The US dollar trading against the Mexican peso isn’t something that comes to mind immediately when trading Forex, but it is a very dynamic pair when it comes to the fundamentals. After all, the Mexican peso is in fact a gateway currency if you will for Latin America, meaning that the peso is used as a proxy for the entire region. If the Latin American region is expected to do well, then the Mexican peso will follow right along. Beyond that, we also have the fact that it is an emerging market, and therefore when it comes to trading EM currencies there are only a handful that are easy to find. The Mexican peso is one of them, right along with the Thai baht, South African Rand, and handful of others. Most retail brokerages won’t let you come in and start trading every minor currency on the planet so a lot of proxy trading is done with these currencies.

Looking at the crude oil market is also crucial in this pair as well, as the Mexican peso is highly influenced by crude. Quite a few of the oil rigs in the Gulf of Mexico are actually Mexican and not American, so that’s something that is quite often overlooked by retail traders. With all that being said, crude oil keeps banging up against major resistance.

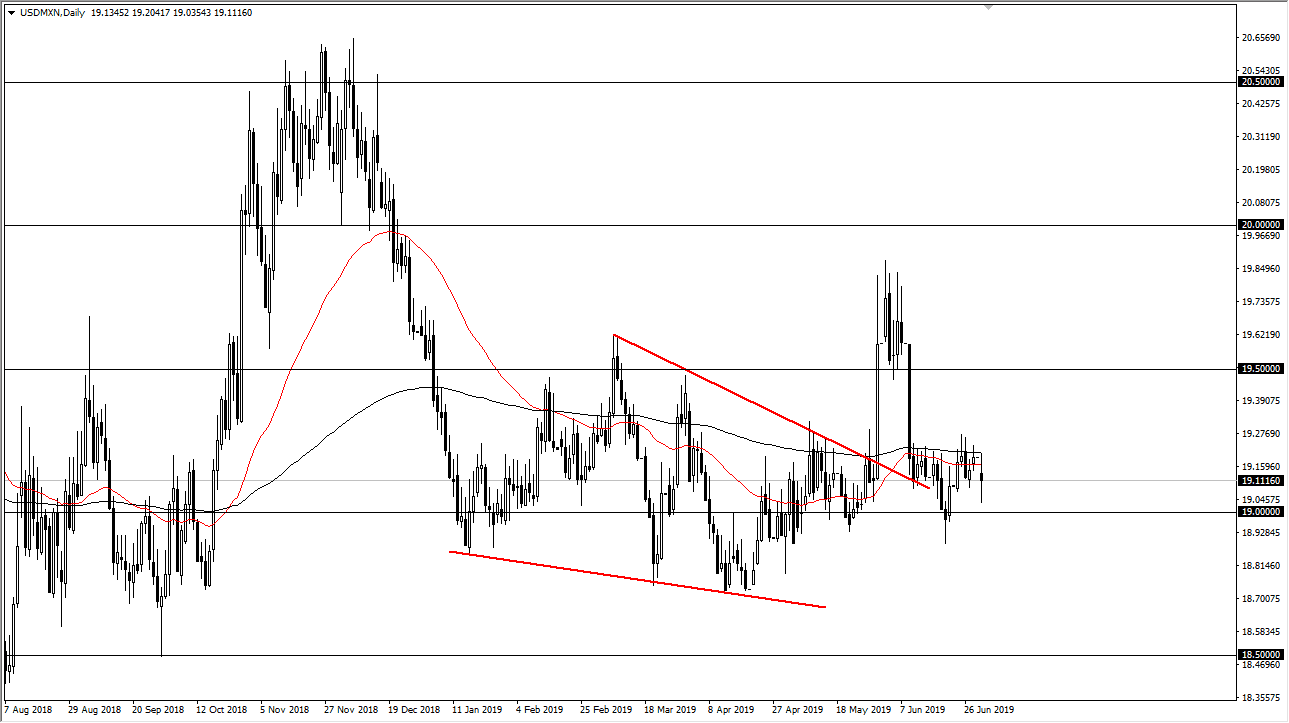

Looking at the technical analysis on the chart you can clearly see that the 19 pesos level has been supportive. We gapped lower to kick off the trading session on Monday but have since gone back and forth in what has been at best a confused market when it comes to clarity for all risk appetite. This of course has an influence on the Mexican peso as it is considered to be much “riskier” than the US dollar. Ultimately, the 50 day EMA and the 200 day EMA are relatively flat and spaced very closely to each other. With that, it looks as if we will continue to be range bound, but if we can break above the 19.25 pesos level, the market should then go to the 19.50 pesos level. Alternately, if we can somehow break down below the recent lows near the 18.90 pesos level, that could open up the “trapdoor” to much lower levels, first of which would be 18.70 pesos, and then possibly 18.50 pesos after that.