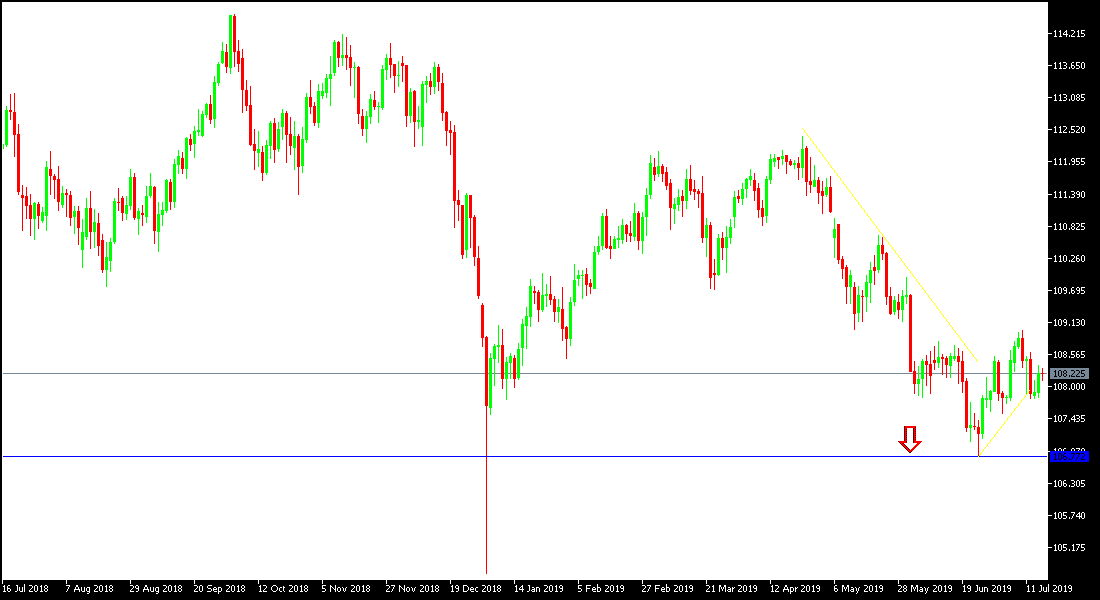

Positive US retail sales for June supported gains for the US dollar versus other major currencies, and the price of the USD/JPY pair moved towards 108.37 after testing 107.80 support at the beginning of yesterday's session, and is now stable around 108.25 at the time of writing. The pair is currently neutral awaiting any updates and is closer to further bearish pressure if it stabilizes below 108.00 support. Technical indicators underscore the pair reaching into oversold areas but still lack incentives to start a major bullish correction, as pressure on the US dollar is mounting with the near date of US interest rate cuts for the first time in 10 years to counter the consequences of slowing world economic growth and its impact on the US economy.

JPY remains the preferred safe haven for investors as global trade and political tensions continue to be supported by the fierce tariff war between the United States and China. The war has contributed to slowing the economic growth of the world's second-largest economy to its lowest level in at least 26 years in the quarter ending in June. Financial markets expect the US central bank to cut US interest rates when the Federal Reserve meets later this month.

US inflation figures came in higher than expected, but did not affect the market's direction to prepare for US interest rate cuts soon.

Technically: The general trend of the USD/JPY is still closer to move within its downtrend channel as long as it holds below the 110.00 psychological top, and the nearest support levels are currently at 107.65 and 106.40 respectively, which confirm the continuation of the bearish trend. In the event of an upward reversal, the nearest resistance levels are currently 108.85, 109.55 and 110.20, respectively. Buying from levels below 108 support remains the best approach in this market.

On the economic data front: The US dollar is on a date with the announcement of US housing numbers, building permits and housing starts. The pair will react with caution and interest to renewed global geopolitical concerns as the Japanese Yen is considered one of the most important safe havens.