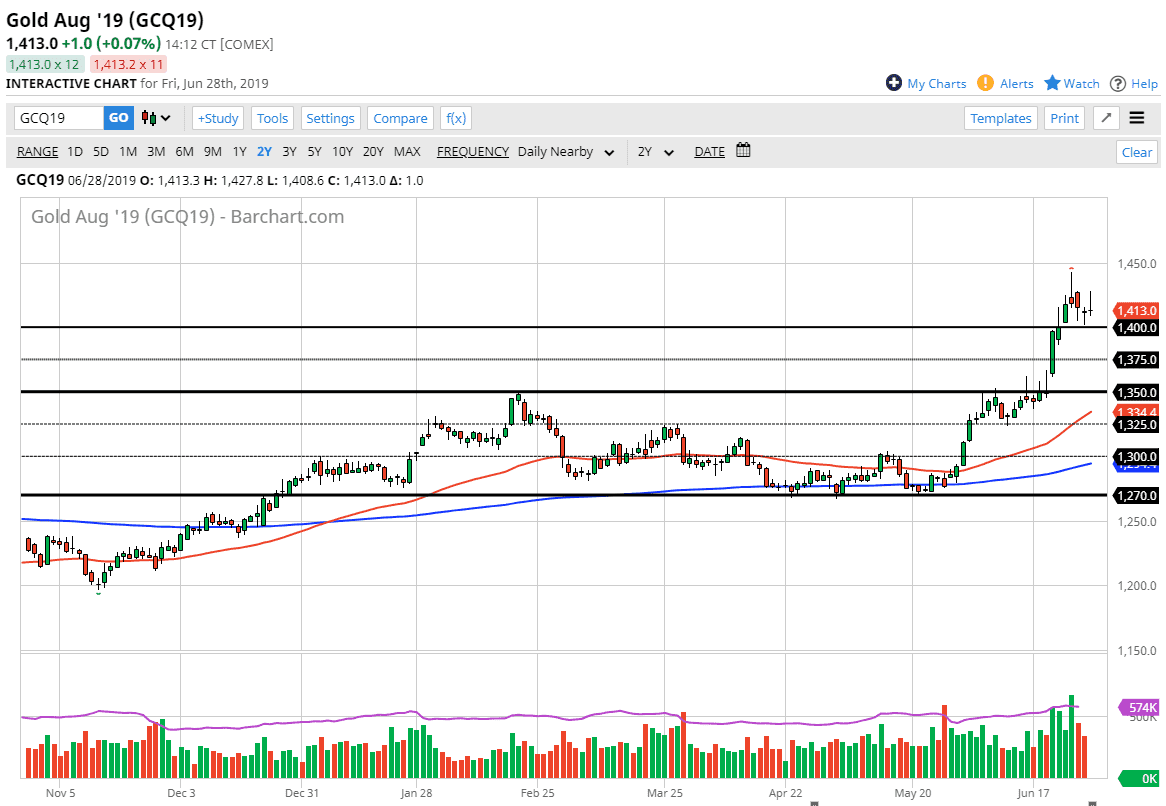

Gold markets tried to rally during the day on Friday but ended up forming a major shooting star. By doing so, the market has shown how much resistance that we have seen above, and beyond that we have formed a shooting star on the weekly chart. If we break down below the $1400 level, then it’s likely that the market is going to go lower, perhaps trying to aim for the gap below. That means that we could go down to the $1350 level eventually. I don’t expect to see that happen overnight, but I do recognize that we could get that move as we take profits from such a huge rally to the upside. Beyond that, one would have to think that a lot of traders have missed the move, so they are waiting for opportunities underneath.

I believe that the $1300 level should be massive support, so at this point I don’t think it makes much sense to try to short this market when you can simply wait a couple of days. I’m simply looking for a bounce in order to take advantage of. The weekly shooting star of course is very negative sign, but if we were to turn on a break above the highs, that could send this market much higher. All things being equal, I am very bullish of gold but I recognize that we have perhaps overextended ourselves quite a bit.

Gold tends to move in $25 increments, as seen marked on the chart. As you can see, the market is very technically driven, and with the G 20 this weekend it’s very likely that we will continue to see fear go back and forth. Ultimately, this is a market that I think as already made up its mind it’s going to rally longer-term anyway, especially considering that the Federal Reserve is looking to cut rates at the same time.