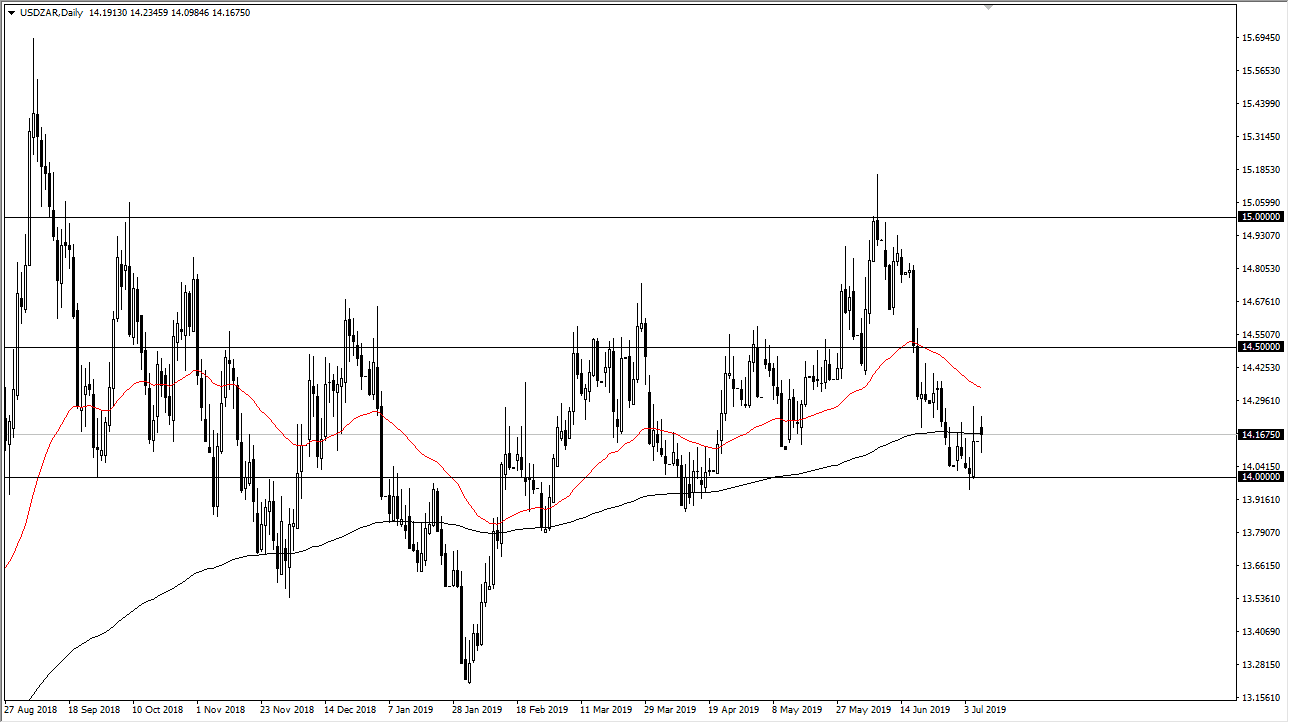

The US dollar has gone back and forth against the South African Rand during trading on Monday as we continue to hang about the support level underneath. At this point, the 200 day EMA is slicing through the daily candle stick, but at this point the candlestick is starting to look at signs of support.

The candle stick from the Friday session was rather impressive but gave back quite a bit of the gains. If we can break above the top of that candlestick, then it’s very likely that we go to the 14.50 Rand level. That’s an area that I think also offers a lot of resistance. However, it’s possible that we could drift back into the range of the session from Friday, but I do think that there is plenty of support underneath. The 14 Rand level should be crucial, so if we were to break down below there it would be a very negative turn of events. However, looking at this candlestick, it looks as if the buyers are probably starting to take advantage of the fact that there is a bit of a “risk off” attitude as the South African Rand is most certainly an emerging market currency. In fact, it’s probably one of my favorite EM currencies, because it’s a proxy for an entire continent. That being the case, if there is concern, it makes sense that the US dollar should gain a bit.

However, if we get a huge “risk on” move, we could see the US dollar drop down below the bottom of the cluster from early April, which opens the door to much lower pricing, perhaps the 13.50 Rand level, maybe even the 13.25 Rand level. Remember, in times of concern the US dollar will be purchased, even if we see the Federal Reserve cut interest rates. In fact, that brings up a very important point: if the Federal Reserve is cutting rates, can there really be an appetite for risk from a larger standpoint? There’s a lot to digest here, but I think that we will continue to try to see the US dollar rally. However, we always have to keep an eye on the other possibility which of course was mentioned below 14 Rand. The last couple of sessions have shown a proclivity to trying to bounce, and if we get some type of negative attitude in the overall global markets, that should continue to cause a bit of an issue.