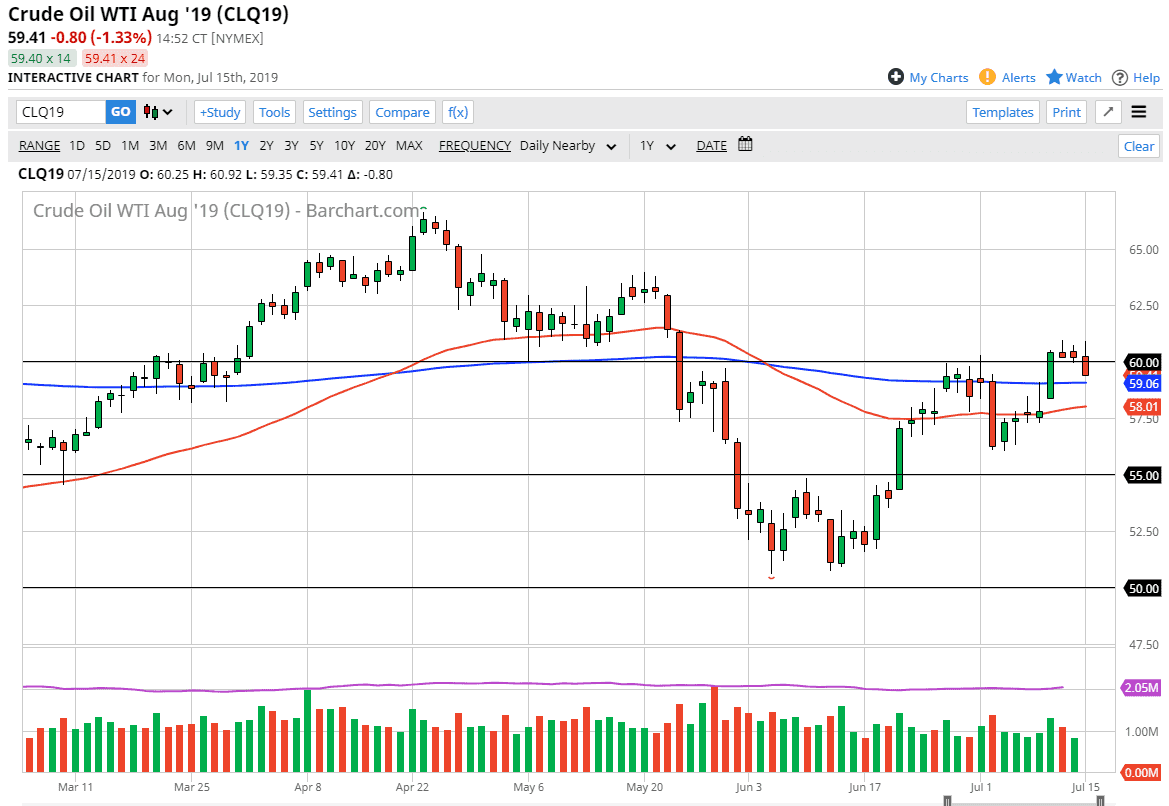

The crude oil markets initially tried to rally during the open on Monday, and for some time it appeared that we are simply going to hover around the $60 level. However, we have broken below that level and that of course is a negative turn of events. Nonetheless, there are multiple support areas underneath that could come into play and offer buying opportunities but we need to be very patient if we are going to try to take advantage of them.

If we turn around and break above the highs of the last three days, that would obviously be a very bullish sign, and trap a lot of sellers on the wrong side of the trade. However, in the meantime we are looking at the 200 day EMA at the $59 level as potential support, and then the 50 day EMA at dollar lower. This is a market that continues to be very bullish in the short term, but we have a lot of moving pieces out there that could move this market in both directions.

Crude oil markets are suffering at the hands of a potential global slowdown, and that could of course drive down demand. The fact that we are closing towards the bottom of the range for the day doesn’t help the situation either so I think at this point if you’re looking to buy the crude oil market, you need to see a daily supportive candle underneath that you can take advantage of. The alternate scenario of course is the previously mentioned break out to the upside.

As for selling, it’s not really until we break down below the $57.50 level that I’m a little bit more comfortable doing so, because at that point we will have broken through the summer rather significant support. At that point I would expect the market to go down to the $56 level, possibly even the $55 level after that. This is a market that is going back and forth not only due to the value of the US dollar possibly collapsing due to the Federal Reserve, but the global economic slowdown. Beyond that, we still have the occasional flareup between the Americans and the Iranians of the last couple of days, so at this point things remain very difficult and choppy to say the least. Short term back and forth trading continues to be how this market goes going forward.