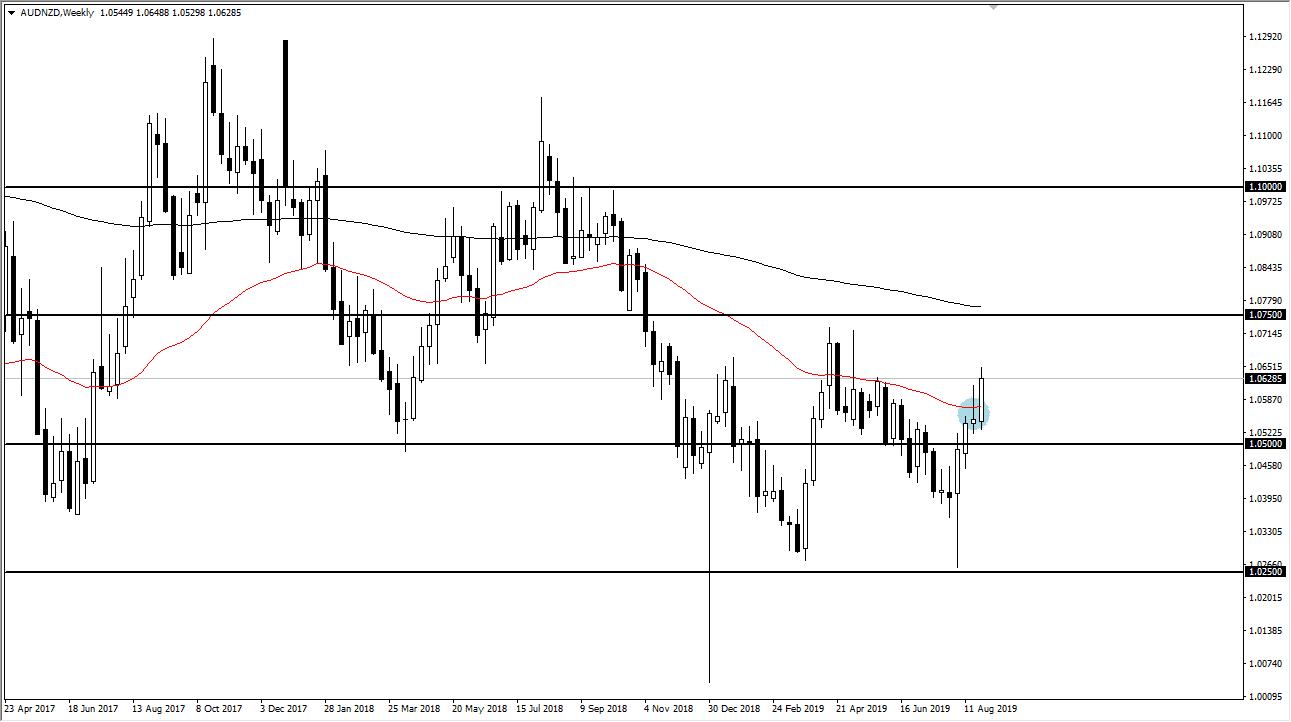

The Australian dollar has rallied quite significantly during the month of August against the New Zealand dollar, essentially forming what could be thought of as a “double bottom” in the market near the 1.0250 NZD level. This is a market that of course is going to be interesting considering that the two currencies are both highly levered towards the commodities markets. With everything that’s going on between the United States and China, it is interesting to see that we have seen a definitive swing as of late.

That being said, that argument can be made for consolidation between the 1.0250 level on the bottom and the 1.0750 level on the top. You can also recognize that the 1.05 level has offered a bit of support and resistance as well, so these are the three lines that I think we will be paying the most attention to during the month of September.

One thing that I would point out is the fact that we have broken above the 50 week EMA, and of course broken above the shooting star from the previous week both point to higher pricing. Ultimately, I think that the market will make a move towards the 1.0750 level given enough time, using the 1.05 level as support. As long as we are above the 1.05 level, then I think that you will be a buyer of dips in this market, at least for the month of September as we try to form some type of “W pattern.”

Ultimately, if we were to break down below the 1.05 level, then I would be a seller. I think it’s going to be essentially a “binary event” at this point, with the 1.05 level being the pivot point. One way or the other, we will reach the outer range, but the directionality is determined that the 1.05 handle. I believe that one of the things that may be pushing this market higher is the fact that the Australian dollar is somewhat levered to the gold market, which of course as you know has been very strong. I expect more of that, so this is a relative strength/weakness play. It isn’t necessarily that you want to own the Australian dollar in general, it’s just that it has the benefit of gold backing it as far as commodities are concerned while the New Zealand dollar is more highly levered to agricultural commodities.