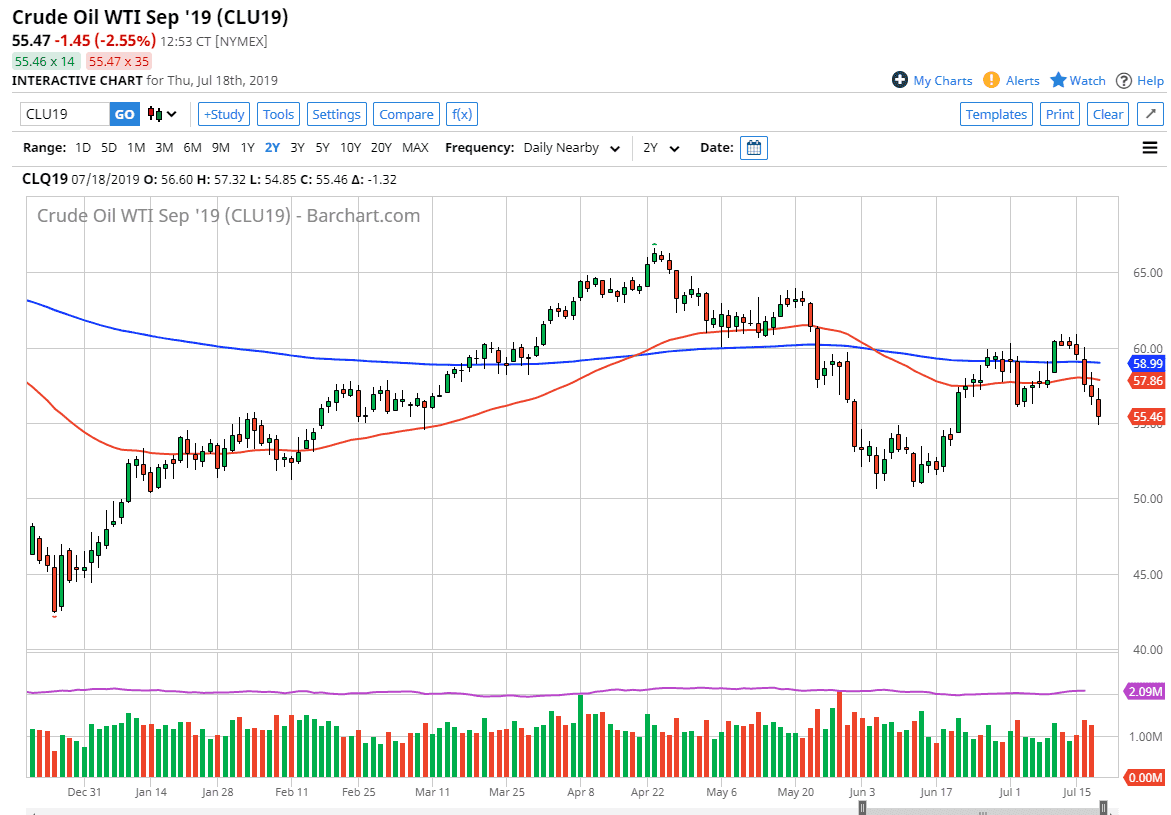

The crude oil markets got absolutely hammered during the trading session on Thursday, as we initially tried to rally but then broke down from there. In fact, we have lost more than 3% during the day, as crude oil markets continue to find absolutely no reason to rally. It looks very likely that we could go even lower.

At this point, you can see that the crude oil markets have been falling like a stone over the last several sessions, as the $60 level was massive resistance that extends all the way to the $61.00 level. The fact that we are closing at the low end of the range for the day also suggests that we are going to go lower. The $55 level has offered support, at least for the short term. After all, it was an area of significant resistance, so it would make sense to see this market pay close attention to this area. I think we could get a short-term rally but the fundamental reasons that were picking up the WTI Crude Oil market are disappearing.

Looking at this chart, it’s obvious that the President of the United States sending Senator Rand Paul to speak to the Iranians has cooled a lot of the fear. After all, Senator Paul is well known as an anti-interventionalist, and will work partially to keep conflict from happening. That has absolutely crushed the concern about Iranian troubles. Beyond that, we have a lot of concerns when it comes to the global economy, which of course will dictate how much oil as needed.

The Federal Reserve is looking to cut interest rates, and the cheaper US dollar of course should lift the crude oil market overall. That would be of course if it were normal times. The fact that the global economy is slowing down so much is probably a bigger issue than currency fluctuation, so I think that if we get some type of rally we should be looking to sell. I suspect the $56 level could cause some issues. That being said, the next couple of days will probably be very volatile, and we may get a bit of a pop on Friday just due to the fact that a lot of people will be looking to close positions ahead of the weekend as it could be one headline away from causing major problems.