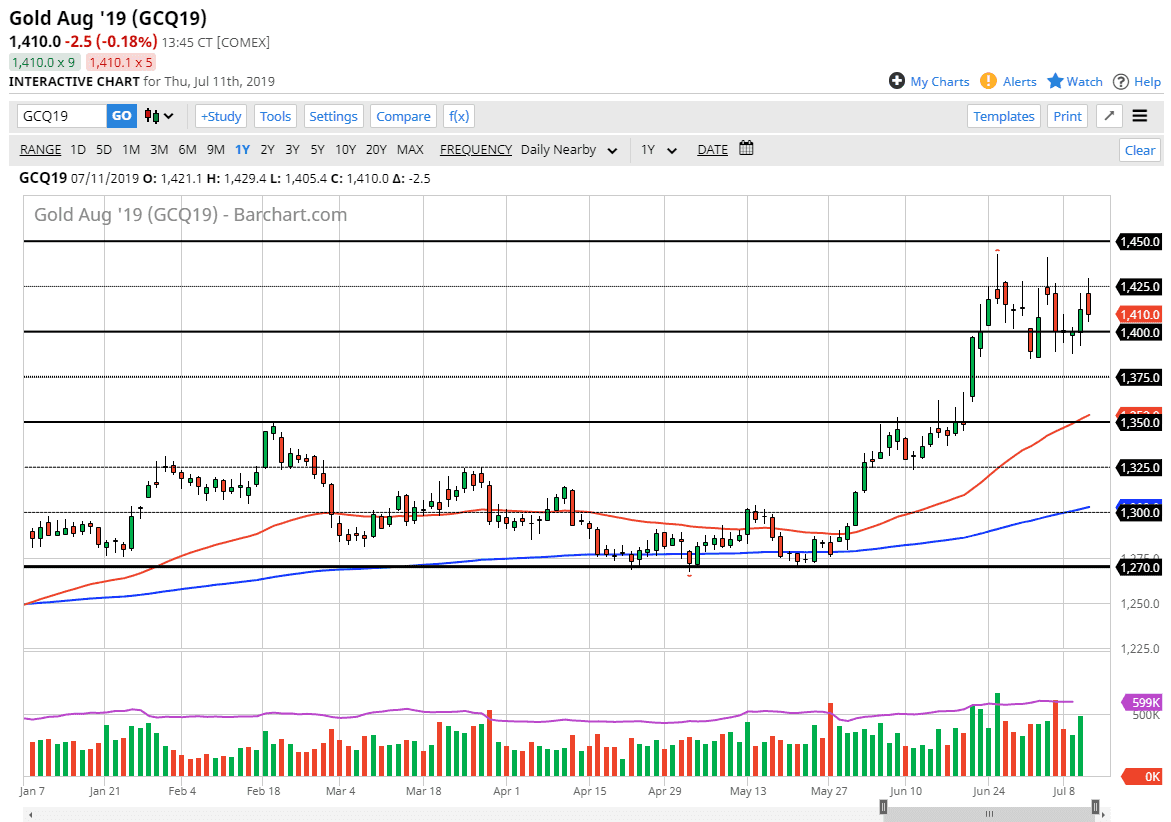

The Gold markets did very little on Friday, rallying slightly but at the end of the day we haven’t changed much. In fact, there are warning signals with the gold market right now of a potential pullback. The weekly chart features three shooting stars in a row and that of course is not a good look. With this in mind, keep an eye on the $1380 level. If we were to break down below there it would fire off the shooting stars and send the market much lower. At that point though, I’m not a seller, I’m simply waiting.

I see the $1350 level underneath as significant support, as there is a slight gap there. Beyond that, we also have the 50 day EMA, which of course will be technically supportive as well. Beyond that, the 50% Fibonacci retracement level sits at that level as well, so I think it’s only a matter time before the buyers would return there. I would be willing to become aggressive in that area on signs of support and more importantly a bounce, as it would show the market turning around and continuing the overly bullish attitude.

Keep in mind that the central banks are looking to cut interest rates, and that of course will be very bullish for precious metals overall. Keep in mind that with the Federal Reserve jumping into the picture, that is a very likely bullish situation just waiting for precious metals. Precious metals feast upon the low interest rates of central banks, and I think that should continue to be the case here. I think that traders are front running monetary easing not only out of Washington DC, but also Brussels here.

Pullbacks offer plenty of support underneath, so I think it’s only a matter time before that comes to play. However, if we were to break above the $1450 level, then the market is free to go much higher. That would be an explosive break to the upside and show yet another impulse higher. Either way, I have absolutely no interest whatsoever in trying to sell gold, as we are starting to enter a longer-term bull move, and I think there’s no way to short this market with any type of confidence. If we break down below the support of the last couple of weeks, we could get a big flush, but that should offer quite a bit of opportunity.