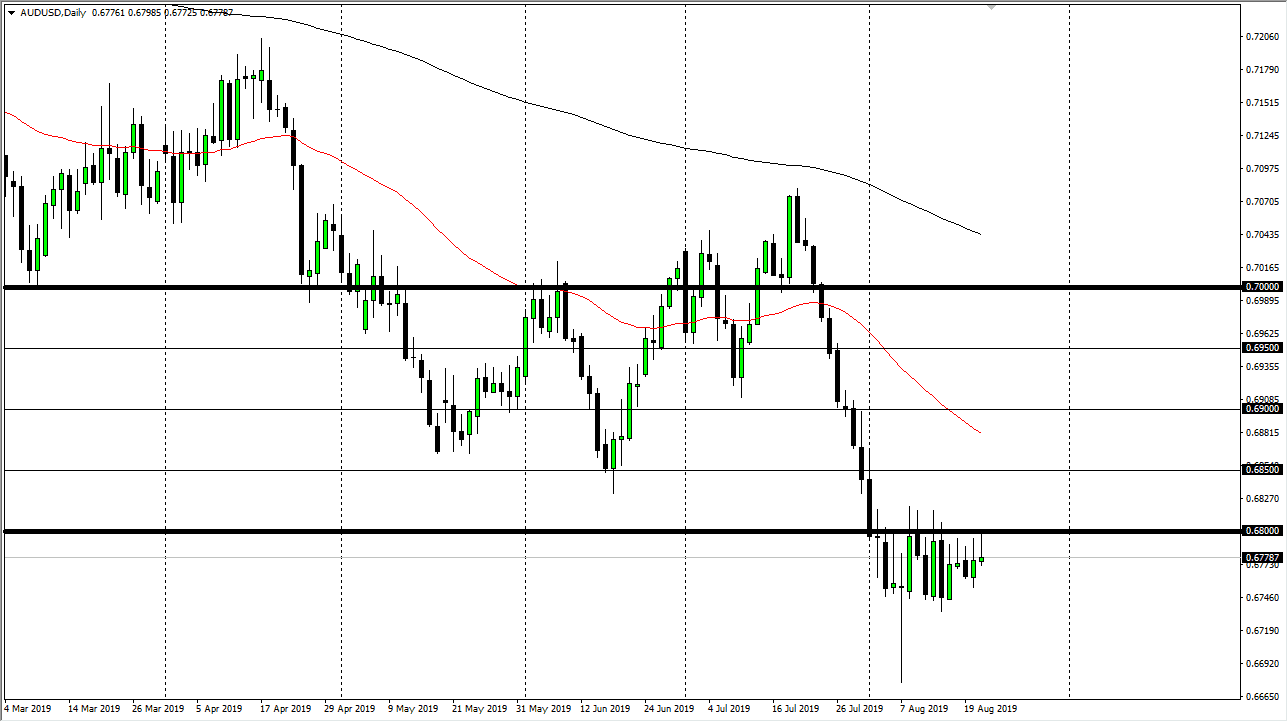

The Australian dollar initially tried to rally during the trading session on Wednesday, reaching towards the 0.68 handle. That is an area that has seen a lot of selling recently, so it makes sense that the market has rolled over, reaching back towards the overall consolidation area. Beyond that, the 0.67 handle has offered quite a bit of support. I think the market has gone back and forth recently and therefore it looks very likely that the market will continue to try to figure out where to go to next. With central bankers meeting in Jackson Hole, Wyoming over the next couple of days, I think that a lot of traders are really starting to think that a significant move could be coming.

It won’t be until we break above the 0.6833 level that I will be convinced of a move higher. Even then, I think that the market will have a lot of resistance built in to the 0.69 handle, and the 50 day EMA. Overall, I think if we do break out to the upside I will simply look for signs of exhaustion that I can take advantage of. Given enough time, the market will probably continue to look at the US dollar as crucial and more important to own than the Aussie as we have a lot of trouble around the world, especially between the Americans and the Chinese. The trade war continues to cause a lot of hassles for the Australian dollar, as the Australian economy is so heavily levered to the Chinese economy. After all, Australia exports quite a bit of its commodities to that country.

As long as we continue to struggle with the trade war, I think we will continue to go lower. Global growth of course is slowing down and that of course works against the Australian dollar as well. One thing you can notice here is that the highs continue to get just a little bit lower, just as the lows continue to do the same. At this point, it looks like we may go looking towards the bottom of the hammer from a couple of weeks ago, and then possibly the 0.65 handle after that. All things being equal I believe that the market continues to grind lower, so I look for short-term rallies to sell going forward.