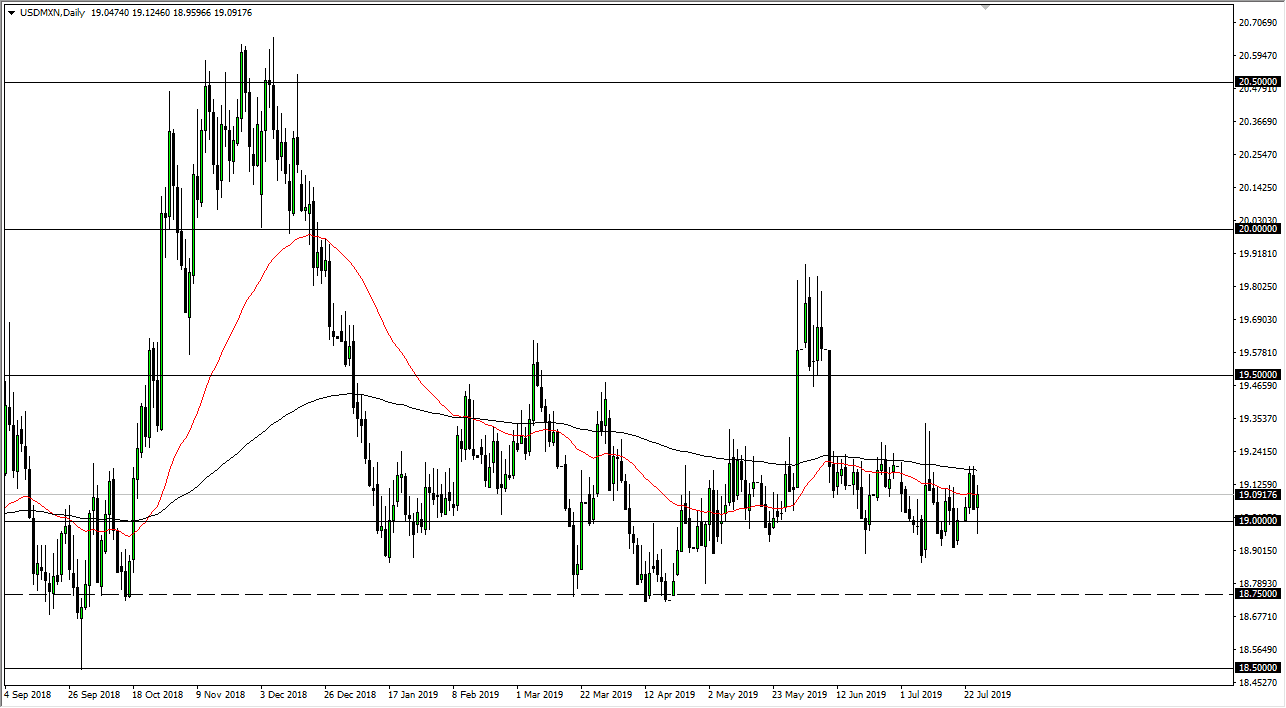

The US dollar has initially fallen during the trading session on Thursday, reaching down towards the 19 pesos level. Ultimately, this is an area that has offered a lot of support lately, so it’s only a matter time before the buyers get involved on short-term dips. After all, the US dollar is more of a safety play then the Mexican peso will ever be, and of course we have a lot of soft news when it comes to the petroleum markets. The Mexican peso is a bit sensitive to crude oil, so pay attention to that market. Currently though, the market is looking a bit sluggish to say the least.

All things being equal though I do like the idea of buyers jumping into the market and reaching towards the 19.25 pesos level next, which is the top of the recent consolidation area. If we do break above there, the market is likely to reach towards the 19.50 pesos level where it will see much more considerable resistance. After all, that’s where we broke down from previously and it of course will attract a lot of attention if we revisit that area.

One thing that this market can gauge at times will be risk appetite, as the US dollar of course is a safety currency in the Mexican peso represents Latin America for most large institutions, as many of them won’t be bothered to trade things such as the Argentine peso, Brazilian real, or some of the others. The Mexican peso is the largest currency when it comes down to that part of the world, so it’s representative of not only Latin America, but it also has a knock on effect as far as emerging markets are concerned. Currently, I look at short-term pullbacks as buying opportunities but recognize that it is probably going to be a choppy market.

At this point in time though, it’s likely that the market continues to bounce around in this general vicinity with the 16.90 level being the bottom of the support level, and the 19.50 pesos level being resistance. Short-term traders can continue to use range bound markets, but I do think that we are basing for a bigger move, probably to the upside based upon the length of this rectangle. Quite frankly, the longer the basing pattern, typically it means the longer the move.