the short term, allowing the market to rally towards the red 50 day EMA on the daily chart. The 0.69 level of course is also psychological resistance, so I think that any rally at this point is going to run into a lot of problems. If and when we get to that point, it’s likely that the market will roll right back over and give us an opportunity to start shorting again.

Ultimately, the market will probably go looking towards the bottom of the hammer from two weeks ago, and then eventually down to the 0.65 level after that. I have no interest in buying the Australian dollar until we get some type of movement forward in the U.S.-China trade relations, but that seems to be very unlikely at this point. Ultimately, this is a market that I think will continue to show a lot of resiliency due to the gold market rallying, but that will only slow down the selling, not reverse it by itself. I look for a grind lower more than anything else.