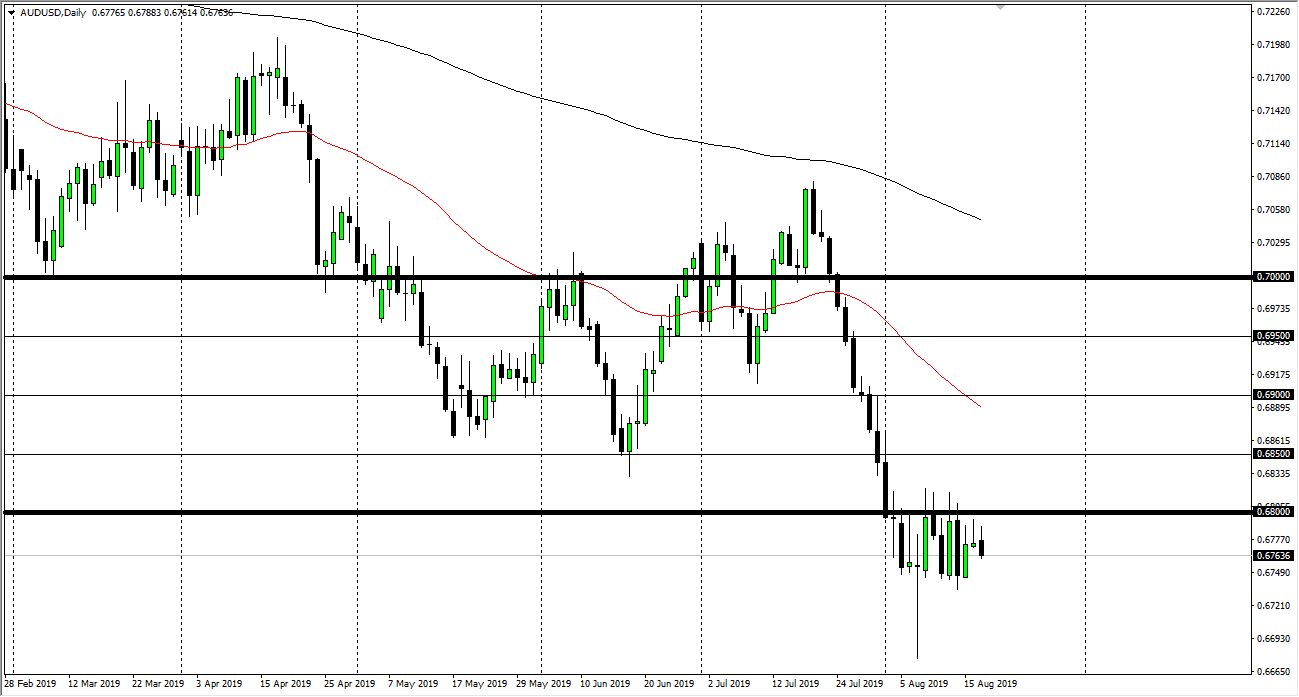

The Australian dollar initially tried to rally during the trading session on Monday, showing signs of exhaustion near the 0.68 handle. Following this activity, it’s very likely that we will continue to see selling pressure in that general vicinity, as it has been so resistive. I think at this point it’s likely that we continue to consolidate in this general vicinity, and therefore it could be a bit choppy.

That being said, the market has been giving us a few hints as to what it wants to do as the highs continue to get ever so slightly lower. Beyond that, the lows continue to be slightly lower as well. Ultimately, this is a market that should continue to grind to the downside in trying to test the hammer from the previous week. At this point, the 0.67 level will be targeted, and then I think we probably break down through there and go looking towards the 0.65 level. That’s a level that is massive support on the monthly chart, it should be massive support in general because of this.

If we were to break below the 0.65 handle, this would be the beginning of something horrible for the Aussie dollar. There are a lot of concerns with the US-Sino trade relations, and therefore a lot of concerns about the Aussie dollar and of course the Australian economy. Unfortunately, this is a market that should continue to find plenty of reasons to sell off. In addition, we have the US dollar strengthening in general as the Treasury market will continue to attract a lot of flow.

Ultimately though, if we were to break above the 0.6833 handle, the market could go looking towards the 50-day EMA which is painted in red on the chart. At this point, I would be more than willing to sell this market near that level, as the Aussie has seen so much in the way of pressure as of late. The fact that we have been grinding sideways makes quite a bit of sense considering that we had sold off drastically. After all, you have to learn to digest those gains or losses in order to continue to go lower. I believe that the Aussie is so highly tied towards the Chinese situation that I think we are going to truly struggle to turn the trend around as the situation continues regardless.