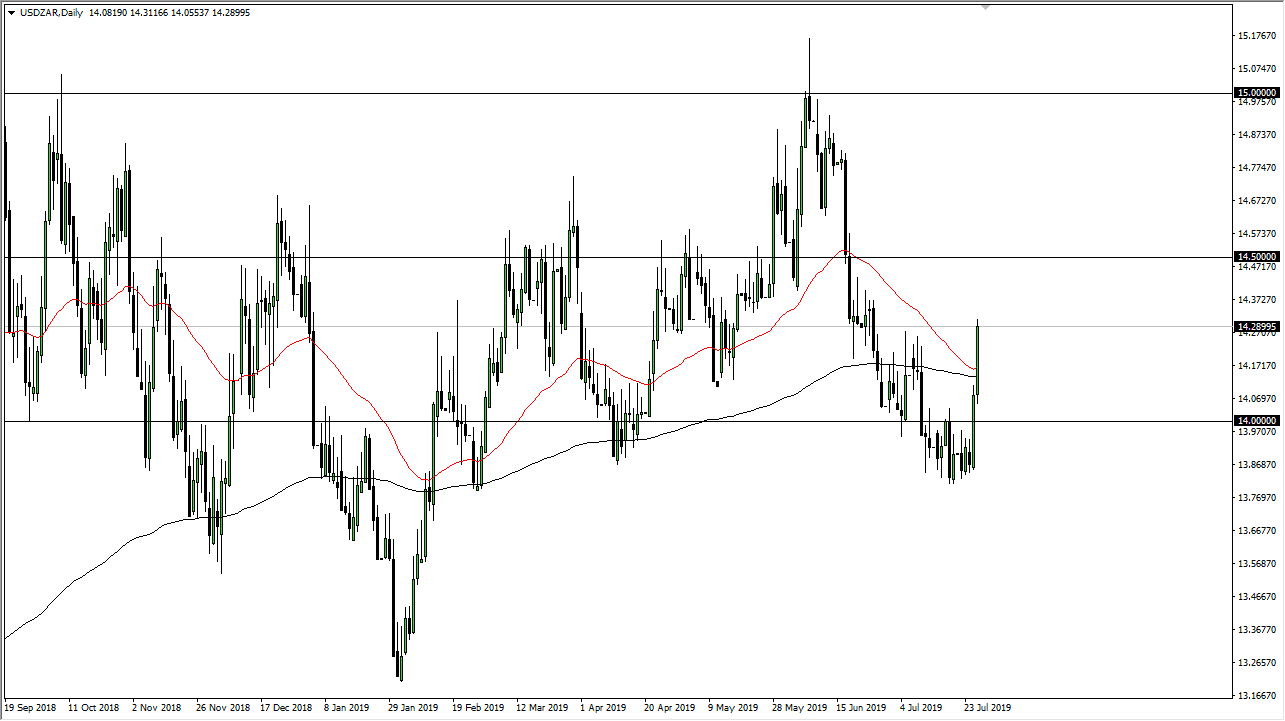

The US dollar has rallied for a couple of consecutive sessions against the South African Rand, as we have sliced through both the 50 and the 200 day EMA indicators. This has been a very explosive move to the upside and now we are well above the 14 Rand level which had been so resistive going back just a couple of sessions. Looking at this chart, this is a very bullish turn of events as we have sliced through several long wicks.

If we do get a pullback from here, and I do expect to see that in the short term, it is only a matter time before buyers would return after this type of action. This being the case, the market seems to have a lot of support underneath, and therefore value hunting is probably the best way to go going forward. To the upside, I see a lot of resistance at the 14.50 Rand level, but that is an area that could be broken rather quickly. Ultimately, I think that the market probably tries to go through there and reach all the way to the 15 Rand level above which was the recent swing high.

The main reason for this I believe is that we are starting to see a lot of concerns about the global economy, and therefore traders are trying to run away from emerging markets. The South African Rand is of course a proxy for the entire continent of Africa as it is the only liquid currency that you can trade from there. This being the case, I like the idea of looking for value going forward. There does seem to be a cluster of resistance just above and extending to the 14.40 Rand level, so it might be more of a grind more than anything else going forward.

If we do turn around and break down below the 13.85 Rand level, that would wipe out all of this bullish attitude, and most certainly be a very negative turn of events. I don’t forsee that happening, but it’s always a possibility. We must always weigh both possibilities in trading. That being said, it looks as if the buyers are starting to take over yet again. If there is more geopolitical concern, that should drive this market much higher. Yes, the Federal Reserve is looking to cut interest rates but I don’t know if that matters so much against the currency like the South African Rand.