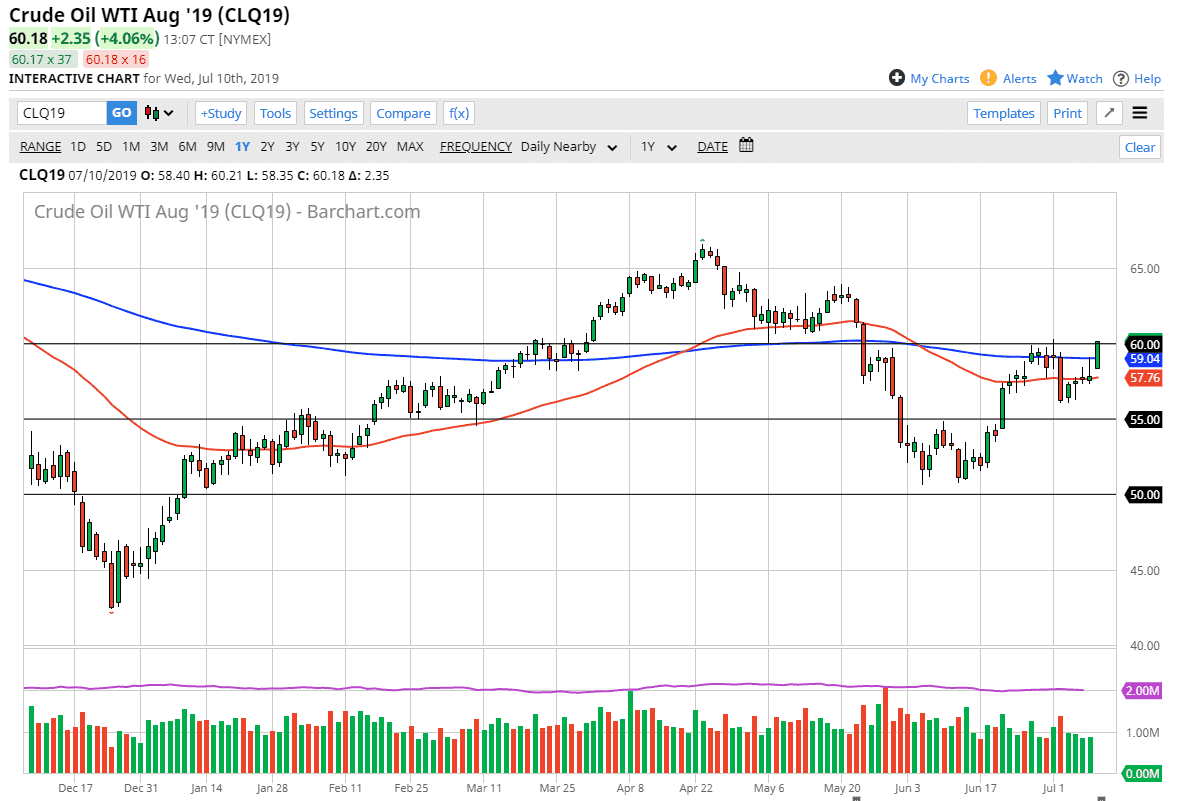

The crude oil markets had a positive session on Wednesday, breaking above the psychologically important $60 handle. This is an area that had offered a lot of resistance previously, so as you can see the market has at least given seller something to think about.

When you look at the chart, you can see that we have made a “higher low” recently, breaking above the $60 level. Another thing that is relatively important is that we are above the 200 day EMA, which is a longer-term signal. Beyond that, we have also broken above the top of the shooting star from the previous session, wiping out the sellers and forcing short covering. By doing so, we could continue to see momentum to the upside, and the fact that the Federal Reserve looks very likely to cut interest rates could put bearish pressure on the US dollar. However, there is a bit of a knock on effect here: if you have a falling US dollar quite often you will have rising commodities as they are priced in that same currency.

However, you have to ask a simple question: “Why exactly is the Federal Reserve cutting rates?” If the Federal Reserve is likely to cut interest rates, then while it gives an argument for perhaps stimulating the economy, it also suggests that there could be problems with global demand. If that’s going to be the case, then oil should fall. That being said, at least in the short term we have very strong technicals that allow us to think about buying. A break above the highs of the trading session should send this market towards the $62.50 level which is where we had broken down from at the end of May.

It’s not until we break down below the 50 day EMA, pictured in red on this chart, that I would consider selling. I think you are either a buyer of crude oil now, or on the sidelines. I had recently been talking about a five dollar range that we are trading in, and now we are breaking out of it. Ultimately, there’s a good sign here that we are trying to break out and move higher for a longer-term move, but I do think there are a lot of questions when it comes to whether or not we will use as much crude oil as Americans can produce. After all, even though OPEC has extended production cuts, the Americans continue to produce more.