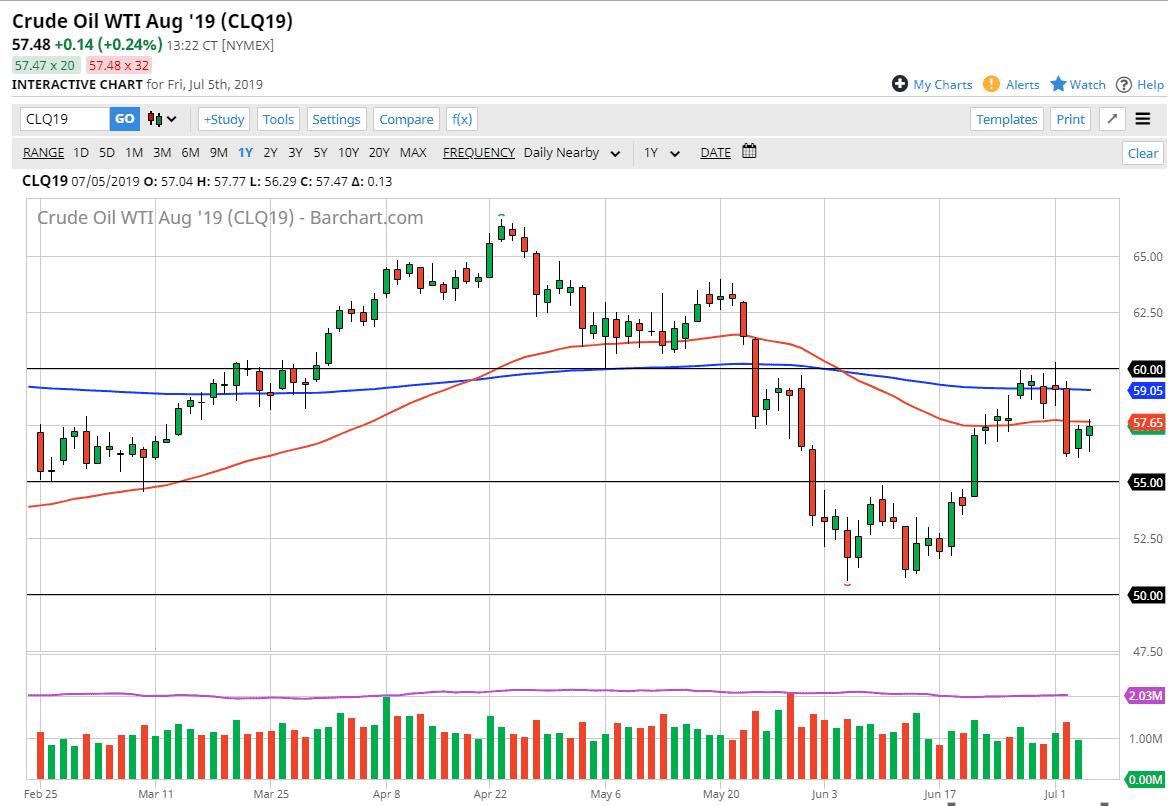

The WTI Crude Oil market initially fell hard during the trading session on Friday, reaching down to the bottom yet again. We did turn around to form a bit of a hammer though and that of course is a bullish sign. That being said, we are still in the middle of a massive bearish candle that formed in just a couple of days ago. We are currently trading around the 50 day EMA, which is flat so therefore I think the market is just showing us just how undecided we are at the moment.

We have a lot of different things moving this market around right now, not the least of which is the US/Iran tensions going forward. I think at this point; the $57.50 level is rather crucial as the market does tend to move into dollars $0.50 increments. To the upside, there is a lot of resistance near the $59 level, which is substantively the 200 day exponential moving average. Above there, we have a significant amount of resistance at the $60.00 level as well.

Any time that we rally from here I suspect there will be quite a bit of selling above, because what has been quite striking about this is the fact that the massive selloff that was over 5% the other day was after the OPEC announcement that they were extending cuts. This means that they are enabled to lift the market regardless of what they do. OPEC has no effect on North Dakota or Canada, so at this point I think we continue to see a lot of oversupply in this market.

Another problem that you’re going to have with this market is the fact that the economic outlook is starting to slow down in general, and that of course works against the value of crude oil as it is so sensitive to the economic engine around the world. At this point, it does look like we may try to rally but I suspect any rally will be a very short term feature, and we will start to roll over and sell signs of exhaustion’s as soon as we get it. Underneath, I think the $55 level is massive support, so I think we’re going to bang around the 50 day EMA in general, as we continue to go back and forth. Short-term scalping in a range bound system may work, but beyond that I think we need another catalyst to form an impulsive candle stick.