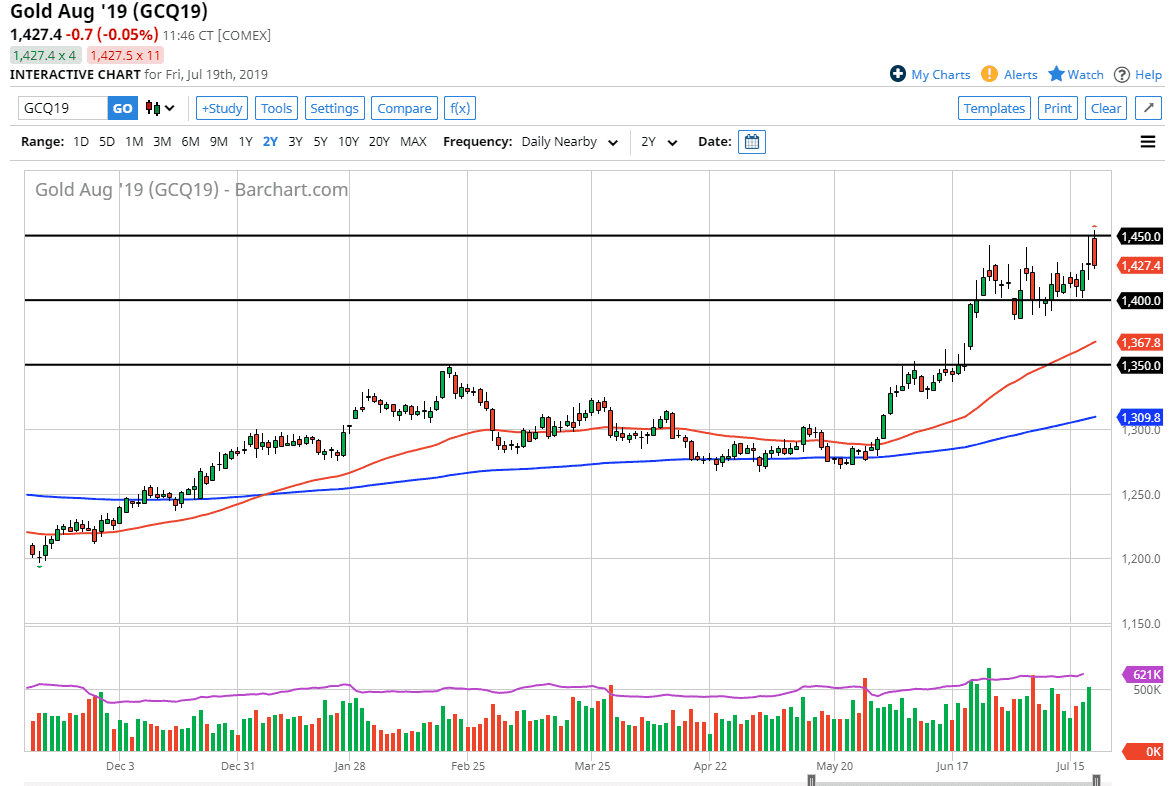

The Gold markets gapped higher to kick off the trading session on Friday but have given back all of the gains to come down and fill the gap. At this point, it’s very likely that we will see buyers jump into this market, with the $1425 level offering support. If we break down below there, then there should be plenty of support near the $1400 level as well.

Gold has a strong uptrend intact due to the Federal Reserve cutting interest rates, and of course a lot of geopolitical concerns. With the greenback set to lose value as well as other fiat currencies, I believe that Gold will continue to strengthen overall. You will be able to buy gold in not only US dollar denomination, but also against the Euro and the British pound at the very least. We are in an area of extreme resistance on the longer-term charts, so this pullback makes quite a bit of sense. At the end of the day though, the fundamental strength of gold should remain intact as we are in an ultra-low interest rate environment, and therefore it makes sense that people will demand “hard money” to protect wealth.

Looking at the chart, I see a significant amount of support below at the $1400 level as well, which extends down to the $1390 level. At this point, there is significant support underneath the continue to push this market higher, and from a technical analysis standpoint the 50 day EMA should also offer support. I believe that there’s no way to short this market, because the US dollar, which this particular chart is priced in, will continue to lose value.

Ultimately, this is a market that is trying to make a move, but we need to build up enough momentum underneath to continue to find buyers. Obviously, you can’t sell a move like this, but you certainly can be patient enough to wait for value. At this point, that’s essentially what gold is going to be “a value trade.” Either we are cheap or not. After the Friday action we are testing the first vestiges of support, so any bounced from here could be a nice buying opportunity but expect the recent highs to continue to offer a lot of resistance. Eventually though, I believe that we break the $1500 level and continue to go much higher, possibly as high as $2000.