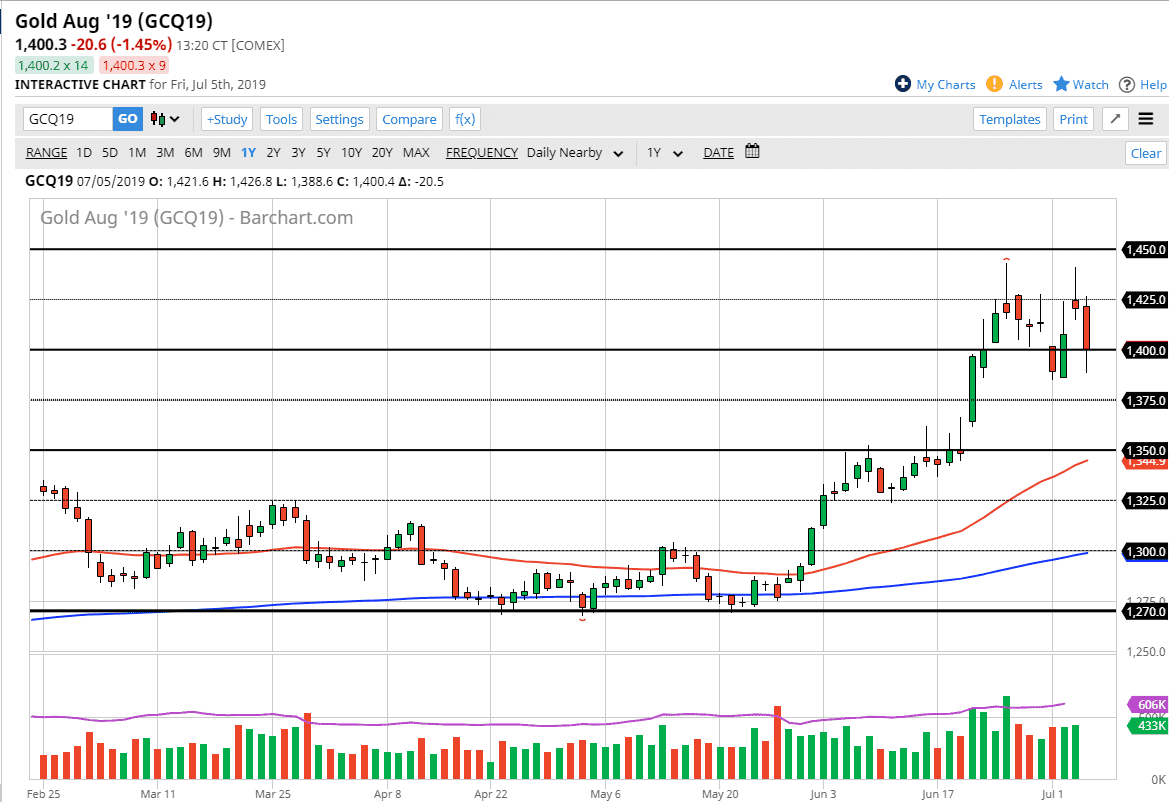

Gold markets broke down rather hard during the trading session on Friday, filling the gap from the beginning of Thursday. By following the way we have, we have cleaned up a little bit of the mess on the chart, but this is a scenario that still has a lot of moving pieces.

The most important thing on this chart is the fact that the gap just above the $1350 level hasn’t been filled yet. Because of this I believe it’s only a matter time before the sellers break down below here and go looking to fill that hole. However, I don’t have any interest in shorting this market as I am looking to buy it on pullbacks that offer value, such as a move to that level. I can give you a multitude of reasons why I would be a buyer in that region.

The initial reason of course is that it offers a bit of value. The $1350 level is a significant level as we had originally seen a lot of resistance there. It should now be supported based upon market memory, and then of course we have the 50 day EMA sitting just below that level and rising. Furthermore, it is also the 50% Fibonacci retracement level, so I don’t have any interest in shorting in that area obviously. However, many amateur traders will try to squeeze out every last dollar available in a contract, and thereby look to sell this market. The biggest problem with that is that while gaps do tend to get filled, the reality is that they don’t necessarily get filled when you want them to. Imagine yourself shorting this contract and being $20 wrong before it turns out asserts drifting toward her target. It is because of that very real threat that I prefer to buy dips instead of trying to get too cute and short here.

The alternate scenario of course is that if we break above the $1450 level, then we could get a bit of a blow off top, shooting this market towards the $1500 level. While I don’t expect that to happen, it is a real possibility as the Federal Reserve looks likely to cut interest rates regardless of what kind of economic news comes out. Again, I prefer to look at this market as one that will offer value given enough time, so therefore I think that being patient is probably going to be the most important thing when it comes to profiting in this market.