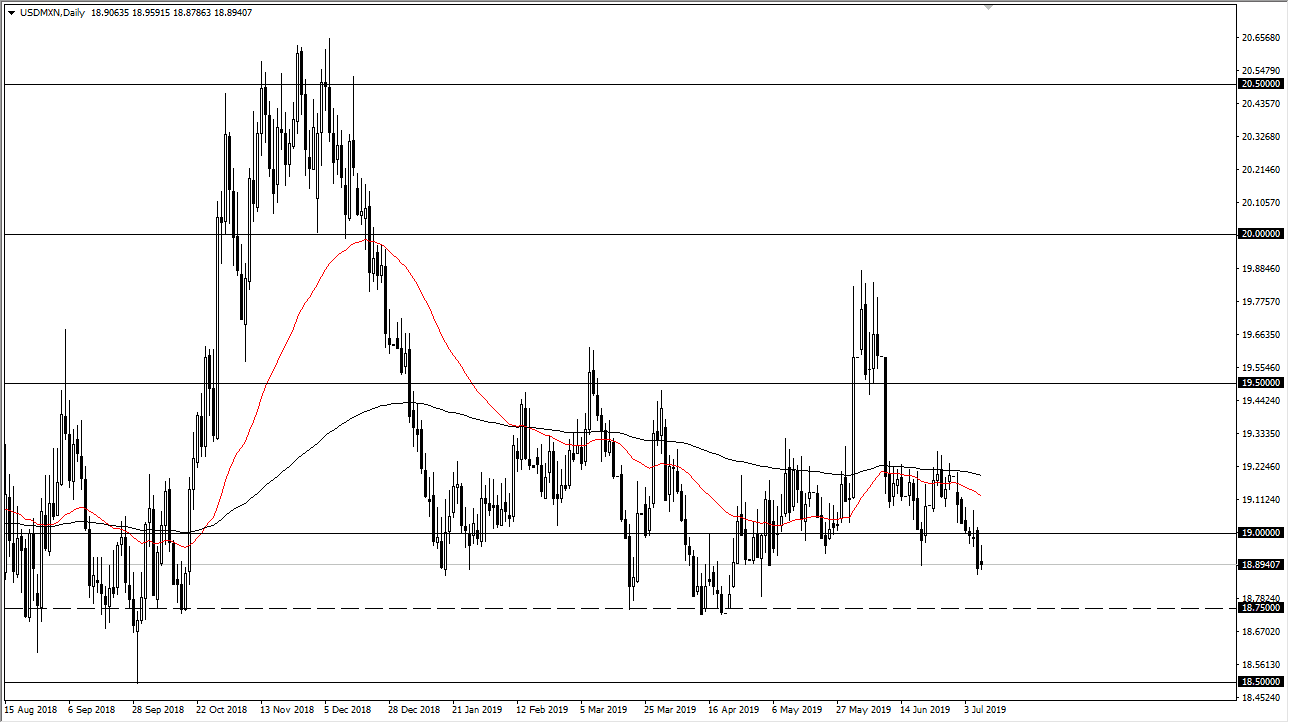

The US dollar initially tried to rally against the Mexican peso on Tuesday but did give back a bit of the gains rather quickly. That being the case it looks as if we are trying to break down below the bottom of the impulsively bearish candlestick from the Monday session. If we do break down below there, it’s very likely that we go down to the dashed line at the 18.75 pesos level. The fact that we cannot hang onto the gains does lend more credence to that, and it now looks as if the 19 pesos level will offer plenty of resistance.

Some of the fundamental aspects of this pair is going to circulate around the crude oil market. After all, the crude oil market is highly sensitive to risk appetite, and of course all of those Mexican rigs in the Gulf of Mexico. In general, if oil rises the Mexican peso will as well. Beyond that, it’s also a gateway currency for Latin America and therefore emerging markets. If there is more of a “risk on feel” to the marketplace, it’s very likely that the Mexican peso can rally.

That being said, we are showing signs of more of a “risk on feel” to the markets overall although the stock market has been drifting a little bit lower as of late. That hasn’t been a big deal, and it is more than likely going to be people profit taking ahead of the Jerome Powell testimony in front of Congress.

Speaking of Jerome Powell, if he sounds overly dovish, that will probably send this market lower as the US dollar should fall. Keep in mind that this is an exotic currency though, so I would not expect to see easy money being made unless of course the US dollar gets pounded everywhere. Keep in mind that emerging markets tend to be a little less liquid, so the spread will be higher. However, the PIP value is also smaller so in the end it works out for the most part.

On a break down below the Monday candle stick, it’s very likely we go to 18.75 pesos, and then breaking down below there opens up the door to the 18.5 pesos level. Ultimately, if we were to break above the Friday inverted hammer, then we could see quite a bit of reversal momentum in this market, perhaps reaching towards the 19.25 pesos level. All things being equal though, that’s the least likely of scenarios.