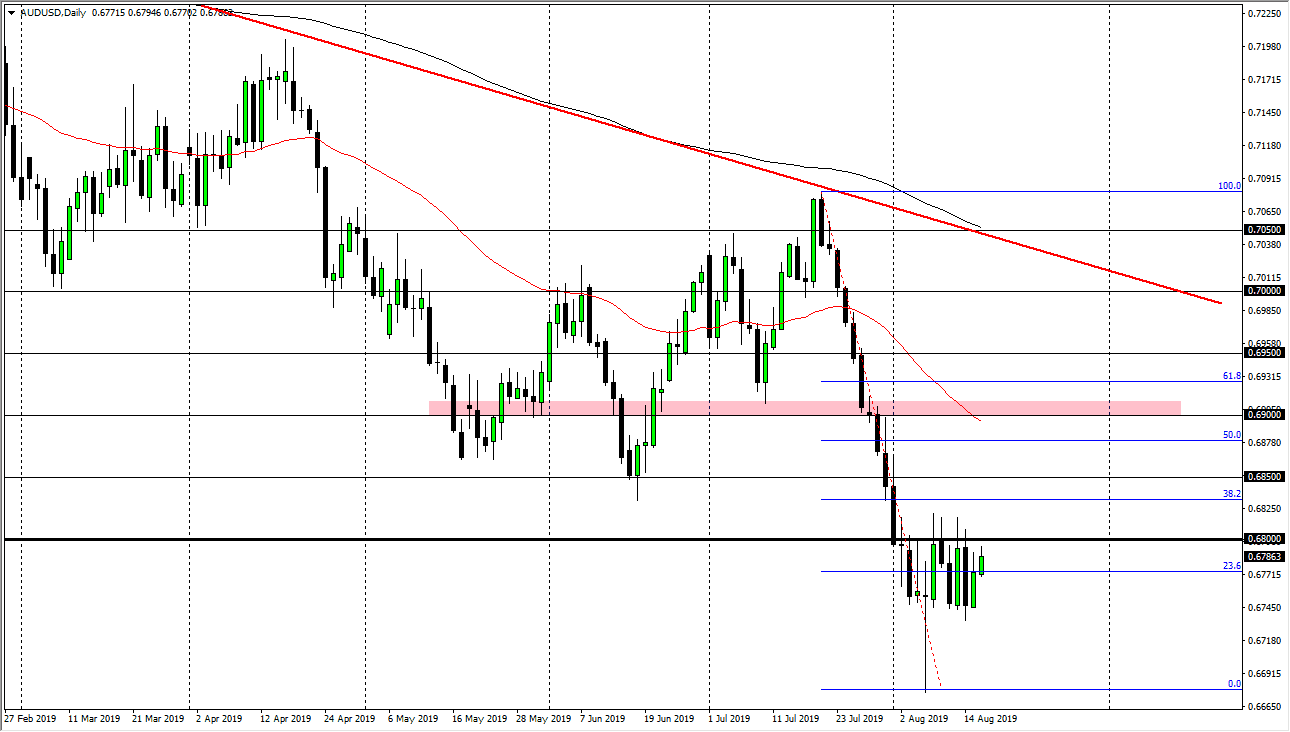

The Australian dollar tried to rally a bit during the trading session on Friday but as usual we have seen the 0.68 level cause a bit of resistance. This is a currency that is going to be highly influenced by the U.S.-Sino trade war which of course isn’t getting any better. With that being the case I like the idea of trading these short-term rallies, as it is only a matter of time before that trouble comes into play.

The 0.68 level has seen a lot of selling pressure; as you can see there are plenty of wicks just above there. Even if we close above the 0.68 level on a daily chart which of course would be bullish, I think it’s only a matter of time before we sell off again. My next area of selling would coincide with the 50-day EMA above, which is pictured in red. It currently resides around the 0.69 level, which I think is also resistance. As long as there are a lot of concerns out there around the world with global growth, it makes quite a bit of sense that the Australian dollar will struggle.

Beyond that, the US Treasury markets have attracted a lot of money, and that of course is all priced in US dollars. This gives us a bit of a boost to the US dollar, so I do think it’s only a matter time before we break down on any rally. I recognize that the hammer from last week is of course supportive, but I also recognize that we are grinding enough that one would probably be correct in assuming that there is at least a certain amount of support in this region. This is a chart that looks very confused at the moment but is most certainly negative from the longer-term aspect. A break down below the bottom of the hammer from last week would send this market down towards the 0.65 handle, which is a longer-term support level based upon the monthly timeframe. I would anticipate a lot of action in that area if we were to make that break down. At this point though, I think it’s simply easier to short this market on small time frames after short-term rallies that show signs of failure. I have no interest in buying the Aussie dollar at this point, although I’m the first to recognize that we had sold off a bit too much in the past.