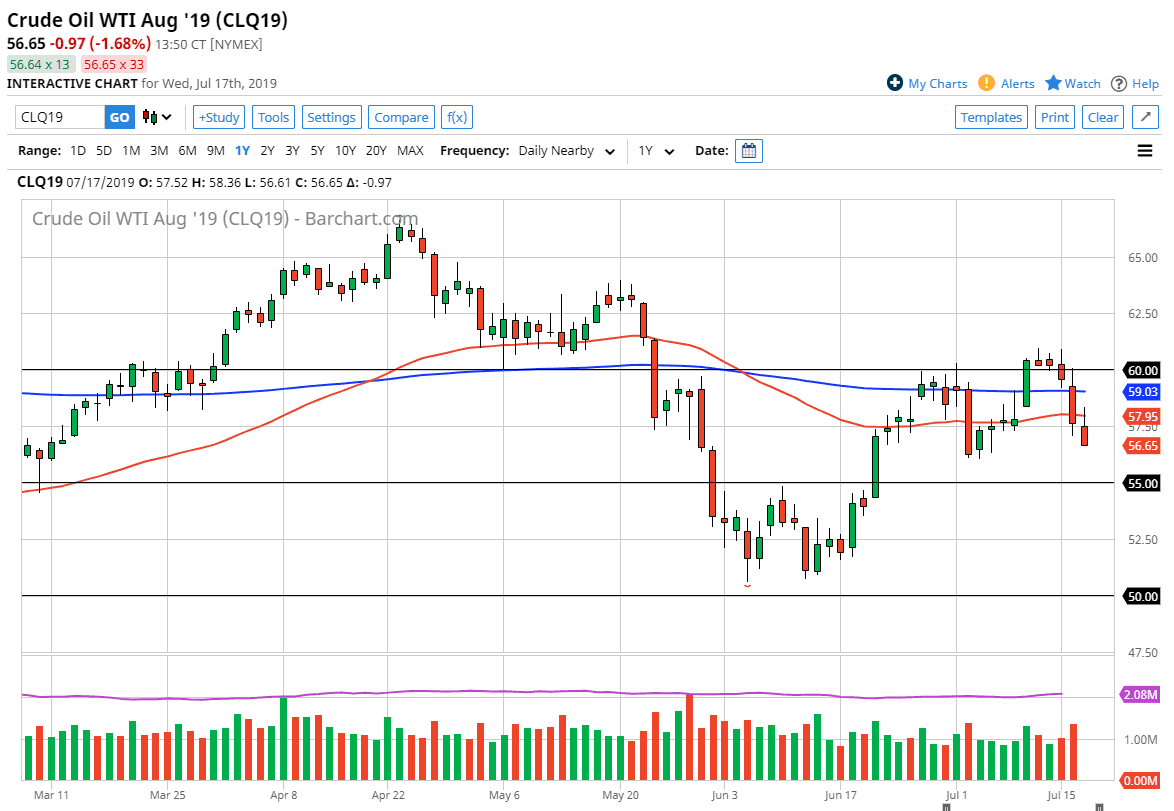

The crude oil markets initially tried to rally during the trading session on Wednesday but found enough resistance above the 50 day EMA to break down rather significantly. The selling then increased as President Donald Trump selected Senator Rand Paul to lead the delegation to deal with the Iranians. Senator Rand Paul is a well-known Libertarian and anti-interventionalist. This gives the market hope that tensions will fall between the Americans and the Iranians, as he is quite far from being a war hawk.

Looking at the chart, it’s obvious that these last couple of days have been very negative in this which is simply a continuation of what we have seen for some time. I don’t think that the market will be able to hang onto gains at this point, because the concerns are far too long and drawn out to keep the price higher. Yes, central banks around the world are looking to add monetary easing but overall the demand for oil is at risk. The global market seems to be looking at either recession or at least a slowing down of economic activity, and that of course means that the crude oil demand will be lower than usual.

With the Iranian situation calming down, that takes the fear of a supply disruption off of the table. If that’s going to be the case, and the fact that the United States is pumping out almost 13 million barrels a day currently, it’s hard to imagine a scenario where crude oil continues to go higher. Going forward, I believe that the $60 level has now proven itself to be resistive enough to keep it as a “ceiling” in the market. To the downside, I think there is a significant amount of support that extends from $55 to the $56 level. In other words, we could be entering a bit of a consolidation phase. However, I do think that the sellers have flex their muscles enough to show that they mean business, and therefore I do like the idea of shorting short-term rallies that show signs of exhaustion based upon long wicks on smaller time frames. If we do break down below the $55 level, then the market is likely to break down towards the $52.50 level underneath. At this point, I am highly skeptical about buying crude oil.