For four consecutive trading sessions, the USD/JPY pair has stabilized around and below the 108.00 psychological support level, with losses reaching support at 107.80. It stopped around that level, signaling that the pair has reached strong oversold areas and awaits a stronger chance of upward correction. The Japanese yen benefited from a slowdown in China's gross domestic product (GDP) growth to its lowest level in at least 26 years, in the quarter ending in June, putting pressure on the Chinese administration, which is engaged in a fierce customs war with Washington. Government data showed on Monday that the world's second-largest economy grew 6.2% from a year earlier, down from the previous quarter of 6.4%. Economists had forecast the recovery of China's economy in late 2018, but has retreated as Trump continued to impose more tariffs on Chinese imports to press Beijing to abandon its plans to develop technology. After the day's results, economists believe the economic slowdown could extend to next year.

The pressure is stronger for the US dollar as expectations for a near date for US interest rate cut for the first time in 10 years are growing, in order to maintain the longest period of record economic growth in the history of the United States. The US central bank is ready to cut interest rates as trade tensions and concerns about the strength of the global economy continues, which directly affect the US economic outlook, were Powell's latest testimony and the contents of the latest meeting of the Federal Reserve, confirmed the near date for the cut.

US inflation figures came in higher than expected, but did not affect the market's direction to prepare for US interest rate cuts soon.

JPY will remain the preferred safe haven for investors as global trade and political tensions continue to be supported by the fierce tariff war between the US and China.

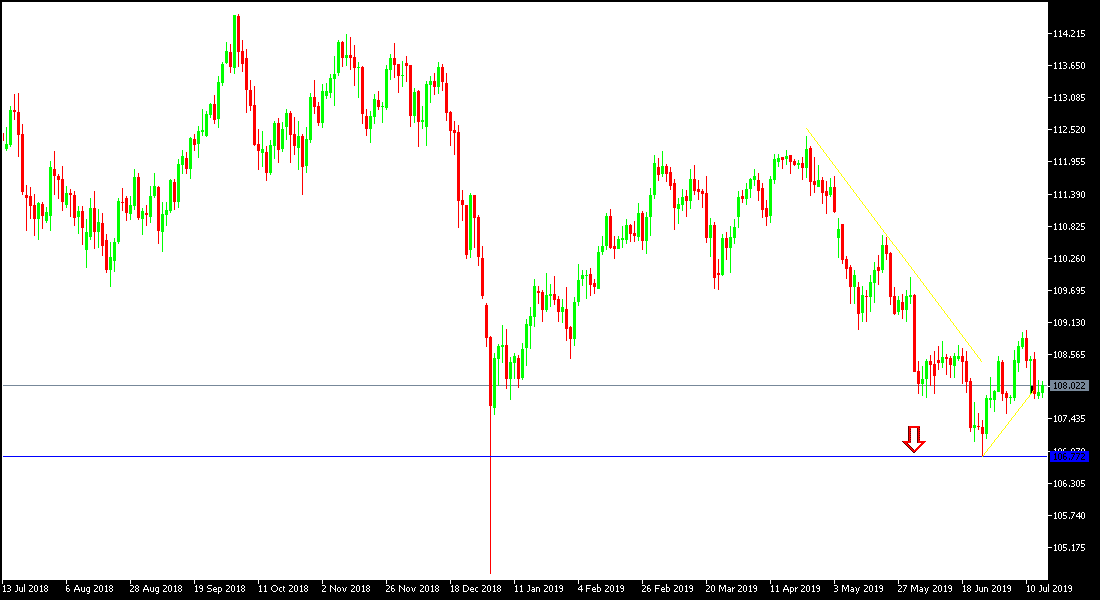

Technically: The USD / JPY's bearish trend remains strongest as long as it remains below the 110.00 psychological peak. The pair is currently near the 107.65 and 106.40 support levels, which confirm the bearish trend’s strengt. On the upside, the nearest resistance levels are 108.85, 109.55 and 110.20 respectively. We still prefer to buy the pair from every bearish bounce.

On the economic data front: The pair will be carefully watching for the release of US retail sales figures alongside industrial output. There are also expected announcements by Federal Reserve Chair, Powell. The pair will also monitor with caution and interest any renewed global geopolitical concerns, as the Japanese Yen is considered one of the most important safe havens.